Construction equipment activity remained steady in October as the market prepared for the return of seasonality and increased yearend activity.

Demand, inventories and values remained mostly steady in October ahead of an expected seasonal uptick in December, Jim Ryan, equipment lease and finance manager at Sandhills Global, told Equipment Finance News

Equipment dealer Anderson Equipment is also preparing for increased activity in the coming months, John Boy, finance and sales administration manager, told EFN.

“Demand has been pretty steady throughout October, and we are ramping up into the busy season now,” he said.

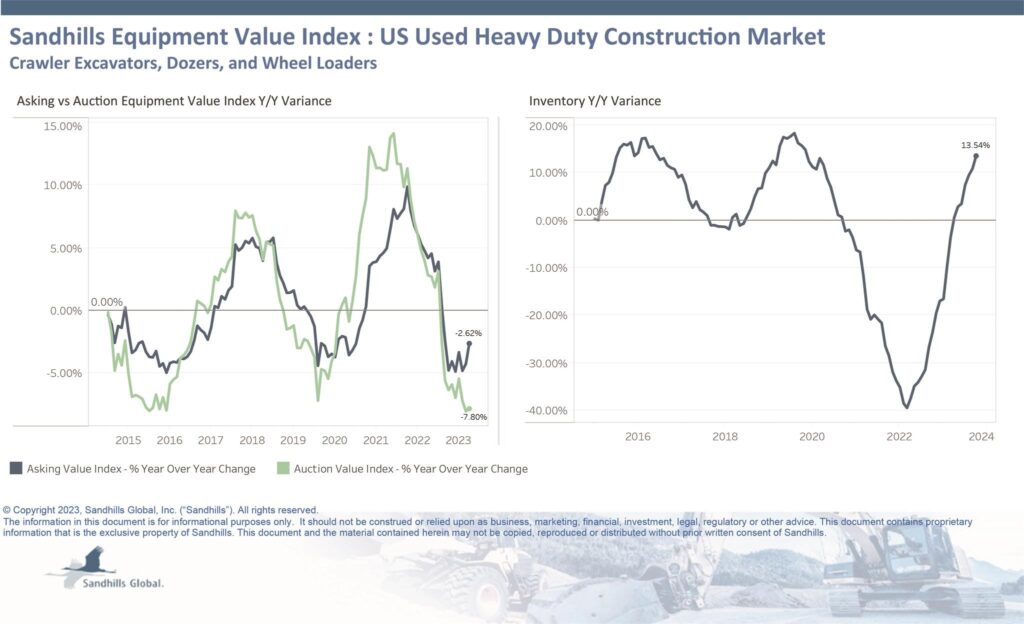

Heavy-duty construction values steady

Sandhills Global auction market data for October showed:

- Retail, or asking, values inched up 0.2% month over month for heavy-duty construction equipment, but dropped 2.6% year over year.

- Auction values dropped 1.6% MoM and 7.8% YoY.

- Inventory for heavy-duty equipment rose 1.5% MoM and 13.5% YoY.

“The heavy-duty construction side has been a little bit lower than normal,” Sandhills’ Ryan said. “We’re seeing more [equipment] hitting on the market, so you’re seeing the demand not be as strong.”

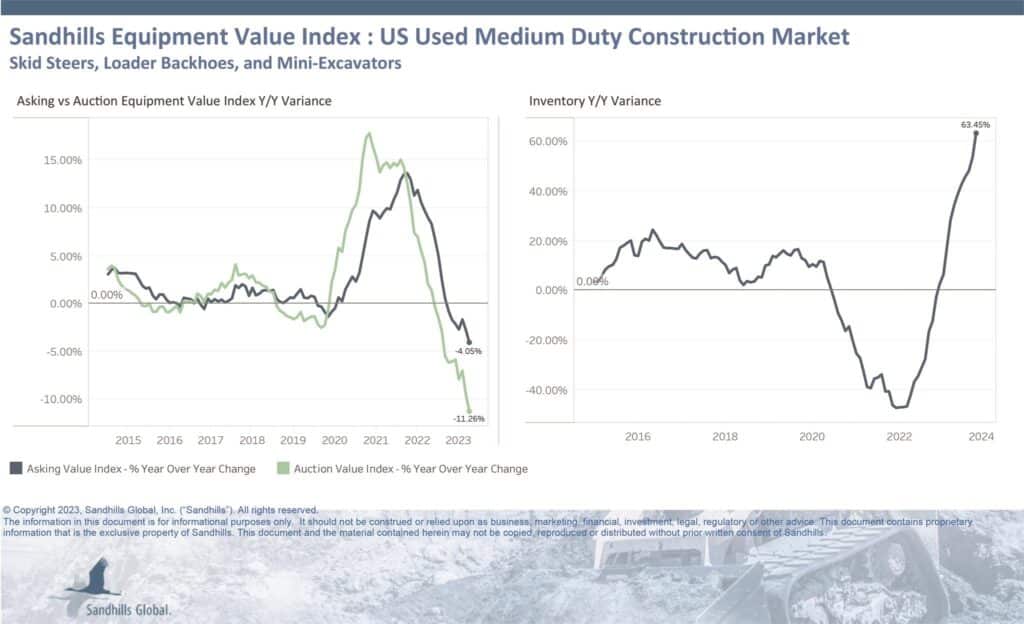

Medium-duty construction inventory spikes

October data from Sandhills also showed:

- Retail values for used, medium-duty construction equipment declined 1.2% MoM and 4.1% YoY.

- Auction values also slid, down 2.7% MoM and 11.3% YoY.

- Inventory for medium-duty equipment continued rising 5.9% MoM and 63.5% YoY.

“The medium-duty side has been rising for months,” Ryan said. “That goes back to a lot of supply chain issues, rental companies not being able to get ahold of new units, holding on to a lot of used units, manufacturing concerns and things of that nature.”

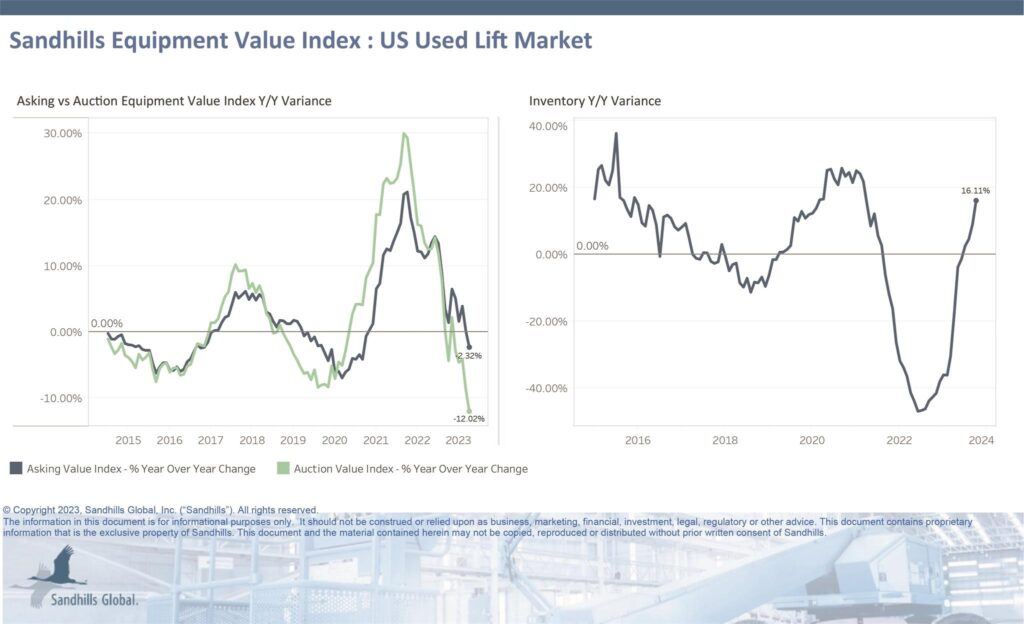

Lift values dip

In October data on lifts, Sandhills reported:

- Retail values for used lifts dipped 1.8% MoM and 2.3% YoY.

- Auction values also dropped, down 3.3% MoM and 12% YoY.

- Inventory for lifts jumped 1.7% MoM and 16.1% YoY.

“Lifts was one of the sectors that was a little lacking, like medium-duty construction, and the supply chain and manufacturing was behind compared to the other side of things,” Ryan said. “You’re starting to continue to see month-over-month inventory increases on that side.”