Values for used lifts were mixed in June as the material handling industry gained traction behind increasing rental activity.

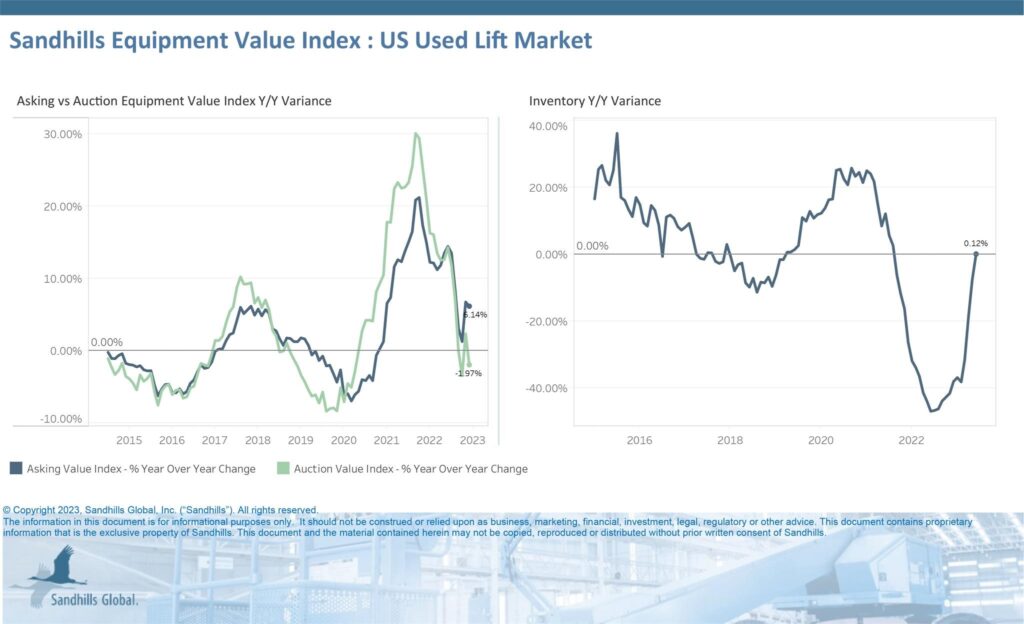

Asking values for used lifts fell 0.5% month over month in June but rose 6.1% year over year, according to Sandhills Global market reports. Meanwhile, auction values declined 5.2% MoM and 2% YoY in June. Inventory for used lifts increased 5.3% MoM and 0.1% YoY, with inventory increasing every month since February.

Asking values were trending in the opposite direction from auction values as of the end of June, but strength in the rental industry will play a role in lift inventories and values, Jim Ryan, equipment lease and finance manager at Sandhills Global, told Equipment Finance News.

“Asking values are almost level month over month and asking values on the lift side have continued to rise this year, as you’re seeing values increase on the lift side of things, they’re trending upward,” he said. “Auction values are a little down on the lift side, but the retail space is becoming more [relevant]. The direct correlation to the lift side is rental companies.”

Pandemic-induced backlogs plagued many segments of the equipment industry, but OEMs such as Volvo and Terex continue to make efforts to clear backlogs. As backlogs continue to clear and rental companies gain new equipment, lifts and the wider material handling sector will see the impact, Ryan said.

“Rental companies play a huge factor in the lift sector, so as they were backlogged on being able to get new rental gear, that’s obviously had an effect on things,” he said. “Your rental companies play a direct impact on inventory levels on the lift side and also values on the lift side.”

Equipment dealer and rental group Alta Equipment Group posted a 41% YoY increase in material handling rental revenue in Q1, according to the company’s May 10 earnings release. United Rentals’ rental revenue also increased 26% YoY in Q1, according to its April 26 earnings release, with the company set to release its Q2 earnings Wednesday.

“There’s a lot of buyers out there that want lift equipment, but just haven’t been able to get their hands on it, so … now if you can purchase it, you may be willing to pay a little bit more,” Ryan said. “You’re seeing a little different trend on the lift side, but there’s a direct correlation to what the rental industry is doing.”