Values for used transportation equipment continue to fall as organizations address procurement, the growing gap between new- and used-vehicle values and rising costs following the pandemic.

Inventories continue to rise and values continue to fall, and as the supply chain normalizes, the price gap between higher-priced new inventory and lower-priced used inventory is creating a problem ahead of 2024, Jim Ryan, equipment lease and finance manager at Sandhills Global, told Equipment Finance News.

“The sentiment on the truck side is we’ve got to find a way to find a happy medium here, as we can’t have new truck prices continue to rise and everything on the used side continue to drop,” he said. “Something’s going to have to give.”

Finding affordable inventory remains a key issue for the transportation industry, Brian Holland, chief executive of Fleet Advantage, told EFN. Organizations not only have to think about procurement; they also must manage costs and select the right partners to work with and the right financial strategy.

“We certainly learned over the past few years, that being nimble and able to respond to a changing market is critically important, not only to the survival of the company, but the bottom line as well,” he said.

New transportation problems arise

While companies adapted to the pandemic era issues, some supply chain issues still exist and new problems continue to arise, Holland said.

“Obviously, the recent strikes impacted the industry,” Holland said. “The equipment shortages and component shortages had been the hallmark of the equipment ordering for the past several years, but those do seem to be easing up.”

Rising interest rates, inflation, a possible recession, rising fuel, maintenance and labor costs, and the transition to alternative fuels are all concerns for fleet managers, Holland said.

For example, 25.9% of commercial fleet management respondents to Fleet Advantage’s benchmarking survey released on Nov. 14 said higher costs on fuel, maintenance and repair, and trucks make long-term truck ownership less appealing.

As a result, 59% of truck operators surveyed said they will be replacing trucks in less than five years. Fleet Advantage’s client portfolio consists of over 20,000 units representing more than 50 top American corporate fleets, Holland said.

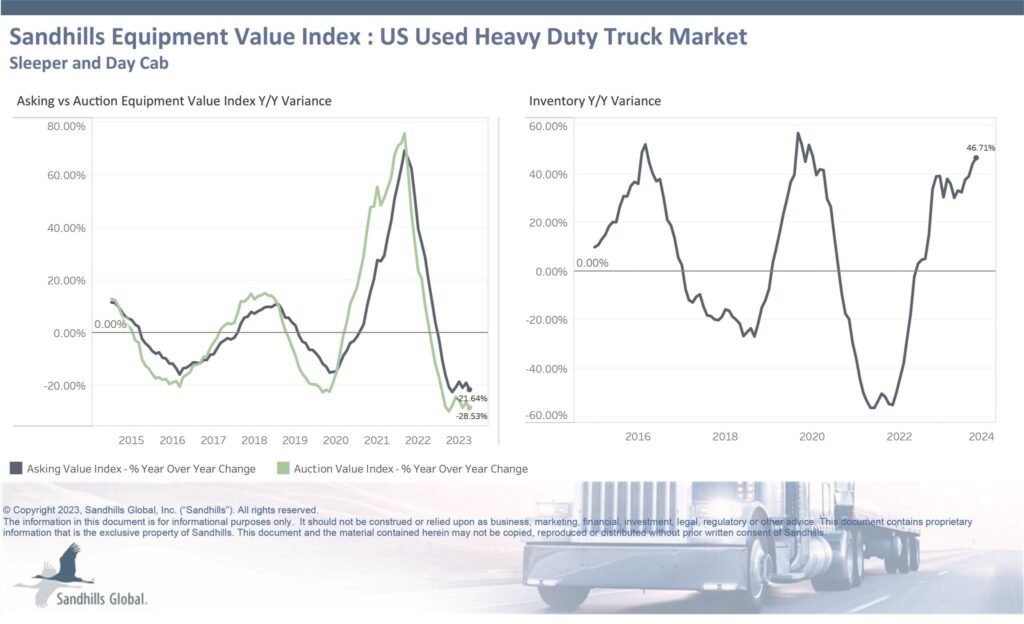

Heavy-duty values continue slip

- Retail, or asking, values for heavy-duty transportation equipment declined 3.3% month over month and 21.6% year over year, with the values still trending downward in October, according to Sandhills Global auction market data.

- Auction values declined 4.3% MoM and 28.5% YoY and continued to trend downward in October.

- Inventory for heavy-duty trucks rose 3.4% MoM and 46.7% YoY in October.

Medium-duty market softens

- Retail values for used, medium-duty transportation equipment declined 0.1% MoM and 15.2% YoY in October as medium-duty market demand softened, according to Sandhills.

- Auction values inched up 0.3% MoM but are still down 19.7% YoY in October

- Inventory for medium-duty trucks rose 0.3% MoM and 44.1% YoY in October.

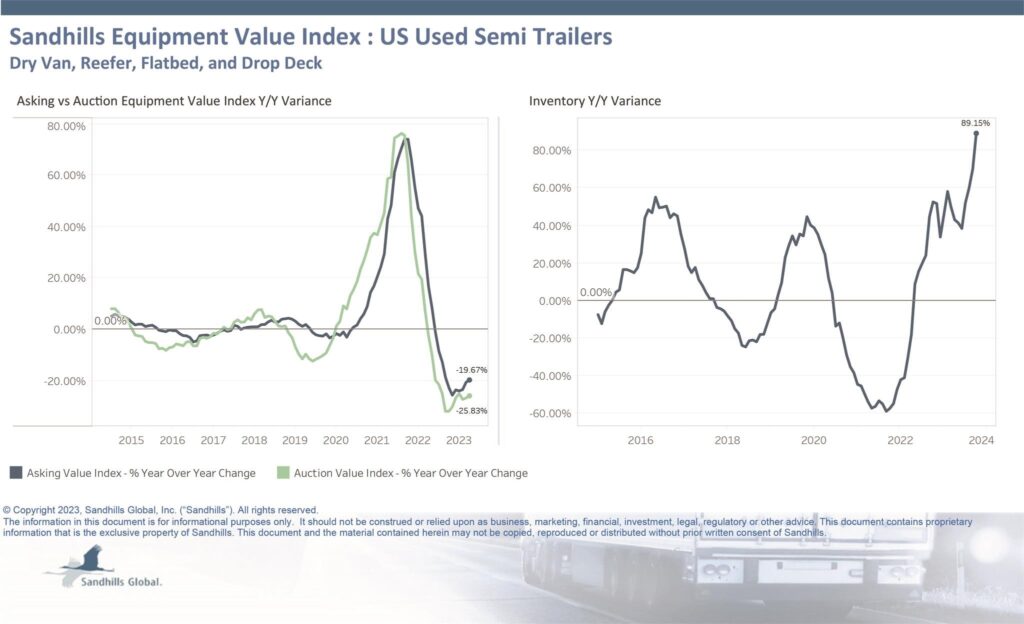

Semitrailers inventory spikes

- Retail values for semitrailers dipped 1% MoM and 19.7% YoY in October, according to Sandhills.

- Auction values also slid down, dropping 1.1% MoM and 25.8% YoY in October.

- Inventory for semitrailers rose 8.3% MoM and 89.2% YoY, with dry van trailers leading the way in October.

“We’ve still seen significant growth on the trailer side, especially dry van trailers hitting the market,” Sandhills’ Ryan said. “The supply and the inventory have almost doubled compared to where it was last year on the dry van trailer side, so extremely high growth, and we’ve seen a lot of double-digit increases month over month on the trailer side the last year.”