Construction equipment activity is normalizing as dealer inventory reaches traditional levels and auction inventory slows.

Construction equipment demand, inventories and values are all trending toward stabilization following supply chain constraints and rising interest rates created by the pandemic, Jim Ryan, equipment lease and finance manager at Sandhills Global, told Equipment Finance News

Inventory build slowed in September alongside equipment depreciation, although certain segments are seeing substantial changes, Ryan said.

Normalization

Demand for construction equipment remains elevated on the dealer side, John Boy, finance and sales administration manager at equipment dealer Anderson Equipment Company, told EFN.

“We haven’t seen a drop in demand, but what we have seen is the rates and availability of new equipment coming out of that pandemic hangover,” Boy said. “We’re starting to see more of the back-to-normal balance as far as new-machine purchases versus … used-machine purchases.”

Affordability is also improving with availability, Boy said.

“Interest rates have stabilized the pricing of used equipment as well, so it’s gotten more affordable to a lot of the customers,” he said. “Someone who might be starting up that might not be able to afford a brand-new machine might look at something that’s [certified used].”

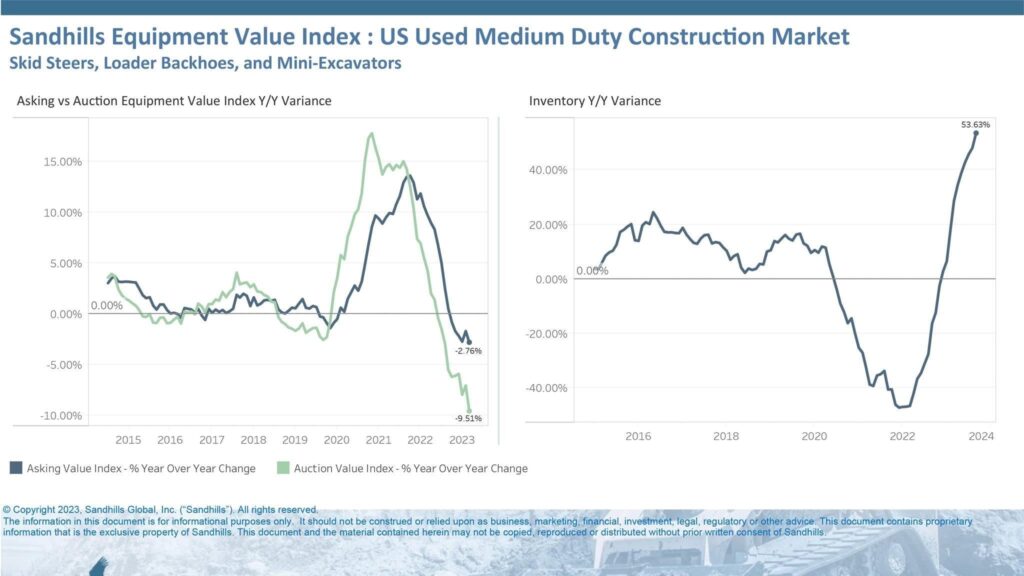

Medium-duty construction inventory up

- Retail, or asking, values for used, medium-duty construction equipment declined 1.4% month over month and 2.8% year over year in September, according to Sandhills Global auction market data.

- Auction values also slid, down 3.1% MoM and 9.5% YoY, although wheeled skid steers and mini excavators fell 12% YoY.

- Inventory for medium-duty equipment rose 3.7% MoM and 53.6% YoY.

“Medium-duty construction still had a pretty good inventory increase, and the sector of it that increased the most was medium-duty track skid steers,” Ryan said. “For the medium-duty, there’s been an influx of the track skid steers coming back to the market, so that’s obviously affecting prices and values as well.”

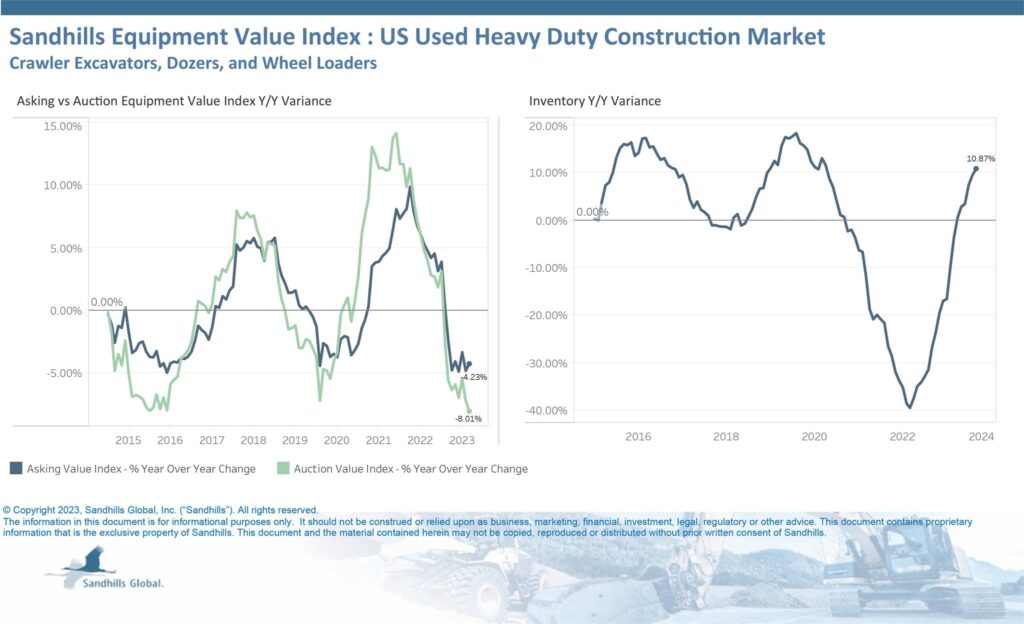

Heavy-duty values down again

- Retail values declined 0.1% MoM and 4.2% YoY in September, according to Sandhills.

- Auction values declined 1.7% MoM and 8% YoY.

- Inventory for heavy-duty equipment rose 0.3% MoM and 10.9% YoY.