How Amazon became the largest private EV charging operator in the US

Hardware likely cost between $50 million and $90 million

Amazon’s Maple Valley, Washington, warehouse is built for speed. At night, big rigs pull up to one end to unload boxes and padded mailers – some after a short drive from a bigger warehouse down the road, others following a flight in the hold of a cargo plane. Waiting employees scan, sort and load them into rolling racks.

Before 7 a.m. each day, many of those racks are wheeled out to dozens of vans lined up in four painted lanes. It’s the starting line at a Formula One race, but for $22-an-hour delivery drivers who ferry bottles of shampoo and packs of batteries to suburban Seattle doorsteps.

Their routes, the last step in a journey that can take products thousands of miles, are the source of a large chunk of the carbon emissions Amazon has pledged to eliminate in the coming decades.

The solution lies in the parking lot across the street: 309 Siemens electric vehicle chargers, which power delivery vans built by Rivian Automotive Inc. Making deliveries without tailpipe emissions, and increasing the size of the electric fleet, is among the most straightforward ways Amazon can wipe carbon from its operations.

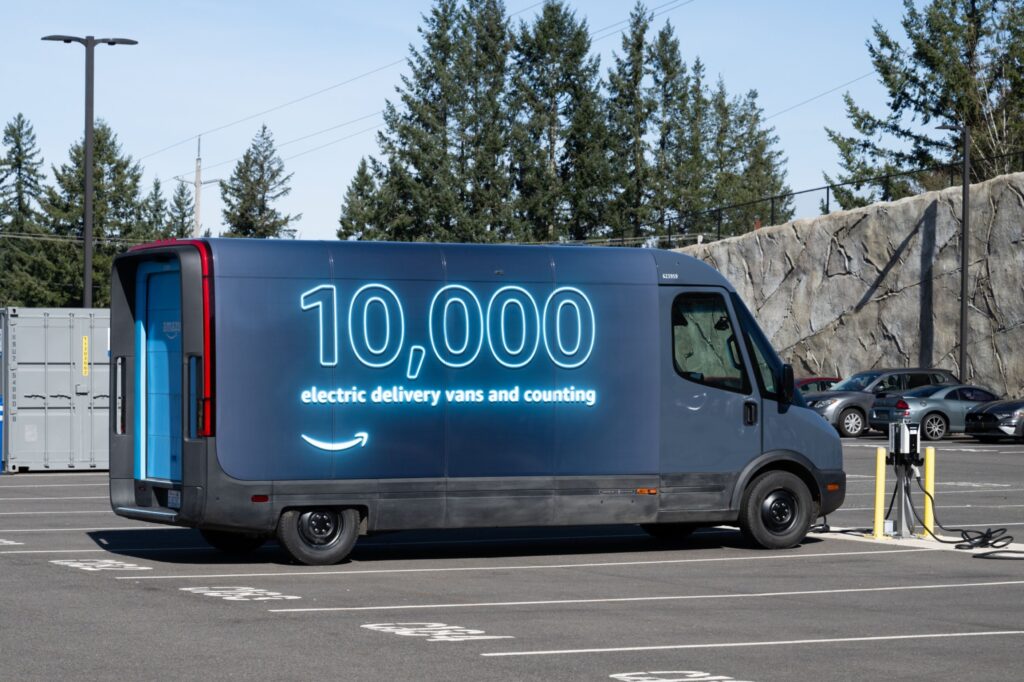

In a little more than two years, Amazon has installed more than 17,000 chargers at about 120 warehouses around the US, making the retail giant the largest operator of private electrical vehicle charging infrastructure in the country. “We’ve figured out the path,” said Tom Chempananical, who oversees Amazon’s fleet of last-mile delivery vehicles.

Logistics companies like United Parcel Service Inc. and FedEx Corp. have rolled out their own ambitious electric vehicle targets, though many have failed to meaningfully curb the growing emissions from e-commerce deliveries. Amazon, meanwhile, backed away from a vow to make half of all deliveries with zero carbon pollution by 2030, saying that initiative was superseded by broader climate goals. But the company has come farther and faster in the transition to EVs than most of its competitors. Understanding the challenges faced by Amazon, a company known for going to extreme lengths to meet tight delivery deadlines, can help chart a roadmap for other companies across industries trying to eliminate their own carbon bills.

“Amazon’s scale matters,” said Kellen Schefter, director of transportation at the Edison Electric Institute, a trade group for investor-owned utilities that has worked to connect Amazon to power companies. “If Amazon can show that it meets their climate goals while also meeting their package-delivery goals, we can show this all actually works.”

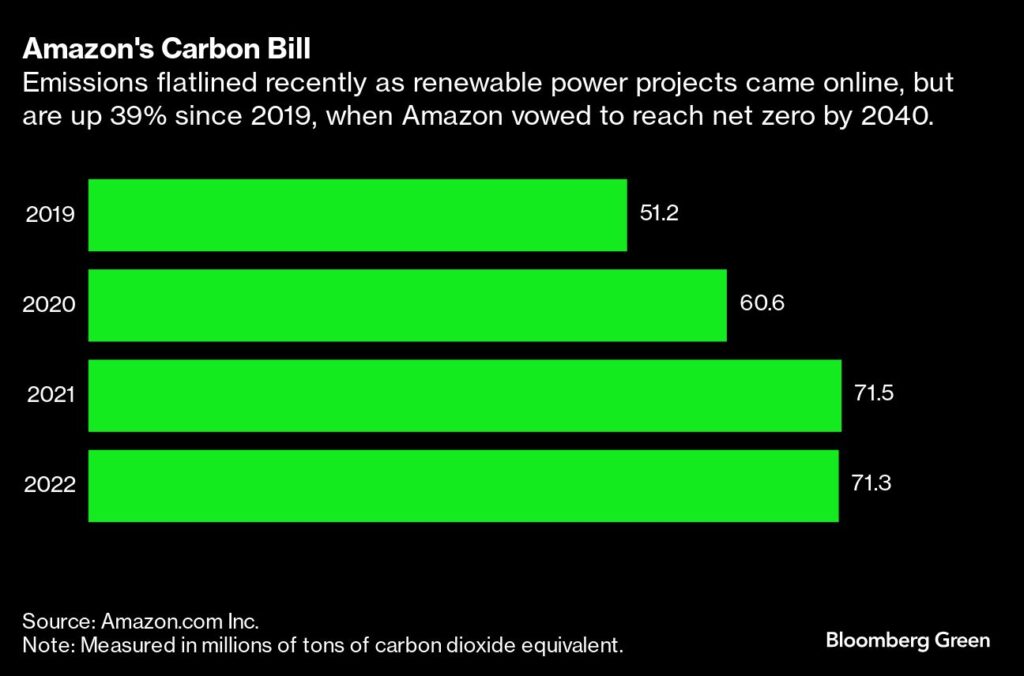

Amazon has a long way to go. The Seattle-based company says its operations emitted about 71 million metric tons of carbon dioxide equivalent in 2022, up by almost 40% since Jeff Bezos’s 2019 vow that his company would eventually stop contributing to the emissions warming the planet. Many of Amazon’s emissions come from activities – air freight, ocean shipping, construction, and electronics manufacturing, to name a few – that lack a clear, carbon-free alternative, today or any time soon. The company has not made much progress on decarbonization of long-haul trucking, whose emissions tend to be concentrated in industrial and outlying areas rather than the big cities that served as the backdrop for Amazon’s electric delivery vehicle rollout.

But Amazon is on track to purchase by next year as much electricity produced by solar, wind and other carbon-free sources as it uses to power its operations. And in Rivian, which Amazon has backed with a massive investment and an order for 100,000 custom-built delivery vans – 13,500 of which have been delivered to date – the company has suggested it can eliminate much of the emissions associated with its last-mile delivery business.

To get there, Amazon had to learn how to pick up the phone and call the power company. Electric utilities, which to that point primarily dealt with electric vehicles through powering the odd home car charging setup, encountered a new type of customer in Amazon. Government electricity use estimates show a 100,000-square-foot warehouse tucked in an industrial area might be powered by about 50 kilowatts, mainly for lighting and air circulation. Setting up 100 chargers in the parking lot could require 10 to 20 times as much power.

“What was different here was this was a new type of electric use,” said Schefter, of the EEI. “That’s a really big power requirement in a parking lot.” That need could be met relatively quickly if the transmission lines in the area have spare capacity. In areas of the grid that don’t, upgrades can take years.

Amazon also learned how to be flexible and how to wait. The company prefers cookie-cutter processes that can be run like a production line. That breaks down in the physical world, where Amazon’s hundreds of last-mile delivery warehouses come in different designs or parking lot layouts, subject to differing local utility protocols.

“It was a bit of a surprise, how long we would need to prepare for the lead time for infrastructure,” said Chris Atkins, who leads Amazon’s logistics sustainability teams.

In 2020, Amazon met with some of the country’s large utilities, who probed the company on how much power it would need and where. Representatives of Commonwealth Edison, Illinois’s largest power provider, were there. The utility, which was struggling to secure some types of new equipment during the pandemic, opted to repurpose old transformers for Amazon. “We were doing some pretty creative stuff internally to make sure that we had what they needed and that we could meet the timelines that they wanted,” said Diana Sharpe, who deals with large customers at the Exelon Corp.-owned company.

By the time Rivian began rolling out large quantities of vans during the spring of 2022, ComEd had routed additional power to an Amazon warehouse in Chicago’s Pullman neighborhood. Rivian’s CEO stopped by that July for a ribbon cutting to announce the vans were hitting the road. Today, ComEd powers about 1,100 chargers at four Amazon warehouses in greater Chicago.

Another lesson Amazon learned is one the company isn’t keen to talk about: going green can be expensive, at least initially. Based on the type of chargers Amazon deploys – almost entirely mid-tier chargers called Level 2 in the industry – the hardware likely cost between $50 million and $90 million, according to Bloomberg estimates based on cost estimates supplied by the National Renewable Energy Laboratory. Factoring in costs beyond the plugs and related hardware — like digging through a parking lot to lay wires or set up electrical panels and cabinets – could double that sum. Amazon declined to comment on how much it spent on its EV charging push.

In addition to the expense of the chargers, electric vehicle fleet operators are typically on the hook for utility upgrades. When companies request the sort of increases to electrical capacity that Amazon has – the Maple Valley warehouse has three megawatts of power for its chargers – they tend to pay for them, making the utility whole for work done on behalf of a single customer. Amazon says it pays upgrade costs as determined by utilities, but that in some locations the upgrades fit within the standard service power companies will handle out of their own pocket.

When Amazon made the Rivian order, people who worked on the program expected that running an electric delivery fleet would eventually be cheaper than the company’s conventionally fueled fleet, a hodgepodge of bulk-ordered gasoline and diesel vehicles built by the likes of Ford Motor Co., Mercedes-Benz Group AG, and Stellantis NV. It’s unclear if Amazon is there yet, though Chempananical said Amazon was happy with the price tag of the Rivian vehicles. “All of those costs continue to scale down,” he said. “As usage grows, there’s more demand, there’s more supply, it gets more efficient and continues to drive to a better spot.”

Amazon also had to figure out the logistics of charger sharing. That’s not an issue at the Maple Valley warehouse, where 77 electric vans have their pick from among a fleet of 307 level 2 chargers. But other sites have fewer chargers than available vans. Fully charging a van can take several hours, and at first, that created some headaches. Amazon initially required the subcontractors who manage van fleets and drivers to keep their own staff working overnight to rotate vans among available chargers. Last fall Amazon brought that work in house, freeing subcontracted workers to drive, rather than babysit chargers. “They need the drivers, at the end of the day,” Chempananical said.

Amazon’s contract drivers say they love the vans, which were built for the company’s sometimes punishing, package-every-90-seconds routes and frequent stops. The people who employ the drivers – Amazon’s Delivery Service Partners – have some complaints. Two West Coast delivery service providers, who asked for anonymity to protect their relationship with Amazon, said body work can cost two or three times as much as conventional vehicles, because few body shops are authorized to work on Rivian vans. Spare parts can be hard to come by.

Trucking presents a bigger challenge, for Amazon and the industry. Automakers are much farther along in electrifying cars and light-duty trucks than the tractors that haul shipping containers from ports and between warehouses (see Tesla’s semi truck, which is still in pilot production years after being unveiled). Bug-eyed Rivian electric vans are a common sight crisscrossing major cities like Seattle, Los Angeles, New York and their suburbs. But the communities that host the massive warehouses further up the supply chain, often poorer precincts in places like northeast Pennsylvania or California’s Inland Empire, have yet to see the same benefits of electrification. In the company’s post-pandemic cost cutting drives, Amazon has delayed and shelved some trucking-related and other so-called “middle mile” sustainability investments, according to a person familiar with the matter.

Atkins rejected the critique, rattling off moves Amazon has made in the arena: buying trucks that run on compressed natural gas, and investing in makers of green hydrogen, among other fuel sources. “It’s important that we get it right and not just scale with the wrong partners,” he said.

“It will get there,” Chempananical said of Amazon’s investments in the “middle mile.” “It’s just a matter of when and how we get there.”

Back at the Maple Valley warehouse, Justin Shearer, who runs Pacific Delivery and Logistics, an Amazon delivery service provider, gives a tour of his corner of the facility. Like many of Amazon’s small army of delivery contractors, he holds another job. Shearer is a commercial fisherman, and earlier in his career he sold mining and logging equipment. He doesn’t consider himself an environmentalist. But the benefits of keeping oil products off the road are obvious, he said.

“Putting this infrastructure in is expensive,” he said. “It’s not been done at this scale, but you’re not going to get better at it unless you start somewhere.”

— By Matt Day (Bloomberg)