Inventory levels in all segments of the used agricultural equipment market remain elevated and could push the industry into a multi-year downturn.

March data from analyst firm Sandhills Global show inventory levels rising alongside falling auction and asking values.

“Everyone thinks it’s going to be a quick turnaround, [but] I always revert back to those inventory levels,” said Ryan Dolezal, sales manager of Sandhills Global-owned auction site TractorHouse. “My prediction is we haven’t seen the bottom yet, until inventory levels plateau.”

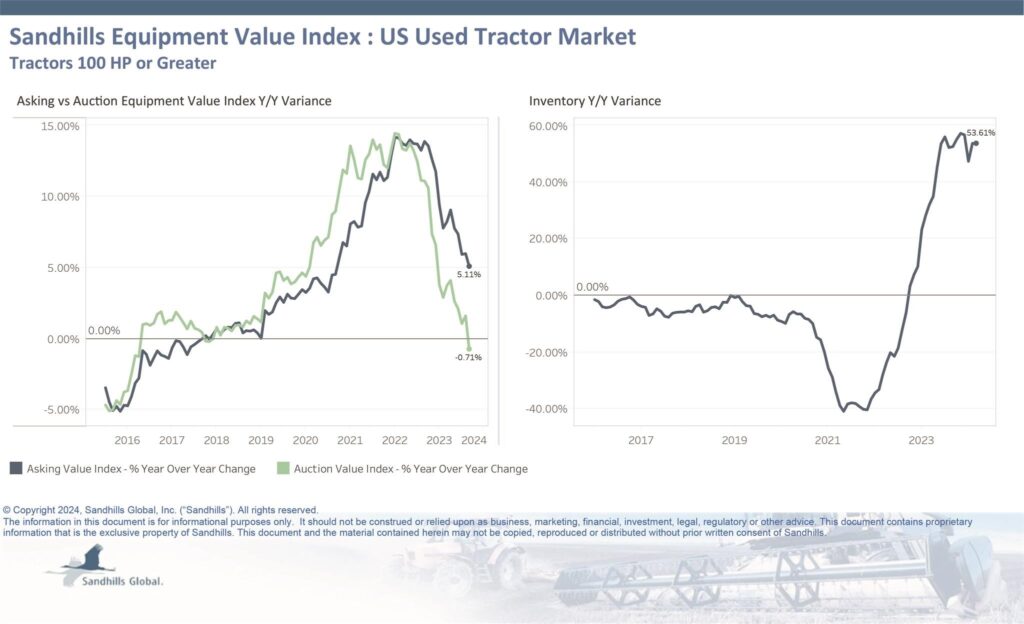

Used-tractors, 100 horsepower or more

Inventory levels, which are “significantly high,” will further push values downward, said Jim Ryan, equipment lease and finance manager for Sandhills. The company began reporting this category separately in March in response to dealer demand, he said.

- Inventory levels rose 53.6% YoY.

- Asking values were up 5.11% YoY but down 0.8% month over month.

- Auction values were down 0.71% YoY.

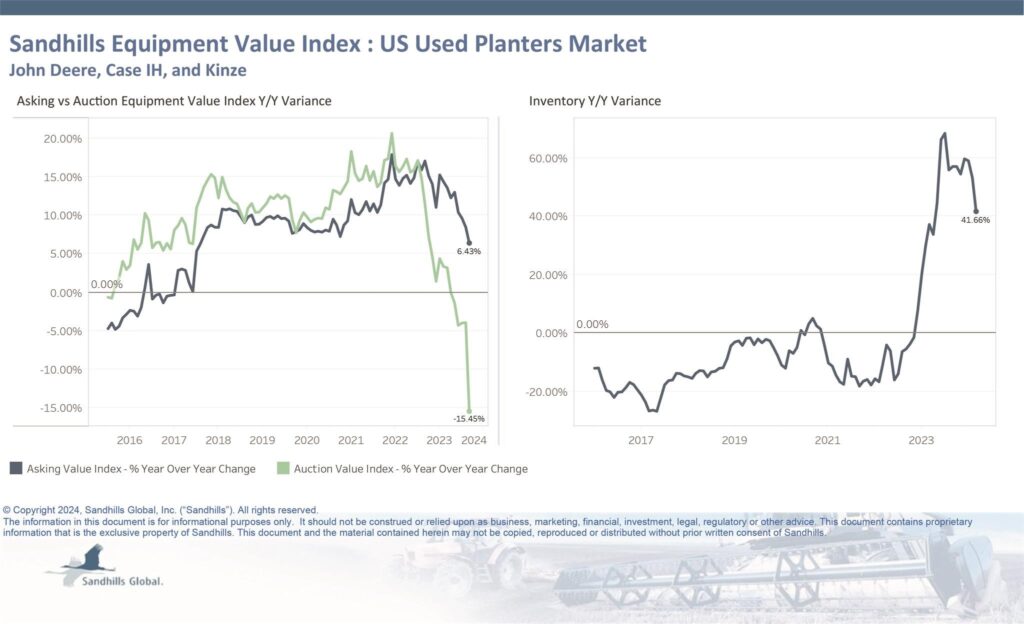

Used-planter inventory

- Inventory levels fell 41.66% year over year.

- Asking values were down 6.43% YoY and continue to trend lower, Sandhills said.

- Auction values were down 15.45% YoY.

- There’s a 70% spread between asking and auction equipment values, the largest difference since May 2015, Sandhills noted.

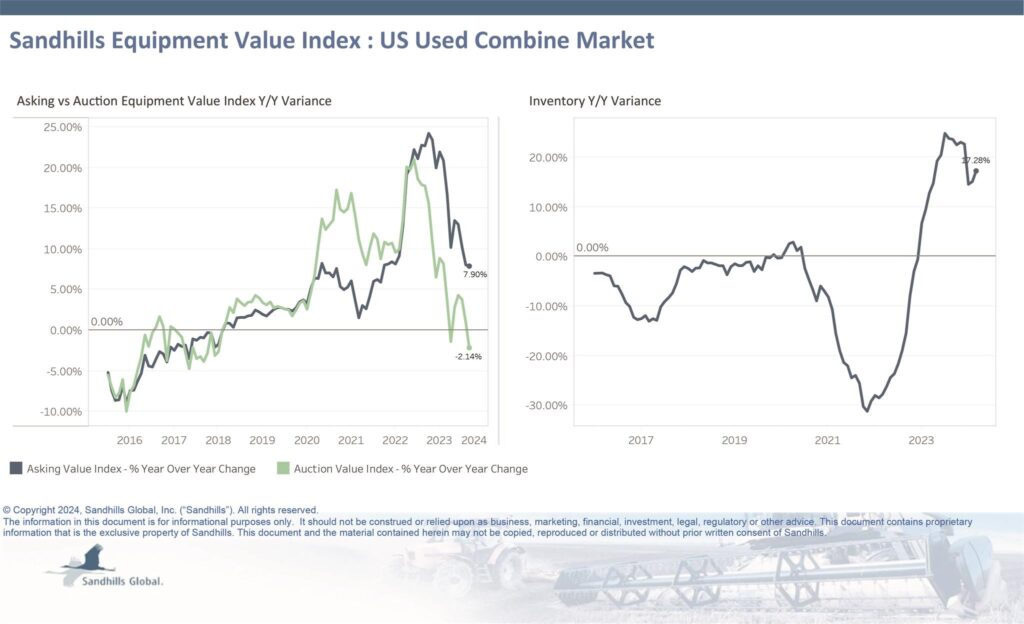

Used-combine inventory

- Inventory levels increased 17.28% YoY.

- Asking values were up 7.9% YoY, but expected to fall alongside dropping auction values.

- Auction values were down 2.14% YoY with the expectation of further decline.

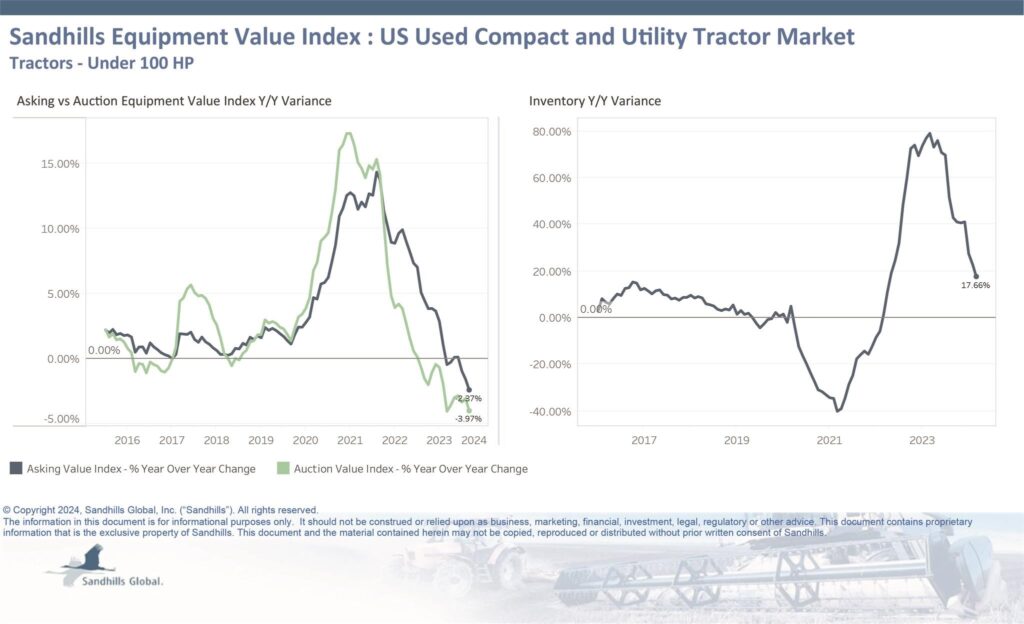

Used-compact and -utility tractors

- Inventory levels rose 17.7%.

- Asking values declined 2.4% YoY.

- Auction values were down 4% YoY and continue to trend downward.

Commodity prices impact equipment

The U.S Department of Agriculture lowered its estimated prices for crops including corn, cotton, soybeans and wheat last week, meaning farmers will have purchasing power.

Overall, the USDA forecasts a 25.5% decline in net farm income in 2024. In February, the agency said it expects farm profits to drop 16% YoY to $155.9 billion.

The combination of dropping profits with the increased volume of aging inventory is expected to lead to a “substantial uptick in auction content [and] dealers liquidating assets off the lot,” Dolezal said. To offload older equipment, dealers may “slash that retail price,” while others could offer more attractive financing, he said.

“You have even seen some 0% [interest] for 72 months on specific assets, which means they’re putting a pretty penny into being able to make it attractive for a farmer to purchase,” he said.

TractorHouse runs farm equipment auctions through Sandhills, and Dolezal noted that equipment often sells for less than full value.

“The dealer’s philosophy is: Do they rip the Band-Aid off and send [equipment] to auction knowing they’re getting 70 cents on the dollar? Or do they reduce the price as much as they can to get back to minimizing losses on some of the assets they took in on trade a year ago,” Dolezal pointed out.

Dealers also compete with manufacturers selling new equipment. “You’re having OEMs offer competitive financing programs and it puts a real strain on that late-model, used inventory,” Ryan said. “Inventory is extremely high, and it’s just now catching up to the auction numbers,” he said.

Registration is now open for Equipment Finance Connect, the nation’s only dealer-centric equipment lending and leasing event, which will take place May 5-7 in Nashville, Tenn. Learn about the event and free dealer registration at EquipmentFinanceConnect.com.