New, used truck prices rise 2% in July

Commercial trucks, trailers for sale rose 1% in July

Commercial truck prices rose in July as tariffs continued to drive up prices amid other pressures such as lower spot rates and higher operating costs.

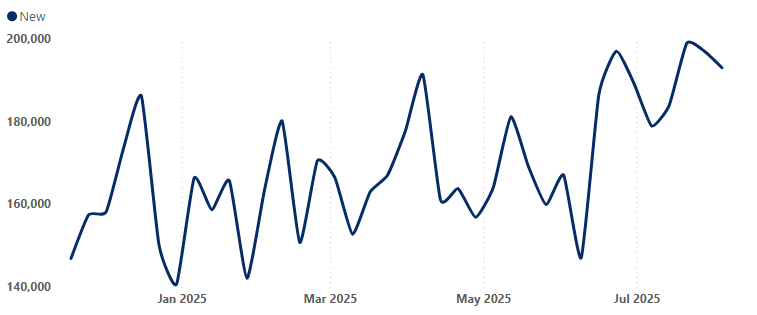

Prices for new, used and certified pre-owned commercial trucks rose in July as tariffs further weakened the industry, according to Equipment Finance News’ Average Truck Price Trends dataset. The average new commercial truck price landed at $193,043 as of Aug. 4, up 2% month over month, according to EFN data.

Average New Truck Prices

Meanwhile, the average used-truck price rose 1.5% MoM to $45,038, and the average certified pre-owned price dropped 57.4% MoM to $79,793, according to the EFN data. The dataset identifies pricing trends in the trucking industry, with data that goes back to November 2024 and updates daily.

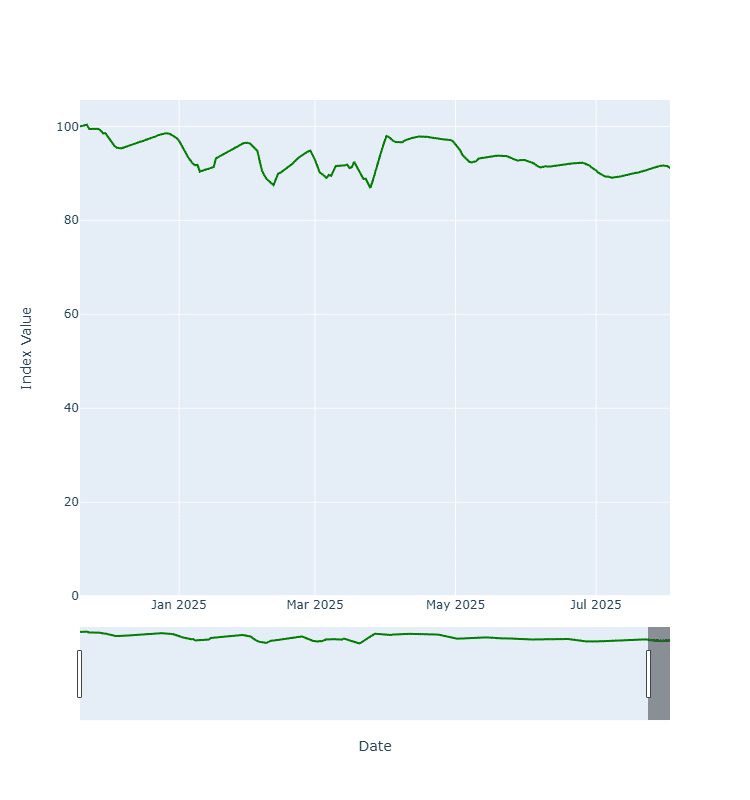

Meanwhile, EFN’s Index of Commercial Trucks and Trailers Available for Sale and Lease, which is a reference point for truck-supply trends, reached 91.5 on Aug. 1, up 1% MoM. The interactive index updates daily and consists of data collected by EFN since November 2024.

Index of Commercial Trucks & Trailers Available for Sale & Lease

Trucking challenges extend beyond tariffs

The trucking industry faces challenges beyond tariffs, including declining Class 8 truck sales, lower spot rates and rising operating costs — offset only briefly by reduced fuel prices in one recent month, Anthony Sasso, head of TD Equipment Finance, told EFN.

Tariffs are not the primary cause, but they worsen existing problems by creating uncertainty, which discourages capital spending, he said.

“Two years ago, as rates started coming up, and as recent as last year, we had a number of clients that had postponed big CapEx spend because of where interest rates were,” Sasso said.

At the lower end of the middle market, it became a significant issue, so much so that several clients said they didn’t want a fixed-rate deal because they were confident interest rates would decline, he added.

The tariff impact varies by carrier type and client base; some dedicated carriers see little change, while others’ customers are shifting sourcing away from overseas suppliers. Overall, tariffs add to industry headwinds by heightening cost and demand concerns, which will only increase if consumers also begin to feel the impact of tariffs, Sasso said.

“If we start seeing any pressure on the consumer in the U.S., where consumer spending now goes down, that’s when you’ll understand the full impact of whether or not tariffs have created a downplay in the economy,” he said. “Once that goes down, then you’re going to see some major impact.”

Consumers facing higher prices

U.S. consumers continued to avoid large tariff-related price increases in July’s Consumer Price Index, with headline CPI up 0.2% and core CPI climbing 0.3%, its strongest monthly gain since January, pushing the annual core rate to 3.1%, the Bureau of Labor Statistics announced today. The firmer core reading was driven mainly by services, particularly medical care and airfares, while shelter costs met expectations and core goods inflation remained modest, according to a research note from Wells Fargo published today.

“Tariff-related price increases continued to seep slowly into the data, with prices for household furnishings, apparel and recreational goods once again climbing higher,” according to the note. “Prices for used autos rose 0.5% in the month, while new-vehicle prices were roughly flat in July.”

U.S. consumers have already absorbed 22% of the tariff costs through June, and their share is expected to rise to 67% if recent tariff patterns continue, according to an Aug.10 Goldman Sachs Economics Research note.

Higher tariffs are expected to slowly raise prices of goods, while core services inflation eases only slightly, according to the Wells Fargo note. As a result, the Federal Reserve is projected to cut rates three times this year, according to the note.

Uncertainty scaling back new truck purchases

Ongoing tariff uncertainty is causing businesses to delay or scale back equipment purchases, with executives opting to conserve liquidity in case other expenses arise, TD Equipment Finance’s Sasso said. As a result, companies may buy fewer trucks and focus on using their existing fleets.

“If [large trucking companies] were looking at 100 units, maybe they’re looking at 80 units, but it’s not a major, significant downplay,” he said. “If we were in the lower-end, middle-market space, we may see more of a dramatic effect, where it’s not going to be 50 units this year, it’s only going to be 25.”

New engine emissions regulations also continue to weigh on demand, leading many customers to postpone purchases and maintenance, Rush Enterprises Chairman and Chief Executive W.M. “Rusty” Rush stated during the company’s July 31 earnings call.

“Due to ongoing uncertainty around trade policy and engine emissions regulations, new Class 8 truck sales may decline sequentially in the third quarter, and the market outlook beyond the third quarter is difficult to project at this point,” he said. “Unlike the new truck market, the used truck market is less exposed to trade and regulatory uncertainty, which could give truck buyers more confidence and incentive to consider used trucks as part of their fleet mix in the near term.”

A recovery timeline for the trucking industry is hard to predict, TD Equipment Finance’s Sasso said.

“It’s going to be slow going in 2025,” he said. “Most of our clients are predicting some type of uptick in 2026, but that’s still yet to be seen.”

Check out our exclusive industry data here.