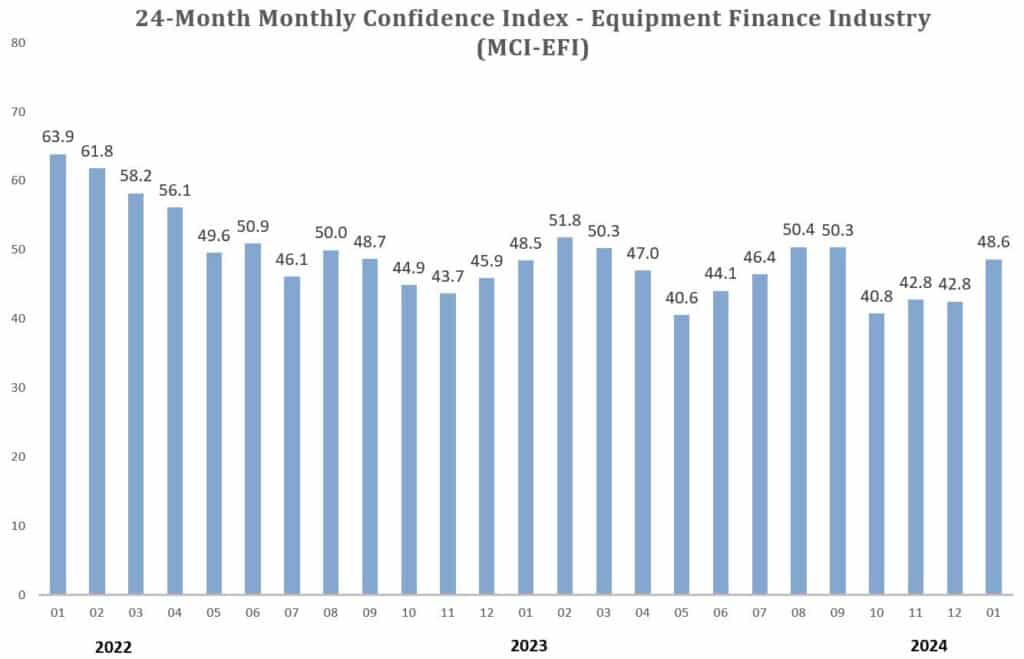

Equipment finance confidence improved in January as interest rate cut expectations grew and new business volume improved at yearend.

The Monthly Confidence Index for the equipment finance industry landed at 48.6 in January, up from 42.8 in December and 48.5 in January 2023, as a growing number of equipment finance executives expect economic conditions to improve, according to the Equipment Leasing and Finance Foundation, the foundational arm of the Equipment Leasing and Finance Association (ELFA).

“I’m bullish on the fact that rates will go down, and I’m bullish that there will be a benefit of that transition downward in terms of rates on our business,” he said. “Those wildcards could wade into decision-making processes of a CEO or CFO of a company expanding their business.”

- Most financiers — 65.5% — expected there to be “no change” in business development spending, down 1.2 percentage points month over month;

- 17.2% of financiers indicated their companies will spend more on business development activities, up 2.4 percentage points MoM; and,

- 17.2% also indicated business development spending will decrease by 1.3 percentage points MoM.

Rising new business volume

New business volume in the ELFA Monthly Leasing and Finance Index, which collects the economic activity of 25 companies across the equipment finance industry, landed at $116.2 billion in 2023, up 3.9% year over year.

New business volume increased to $12.5 billion in December, up 50.6% MoM and 2.5% YoY, according to ELFA.

“Our originations have continued as anticipated,” he said. “New business in 2024 and beyond will come from the vendor channel in the markets that we are committed to and potentially new markets that meet our targeted focus of end-user profile and risk/return dynamics within the small-ticket space.”

Small-ticket lenders represent 48.2% of the January confidence index, according to ELFA. The remainder of the index includes 10.3% large-ticket lenders, 41.4% middle-ticket lenders and the rest in micro-ticket lenders, or tickets under $25,000.

Registration is now available for Equipment Finance Connect. The dealer-centric equipment lending and leasing event of the year offers opportunities for dealers to learn new strategies, foster valuable partnerships and emerge with ideas to immediately apply to their businesses. Learn about free dealer registration at EquipmentFinanceConnect.com.