Values for heavy-duty trucks dropped again in August, while values for medium-duty trucks and semitrailers were mixed as transportation industry inventory increased.

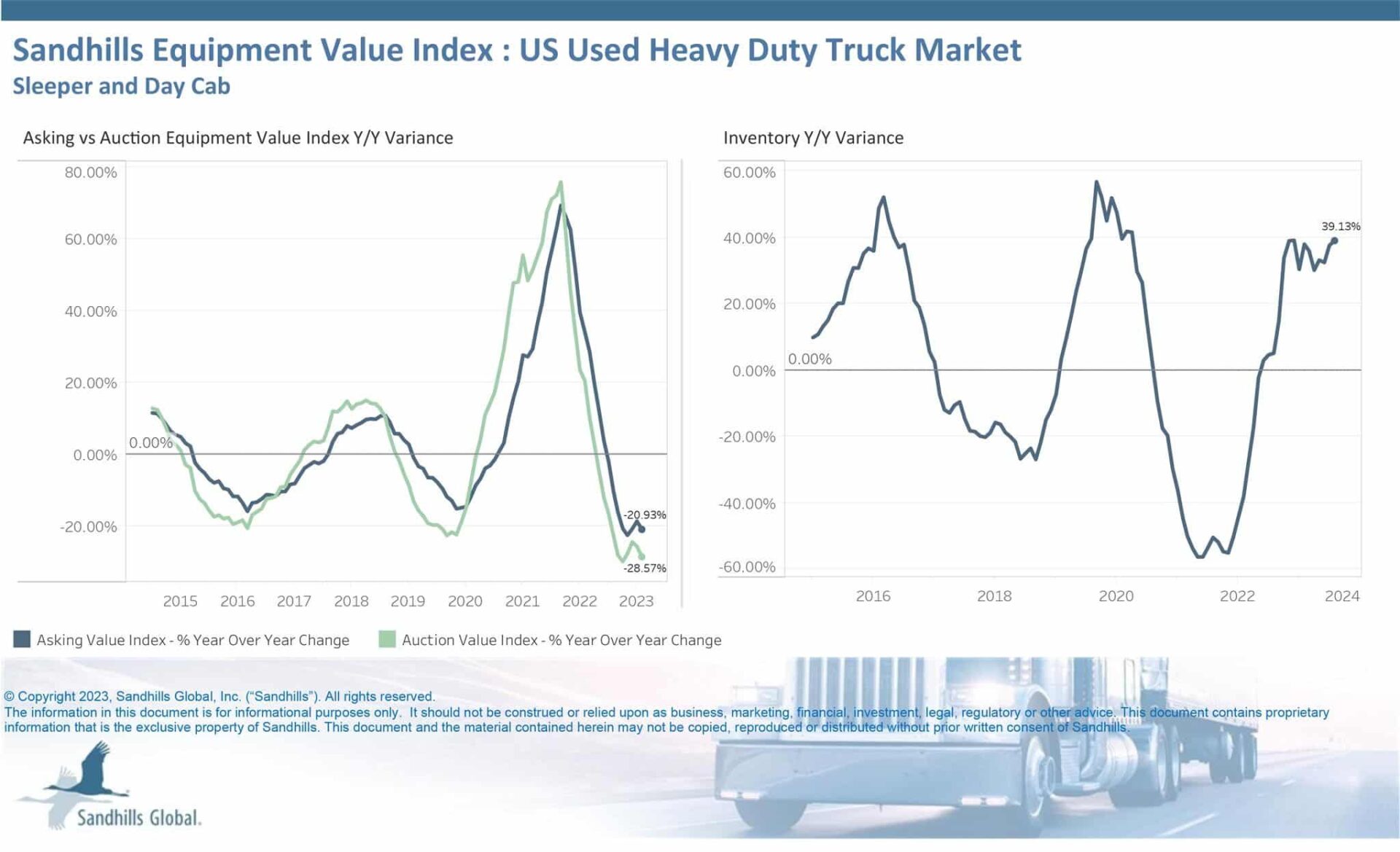

Auction values also declined in August, dropping 2.4% month over month and 28.6% year over year, according to Sandhills Global market reports. Retail values, also known as “asking values,” for used, heavy-duty trucks plunged further, dropping 3.7% MoM and 20.9% YoY, continuing the trend from 2022, Jim Ryan, equipment lease and finance manager at Sandhills Global, said during a Sept. 12 company presentation.

“On the transportation side, what we’ve seen since quarter two of 2022 has been a downturn, as that was the peak of the asking value number,” he said. “Since then, you’ve seen that asking value continually drop, and, in the correlation, you’ve seen the inventory level start rising.”

Inventory for used, heavy-duty trucks remained flat sequentially but increased 39.1% YoY in August, according to Sandhills. Supply is expected to continue building as more trucks enter the market, Ryan said.

“Manufacturing is catching up, you’re getting a lot of lease returns, you’re getting a lot of big fleet companies that are dumping inventory back into the market, and I think that’s going to continue,” he said. “Inventory levels are what drives this industry, and it’s going to be what drives auction and retail pricing.”

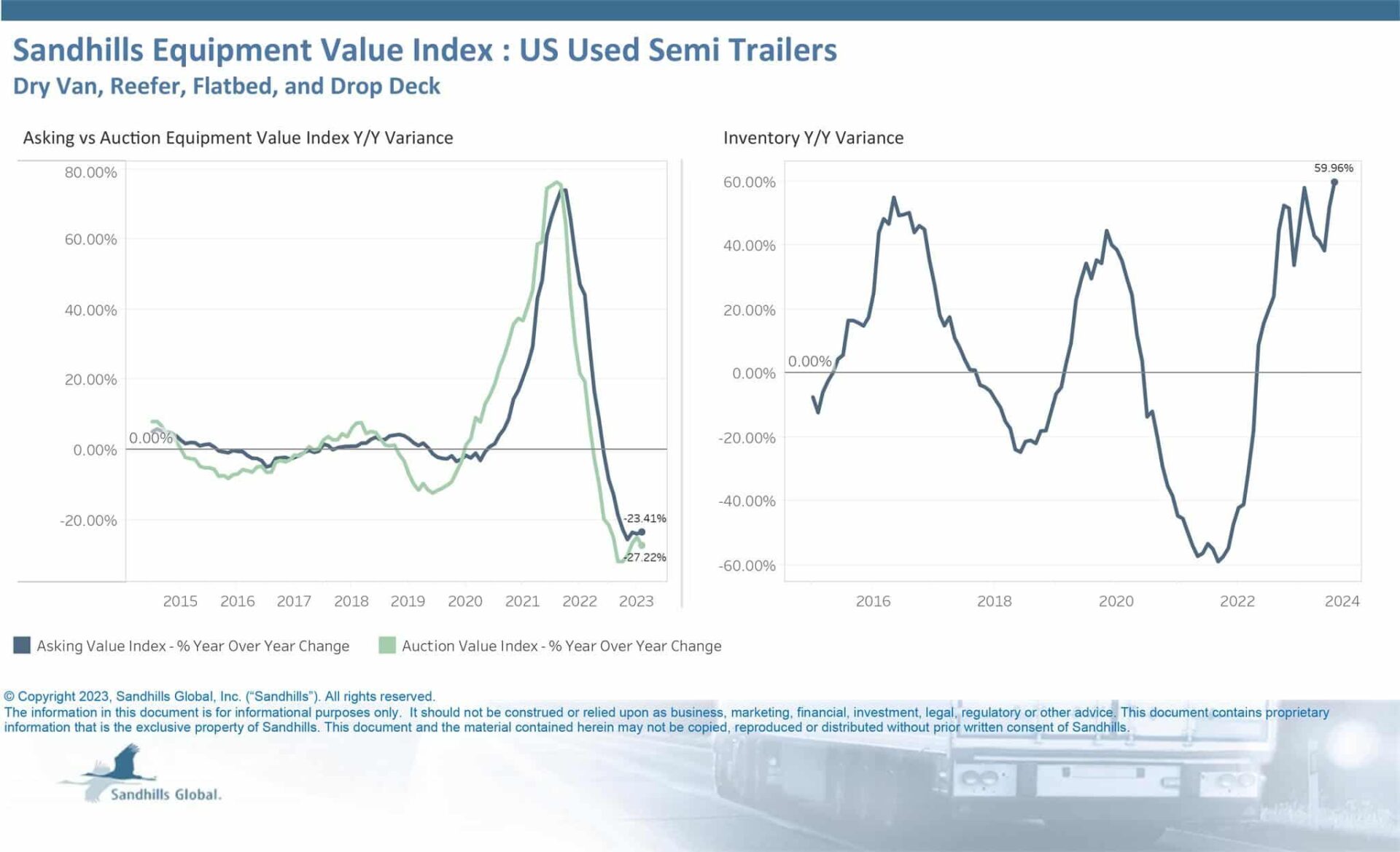

Semitrailer auction values down 25% YoY

Retail values for used semitrailers increased 0.1% MoM in August and 23.4% YoY despite large declines in dry van trailer values, according to Sandhills. Auction values also declined 2.9% MoM and 27.2% YoY.

Inventory for used semitrailers increased 3.6% MoM and 60% YoY, according to Sandhills. Dry van and reefer semitrailers led the way in terms of sequential increases, according to data Sandhills provided to Equipment Finance News.

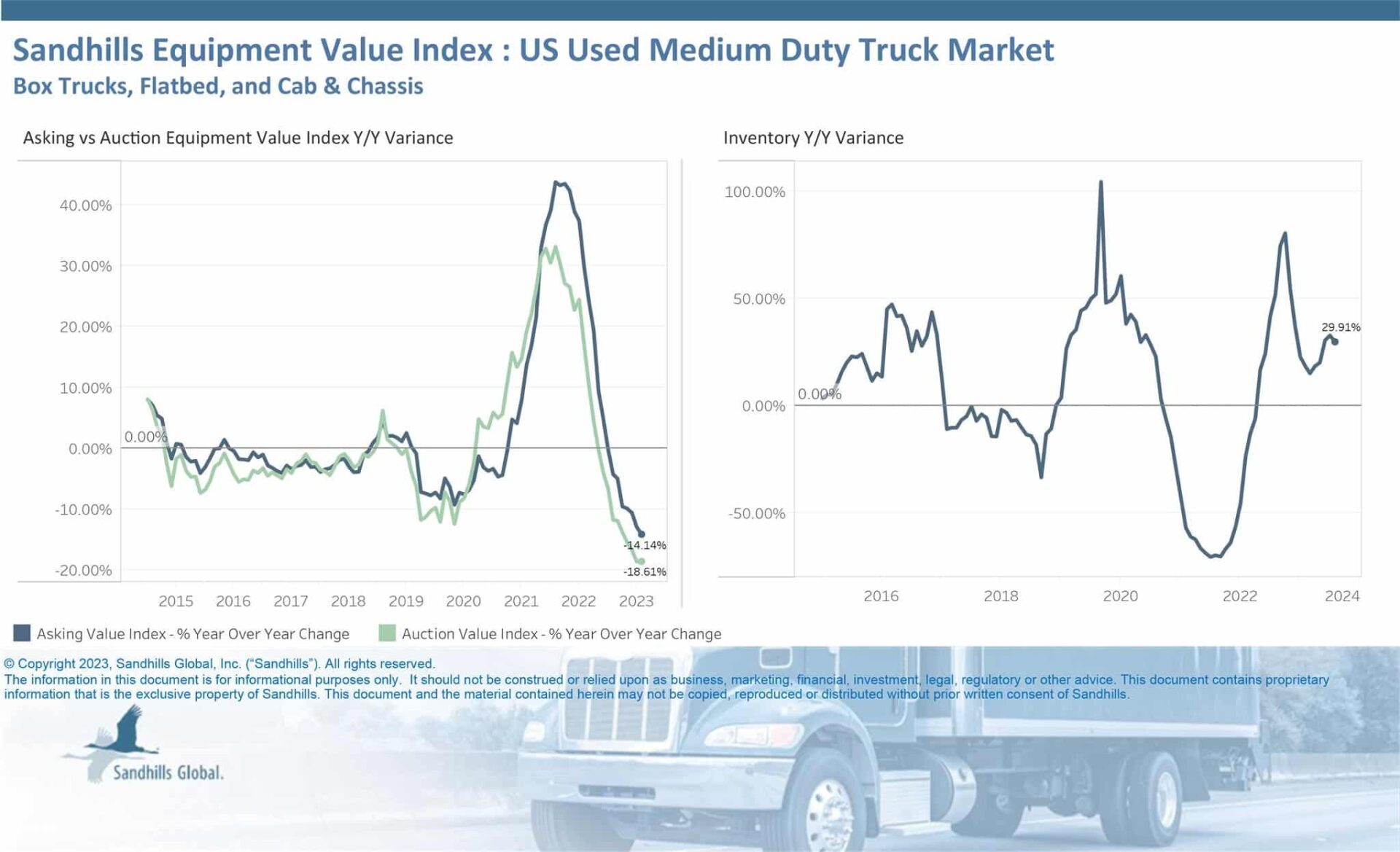

Retail values for medium-duty trucks declined 0.4% MoM and 14.1% YoY, while auction values dropped 1.2% MoM and 18.6% YoY, according to Sandhills. The gap between retail and auction values in medium-duty trucks represents the largest gap between the two values for any segment.

Inventory for used medium-duty trucks increased 1.5% MoM and 29.9% YoY, according to Sandhills. Box truck inventory led the category, as the inventory growth trend continued.