Average new truck price up 25% YoY

Average used price down 10% MoM

Commercial truck prices rose by double digits over the past year despite mixed pricing trends in the past month as uncertainty around tariffs and volatility in the overall market put pressure on the industry.

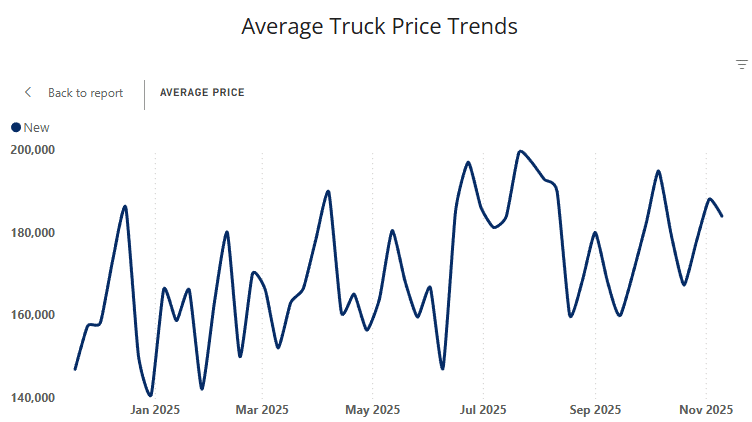

Prices for new, used and certified pre-owned commercial trucks rose during the first year of Equipment Finance News’ Average Truck Price Trends dataset. The average new commercial truck price landed at $183,950 as of Nov. 10, up 2.5% month over month and 25.3% year over year, according to EFN data.

Meanwhile, the average used-truck price fell 9.9% MoM but rose 12.5% YoY to $43,338, and the average certified pre-owned price rose 203.9% MoM and 10.2% YoY to $83,950, according to the EFN data. The dataset identifies pricing trends in the trucking industry, with data that goes back to November 2024 and updates daily.

Market concerns

Meanwhile, rapid year-over-year increases in new truck prices are accelerating early-life depreciation, causing post-pandemic models to lose value far faster than older vintages, Sandhills Global Equipment Lease and Finance Manager Jim Ryan told EFN.

“To the resale market, the end users and everybody else that’s out there buying, this is a huge drop in a three-year time span, so that’s really the glut of the trucking problem right now,” he said. “The depreciation is wild right now on the trucking side.”

Despite issues plaguing the truck industry, the essential need for trucking leaves an opportunity as the industry recovers from the downturn, Anthony Pordon, executive vice president of investor relations and corporate development at Penske Automotive Group, said during Gabelli Funds’ 49th Annual Automotive Symposium on Nov. 3.

“The truck business is a little tough right now, but … everything in this country moves on a truck. When [the marketplace] gets aligned and gets better, that’s going to take a lot of capacity out, and look, these businesses are all going to shine.” — Anthony Pordon, executive vice president of investor relations and corporate development, Penske Automotive Group

In addition, continued uncertainty around truck tariffs has stalled pricing and orders, making the next few quarters difficult while manufacturers sort out compliance and supply tightens enough, Rush Enterprises Chairman and Chief Executive W.M. “Rusty” Rush said during the company’s Oct. 30 earnings call.

“The hard part was, while we were in a freight recession, we just kept building and selling trucks longer than we probably should have,” he said. “Now we’re on that right-sizing piece, along with the government activities … I have some optimism. It’s just not over the next six months.”

Register here for the free Equipment Finance News webinar “Tech-driven risk management: How innovation is reshaping equipment finance” set for Tuesday, Dec. 9, at 11 a.m. ET.