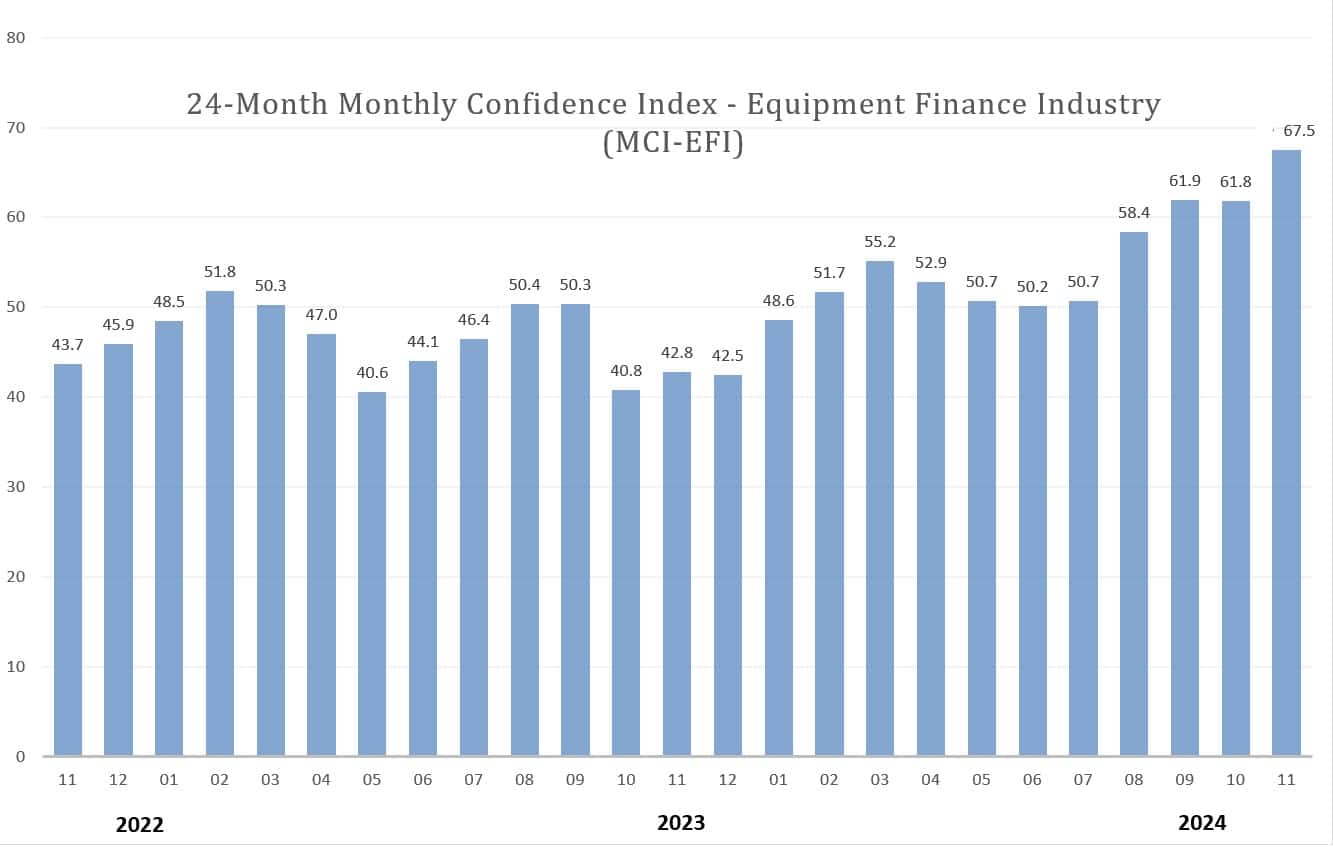

Equipment lender confidence this month is at its highest in more than three years after a second straight federal interest rate cut and the decisive presidential election.

The Equipment Leasing and Finance Foundation’s monthly confidence index reached 67.5 in November, up from 61.8 in October and the highest it’s been since August 2021. The index climbed to a 32-month high in September at 61.9.

A clearer political outlook contributed to higher confidence this month, Global Finance and Leasing Services Chief Executive James D. Jenks stated in the report.

“Looking forward, [President-elect Donald] Trump’s policies will improve the economy and begin reducing government over-regulation,” he said.

However, there are concerns regarding “the state of the consumer and the U.S. from a debt-load perspective,” North Mill Equipment Finance President and COO Mark Bonanno stated in the report.

Meanwhile, 48.3% of equipment financiers expect loan and lease demand for capital expenditures to increase over the next four months, up from 44.8% in October, according to the ELFF report. Nearly 38% expect greater access to capital for equipment acquisitions over the next four months, up from 27.6% in October.

The number of respondents who anticipate improved U.S. economic conditions over the next six months rose to 60% in November from 37.9%. Nearly 45% of equipment lenders plan to hire more employees over the next four months, up from 24.1%.

Slow shift to lower rates

The Federal Reserve on Nov. 7 reduced its federal funds rate 25 basis points to a range of 4.5% to 4.75%, following a cut of 50 basis points in September.

While the rate cuts bode well for the equipment finance sector, lenders may avoid jumping the gun as the market transitions to a lower-interest rate environment, Kevin O’Connor, sales director at Northbrook, Ill.-based Beacon Funding, told Equipment Finance News.

“Regardless of what the current buy rates are or sell rates are in the industry, we try to maintain a certain margin so we move as the market moves as a whole,” he said. “So, I think the strategy is not to be too far behind the shift to the lower end of the spectrum, but also maybe not to be the first one on the lower end of the spectrum.”

The third annual Equipment Finance Connect at the JW Marriott Nashville in Nashville, Tenn., on May 14-15, 2025, is the only event that brings together equipment dealers and lenders to share insights, attend discussions on crucial industry topics and network with peers. Learn more about the event and register here.