Equipment financiers are more confident than they’ve been in years and expect small businesses to ramp up buying amid broader economic improvements.

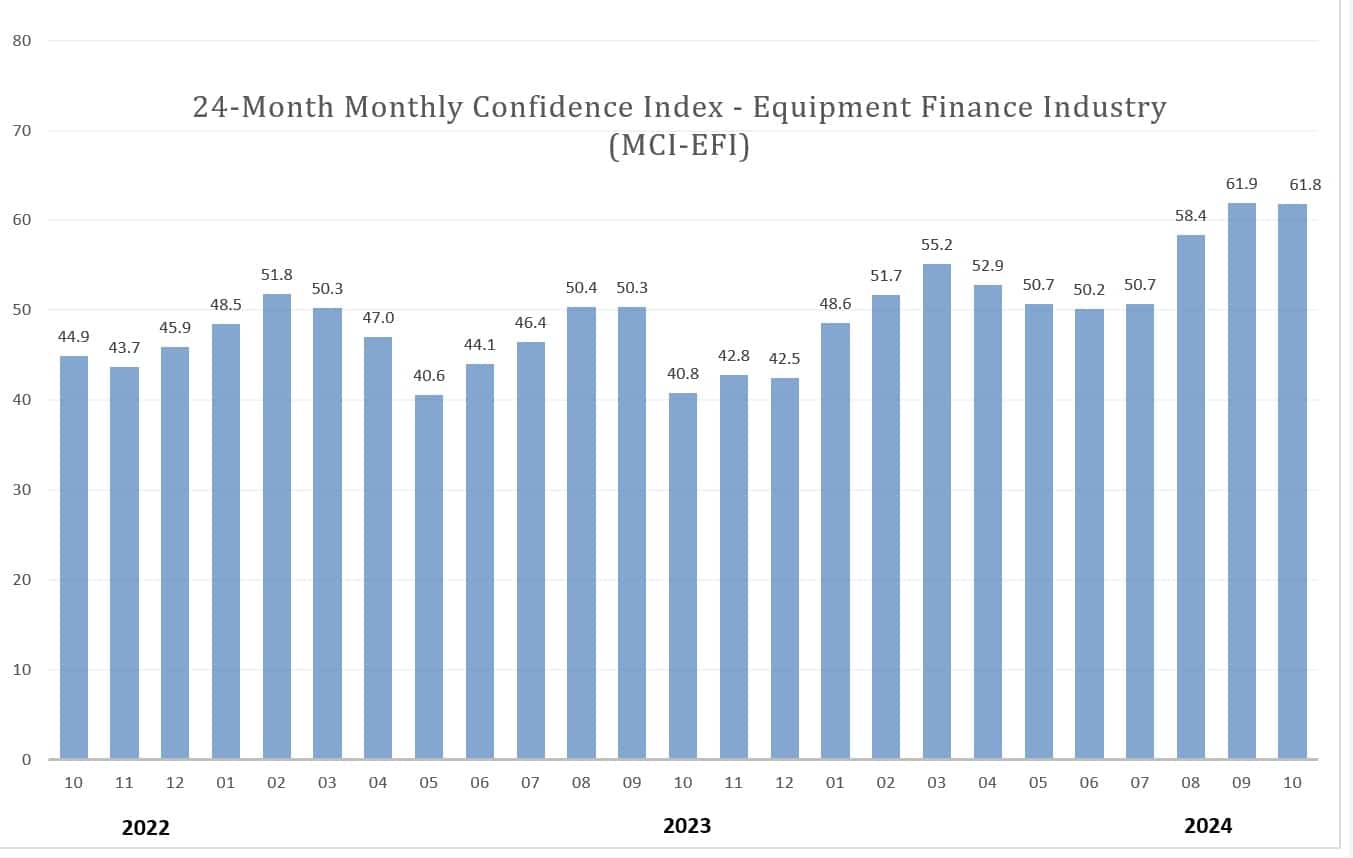

While the Equipment Leasing and Finance Foundation’s Monthly Confidence Index fell in October to 61.8 from the 32-month high of 61.9 in September, nearly 38% of respondents said they expect business conditions to improve over the next four months. This number is down from 40% in September.

However, the number of lenders who believe demand for leases and loans to fund capital expenditures will increase over the next four months rose to 44.8% from 44% last month.

The ELFF report, released on Oct. 17, comprises surveyed responses from banks, captives and independent lenders in the equipment finance sector.

Of the survey respondents, 27.6% expect increased access to capital to pay for equipment over the next four months, up from 24% in September. Nearly 38% of lenders believe that U.S. economic conditions will improve over the next six months, up from 24% in September.

With borrowing costs starting to fall, equipment financiers are seeing an uptick in loan applications, Jody Ray, relationship manager at Chicago-based BMO Bank, told Equipment Finance News.

“Rates are now much lower than they were even just a few months ago,” he said. “That has generated enough interest from the customer side to make those applications to pursue that financing.”

While many prospective borrowers have emerged in recent months, BMO Bank has been more judicious with underwriting and credit approvals as lower borrowing costs create more opportunities to take risks, Ray said.

Market improvements boost small businesses

Lower interest rates and increased access to capital means more small businesses will return to dealer lots, Huntington Equipment Finance President Jeffry Elliott stated in the ELFF report.

“Lower interest rates will ignite capex for smaller companies that have been on the sidelines for a few years and need to add or replace equipment for growth,” he said. “Getting past the election should provide some clarity on the economic direction of the U.S., thus more CapEx investments can be made.”