Equipment finance originations declined year over year in October as concerns persist over banks pulling back and credit standards tightening.

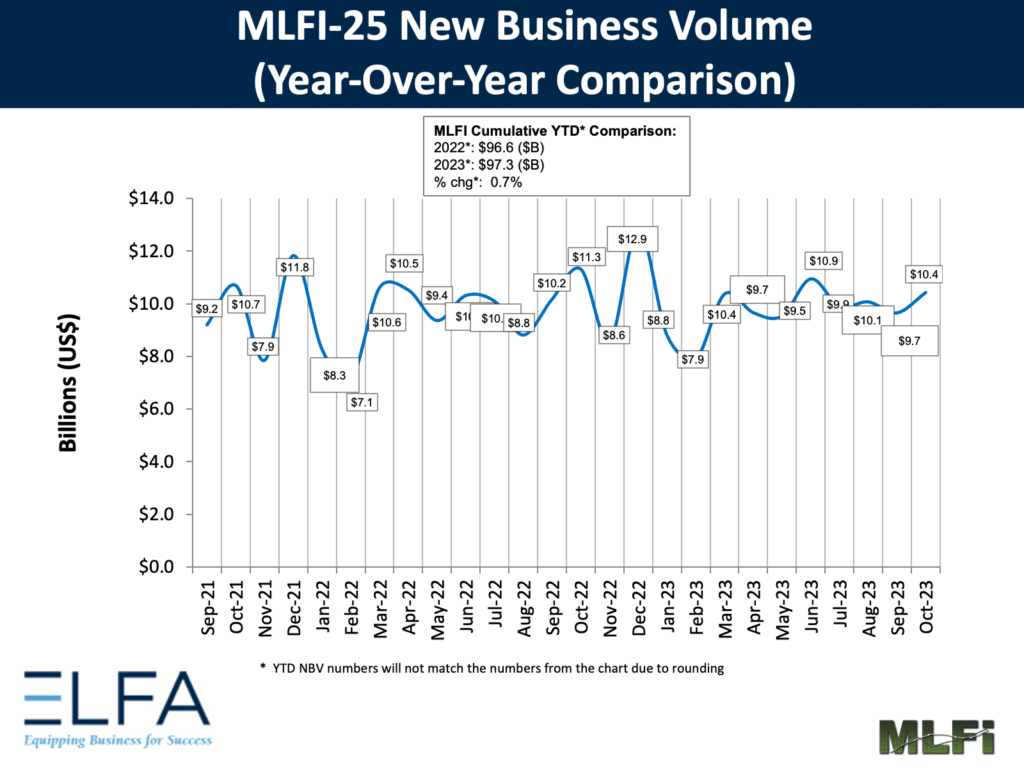

Equipment finance industry new business volume in October dropped 8.7% YoY to $10.4 billion but increased 7.1% sequentially, according to the Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI). Year-to-date new business volume increased 0.7% YoY to $97.3 billion.

“Despite a set of sound metrics in the U.S. economy, MLFI participants report slight increases in both losses and delinquencies,” ELFA Chief Executive and President Ralph Petta said. “This softness in credit quality is indicative of the challenges experienced by some businesses as they operate in a higher interest rate environment, constrained in some sectors, at least, by reports of a pullback in bank lending.”

That pullback and tightening credit standards resulted in higher rates and more difficulty in securing financing for customers across all credit tiers, Brian Holland, president and chief executive of fleet lessor and asset management firm Fleet Advantage, told Equipment Finance News.

“There’s typically a flight to quality in these types of markets, and we’re seeing that, but even the best credits are seeing higher rates and spreads,” he said. “Lower credit [score borrowers] are being impacted more in this market, with a limited capacity and more stringent terms.”

Rising charge-offs

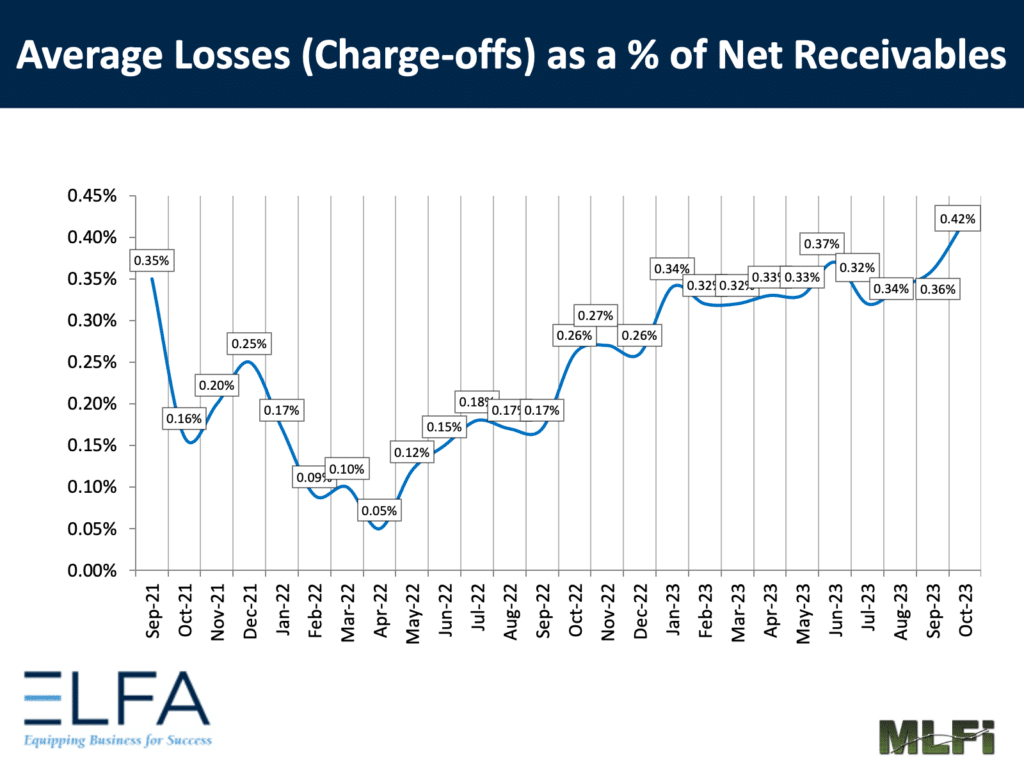

Higher interest rates and tighter financing have also led to growing delinquencies, with average losses net of receivables reaching a two-year high of 0.42% in October, up 6 basis points (bps) month over month and 15 bps YoY, according to the index.

“Volume declines, delinquencies and charge-off increases are moderate, particularly after periods of such artificially low comparable results,” said Dennis Bolton, senior managing director and head of equipment finance in North America at global liquidation and restructuring firm Gordon Brothers. “While challenges remain, the industry is well positioned to manage these challenges and support continued equipment investment.”

Higher interest rates, tightened credit standards and supply chain issues present challenges for the equipment finance industry, but they also present an opportunity for lenders to grow their book of business through servicing and leasing, Holland said.

“Where you have a challenge there’s always an opportunity, and leasing offers a great deal of flexibility,” he said. “It gives companies the ability to better manage their assets and gives them options for upgrades and maintenance.”

Fleet Advantage has more than 20,000 units in its portfolio, representing more than $2.6 billion in assets under management amid its growth, Holland said.