“The current state of the equipment finance industry is strong right now … whether it’s technology, trucks, trailers or marine,” Ron Goheen, senior market sales manager at Wells Fargo Equipment Finance, told Equipment Finance News.

Still, commercial lending performance has been mixed over the past few years amid supply chain challenges.

“Coming out of COVID, with the supply chain issues in our space on the trucking side of it, we’ve seen a forced extended trade cycle; so, whether it’s an owner-operator, a small trucking company or a large fleet, they’ve all been subject to having to hold on to their equipment longer than they normally do,” Goheen said.

Demand for equipment financing is starting to dwindle with high interest rates coming on the heels of a strong market during the pandemic.

“We’ve seen a softening of demand for equipment acquisition; however, we planned accordingly,” RJ Grimshaw, president and chief executive of UniFi Equipment Finance, told EFN. “We knew that this was going to happen because you can’t come off of the last two years with the demand the way that it was, and maintain that, especially with a rising rate environment. That’s what has slowed down demand.”

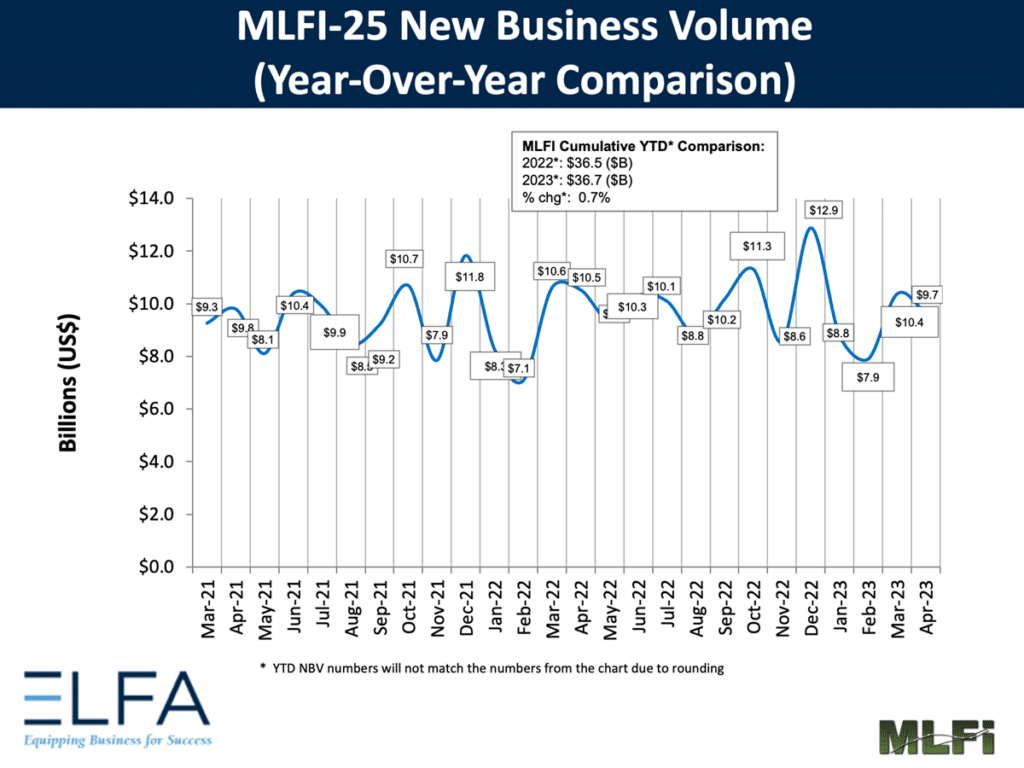

New-business volume in the equipment finance industry was $9.7 billion in April 2023, down 24.8% from December 2022 and 7.6% year over year, according to the Monthly Leasing and Finance Index published by the Equipment Leasing and Finance Association (ELFA). However, year-to-date new business volume ticked up 0.7% YoY to $36.7 billion.

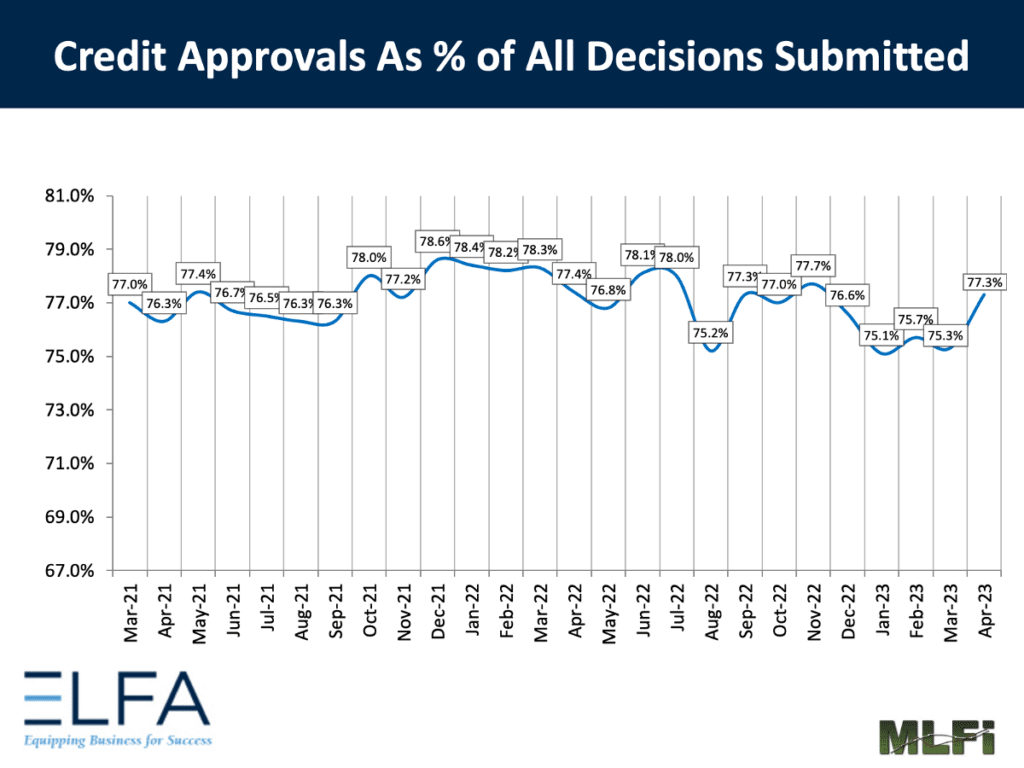

While cumulative YTD volume is up YoY, the industry is seeing a pullback in credit approvals, with 77.3% of loan applications receiving approval, an increase of 70 basis points (bps) compared with December 2022 but down 10 bps YoY, according to ELFA.

Confidence in the industry is also in decline, according to the Monthly Confidence Index of the Equipment Finance Industry published by the Equipment Leasing & Finance Foundation, the foundation of ELFA. The May index landed at 40.6, a 24-month low. Adding to the decline in confidence was that 42.9% of surveyed executives who responded expect demand for capital expenditure loans and leases to decrease in the next four months, up from 25.9% in April.

Inventory management post-pandemic

A pullback on capital investment in the face of economic uncertainty also presents an opportunity for equipment financiers, Jon Biorkman, U.S. head of equipment finance at Bank of Montreal, told EFN.

“During situations of economic uncertainty, whether it’s reality or whether it’s perception, companies often consider pulling back on capital investment,” Biorkman said. “A key value proposition of our industry is providing [customers] options to enable businesses to invest during all types of market cycles.”

Some companies are already pulling back on capital investment, with core capital goods orders and shipments — two measures of equipment industry performance — decreasing by 0.4% in March, according to the Monthly Advance Report on Durable Goods Manufacturers’ Shipments Inventories and Orders, released by the U.S. Census Bureau. The decline in core capital goods orders and shipments follows a 0.7% decline in orders and a 0.4% decline in shipments during February.

While core capital goods orders and shipments saw a slight pullback in Q1, OEMs such as Terex have significant backlogs created by pandemic-spurred supply chain issues. Backlogs are starting to clear up as the supply chain improves.

“The dealers are getting more equipment, which has been a good thing, and contractors have been holding on to equipment a little bit longer than they have in the past. And that’s simply an issue because they can’t get as much as they wanted,” Peter Gregory, senior vice president of Wells Fargo Equipment Finance, told EFN. “Contractors have strong backlogs, so there’s been a lot of work that’s been sent out to the market, and customers are staying busy.”

Despite challenges facing the industry, equipment dealers are seeing strength across sectors, John Boy, finance and sales administration manager at equipment dealer Anderson Equipment Company, told EFN.

“The equipment industry is strong across all sectors,” Boy said. “It’s not just an infrastructure bill that passed. It’s not just a mining need. Everything in all sectors is green right now.”

Inflation, labor conditions present industry opportunities

Navigating rising interest rates and labor shortages are the two top challenges facing the equipment and equipment finance industries and could pose an opportunity for companies to reevaluate capital strategies, BMO’s Biorkman said.

“We’re always focused on what’s happening today, but we’re also focused on looking around one or two corners for our clients,” he said. “The current interest rate environment provides an opportunity to reassess existing investment policies. Equipment finance has largely been a fixed-rate structure industry, which enables further capital structure diversification.”

Beyond rising interest rates, rising material costs due to inflation lead to higher costs for purchasers.

“Inflation is an issue. Costs have gone up, so that’s been another line item that our contractors are facing,” Wells Fargo’s Gregory said. “They’re seeing material costs in the last year up 35% to 40%, and that’s another issue that’s going to get worse, and they’ll try and pass it on in job costs.”

Cost of construction materials and components was up 0.8% YoY, according to the April producer price index released by the U.S. Bureau of Labor and Statistics.

In addition, finding solutions to labor shortages is a priority, but employers may need to look at labor costs differently. One trend in solving the labor shortage is finding ways to improve productivity and quality of life.

“What we’re hearing from our customers is pay is a big part of it, but a lot of it is culture: how they’re being treated, their benefits. It’s more standard to have medical benefits, whereas before it was just pay-per-mile,” Wells Fargo’s Goheen said. “A big topic now is what they’re driving, because if they’re driving a brand-new tractor versus a 3- or 4-year-old [model] that’s constantly breaking down, they’ll forfeit a little bit of pay for nicer, cleaner equipment. That’s what we’re seeing on the larger fleets: the successful ones that can retain drivers are using a combination of those three, not just being the highest paid.”

Komatsu, for one, is utilizing automation technology to provide more quality-of-life benefits and overcome the labor shortage exacerbated by retirements during the pandemic, Anderson’s Boy said. Komatsu’s Smart Construction provides automation and other software tools to ease the transition to a younger, less-experienced generation of workers, which Boy said is helping customers who are using the technology.

Equipment finance’s future

As the second half of 2023 approaches, technology advances in the equipment industry present opportunities such as growth of robotics as a solution to labor issues, UniFi’s Grimshaw said.

“One area that we see is a huge growth opportunity is in the robotics space,” he said. “We have a couple of dealers that are selling robotics that hook on to computer numerical control machines to take the place of human capital, but [labor is] still an issue, and I don’t see it going away anytime soon, especially for the small- to medium-size [businesses].”

While robotics and smart equipment represent increased costs for customers, the potential return on investment benefits all parties, Boy said.

Smart equipment is “costing more because there’s more jam-packed into these machines to have higher productivity and higher efficiency,” he said. “They’re seeing that the investment they’re placing on these is a good return on investment and they’re reaping the benefits of lower manhours and more efficiency with the equipment. I don’t see the rate climate impacting that as far as the increased investment in those machines.”

Stringent climate standards

The U.S. Environmental Protection Agency is set to revise standards to reduce greenhouse gas emissions from heavy-duty vehicles in model year 2027 and set more stringent standards for model years 2028 through 2032, according to an April 12 release. As a result, the equipment and equipment finance industries are preparing for a shift toward compliant equipment, Wells Fargo’s Goheen said.

“We’re preparing for 2025 and 2026, as that’ll be a pre-buy because the projected amount is anywhere from $12,000 to $20,000 in increased cost for that 2027 engine,” he said. “Folks are going to put their orders in early, so we will be ready for it if the manufacturer can build [enough to meet] the orders that they’re going to be seeing.”

As customers, financiers and vendors navigate new environmental compliance standards and the growth of climate financing, rentals may see growth, Wells Fargo’s Gregory said.

“With interest rates, customers may rent more equipment than buy because it’s a higher cost, and there are so many rental companies out there now,” he said. “Most contractors have probably four or five rental companies on speed dial and they’re checking rates to make sure who’s got the best rate and then they go with that. Relationships are important, and support is important, but the cost is important, too.”

Reshoring, or moving manufacturing operations back to the United States, is another growing trend in the equipment finance industry, BMO’s Biorkman said.

“The theme of reshoring is not new but continues to be top of mind for our clients as they navigate various supply chain scenarios,” he said. “The real value for our industry is bringing ideas, and I think that, in light of any uncertainty, your ideas become that much more important, and that’s what we’re focused on.”