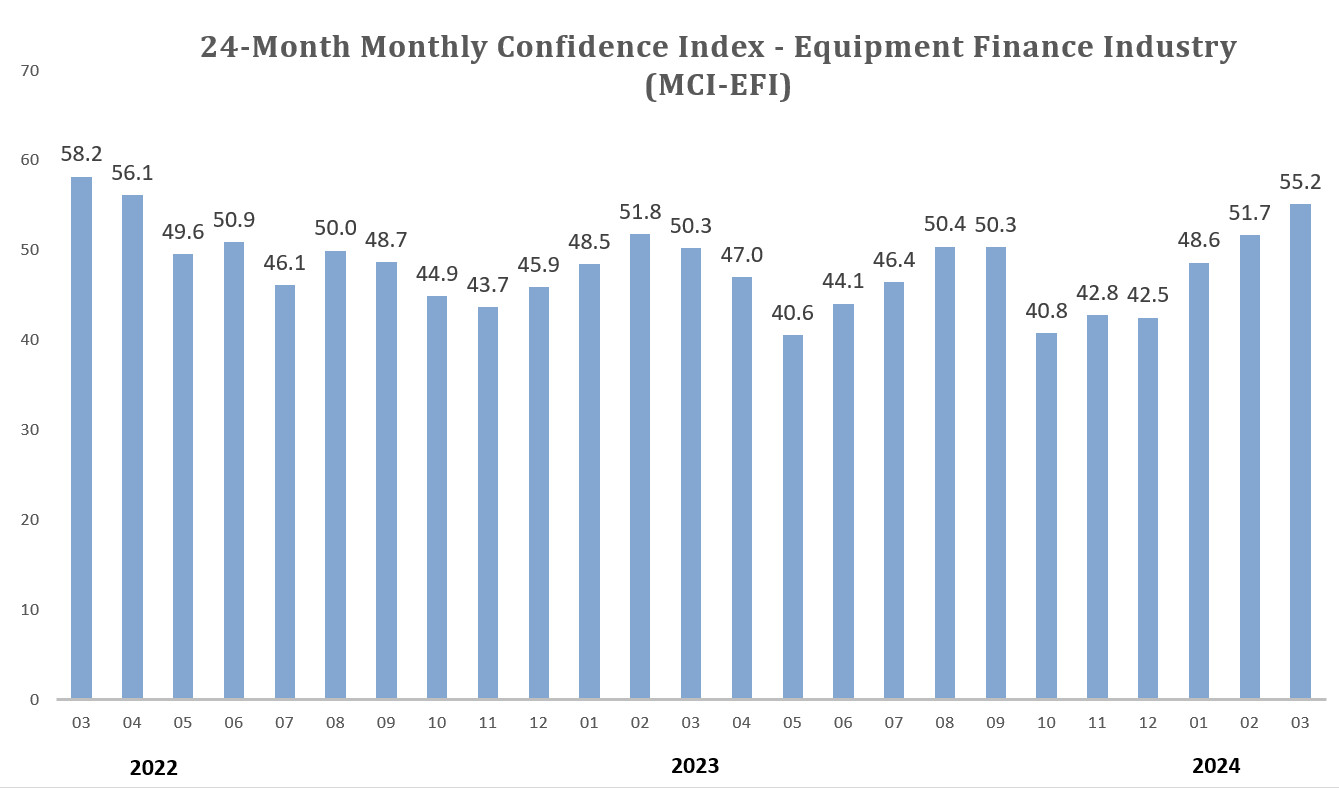

Confidence in the equipment leasing industry is growing, according to new data from the Equipment Leasing and Finance Foundation.

The foundation tracks 50 organizations’ confidence in current business conditions as well as market outlook. In March, the index was 55.2, up from 51.7 the previous month. This marks both the third consecutive month that confidence increased and the highest level the index has achieved since April 2022.

“Supply chain and demand seemed to have caught up to each other, we are finally seeing equipment ordered and delivered in real time. This has increased the overall activity in the equipment funding space,” Keith Smith, president of equipment and franchise finance at Star Hill Financial, said in a statement.

Smith said, however, that he is concerned about market volatility, which continues to play a role in the health of mid-market and regional banks.

“Historically these institutions have been the backbone of funding in the equipment finance industry, and right now even the deposit-healthy institutions are slowing their lending due to regulatory concerns,” he said.

By the numbers

- 19.4% of executives responding to the survey said they believe business conditions will improve over the next four months, up from 10.7% the prior month.

- 77.4% believed business conditions would stay the same over the next four months, while 3.2% expected conditions would worsen — a decrease from 7.1% in February.

- 25.8% of respondents said they expect demand for loans and leases to fund capital expenditures would increase over the next four months, up significantly from 7.1% in February. A majority of those surveyed, 71%, expect demand will stay the same.

- More lenders expect increased access to capital in the coming months: 25.8% of respondents said they anticipate more access to funds to acquire equipment, up from 14.3% last year; 74.2% of executives expect capital availability to remain the same.

- 19.4% of lenders surveyed said they expect to hire more employees in the next four months, down from 21.4% in the last month; 67.7% expect no change in headcount.

- 22.6% of the respondents believe their company will spend more on business development in the next four months, up from 21.4% the previous month; 12.9% believe there will be a decrease in spending, while 64.5% anticipate no change in headcount.

Confidence in the American economy growing

The industry leaders surveyed by ELFF also indicated confidence in the nationwide economy.

Compared to last month, 25.8% of respondents said they anticipate the economy will get better in the next six months, up from 17.9% last month. Most lenders, 54.8%, think the economy will remain the same. However, a growing number of lenders, 19.4%, said they expect the economy to worsen in the next half year, up from 14.3% last month.

None of the respondents rated the American economy as “excellent,” which was down from 3.6% that did last month; 93.6% evaluated economic conditions as “fair,” up from 89.3% in February; and 6.5% rated the economy as “poor,” down from 7.1% last month.

For businesses that have managed to endure the turbulent economic times, there could be a reward in learning how to optimize operations during a downturn that could benefit their overall business in a better market, some lenders told ELFF.

“The borrowers that have navigated through the uncertain economic conditions and higher rates should emerge even stronger as the economy strengthens,” Charles Jones, senior vice president at small-ticket bank First Equipment Finance, told ELFF.

With inventory levels climbing, dealers are flush with older products to move. A reduction in interest rates could spur this, some lenders said.

“Inventories are returning to pre-COVID levels and end users need to replace older equipment they were forced to keep in service,” Jim DeFrank, chief operating officer of small-ticket captive Isuzu Finance of America, told ELFF.

“A stabilizing rate environment and an election coming up could make 2024 a very good year,” he said.