Equipment manufacturer John Deere continues to push autonomy and technology innovations to keep farmers working, despite concerns over cost and technology adoption.

Deere’s 8R autonomous tractor, the company’s first fully autonomous tractor for large-scale production, provides a potential solution to farm labor shortages, Chris Padwick, director of computer vision machine learning at agricultural technology manufacturer Blue River Technology, said during a March 19 presentation at Nvidia GTC in San Jose, Calif. Blue River Technology is a John Deere subsidiary.

“This product has been well-received in the market because it really scratches that itch of labor availability,” he said. “This is a pretty low-skilled job … anybody in this audience who’s capable of driving a car could learn how to do this inside of [30] to 45 minutes. It’s not that difficult, but it’s very time-consuming.”

By automating the time-consuming tasks, Deere hopes to free up farmers “to do more valuable things with their time,” Padwick said.

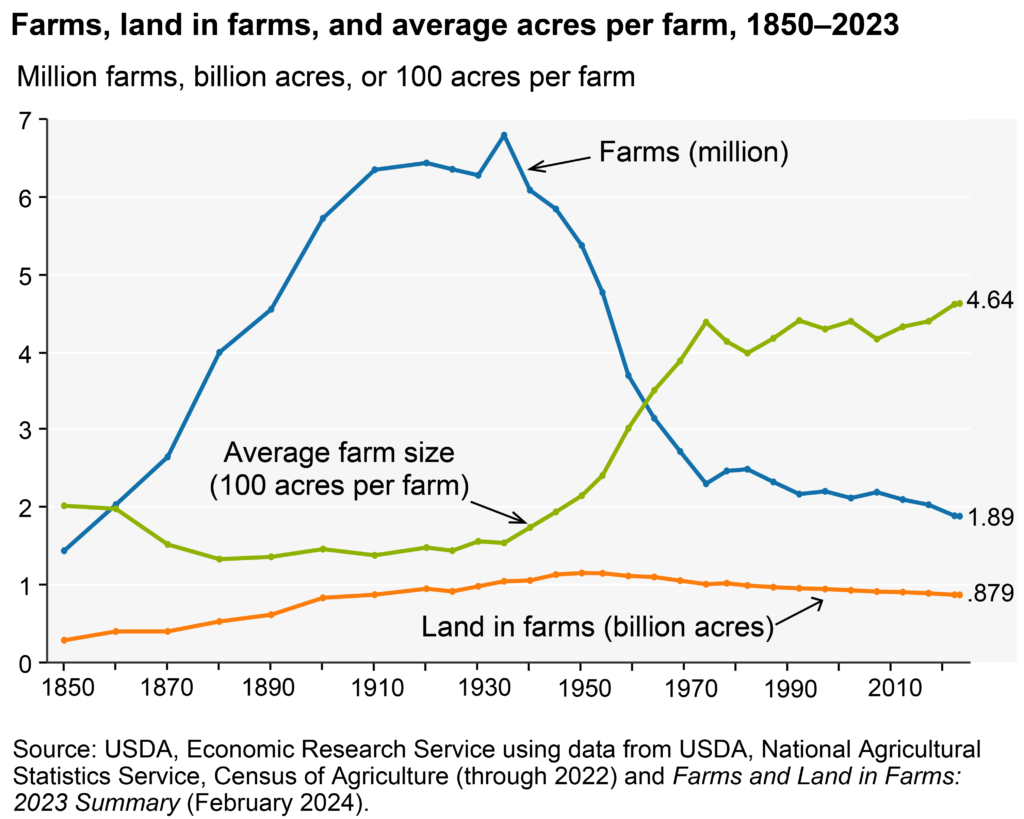

Quality of life and labor shortages remain concerns as the number of farms continues to decline, according to the United States Department of Agriculture’s Census of Agriculture. There were 1.89 million farms in the U.S. in 2023, down 7% from the 2017 Census of Agriculture and continuing a downward trend since 1935.

Solving the farming slowdown

John Deere continues to emphasize its technology, including autonomy and AI, to keep farmers farming, Josh Jepsen, chief financial officer, said during the company’s first-quarter earnings call on Feb. 15.

“We will continue to adapt our business model to enable customers to adopt, use and benefit from our tech stack,” he said. “One important thing to consider is our customers do critical work to produce food, fiber, fuel, shelter and infrastructure.”

With labor shortages and the continuing decline in the number of farms, Deere is looking at its total product offering to better support customers, Jepsen said.

“What this means is that our solutions need to do more, and no one is better positioned to meet our customers’ needs [than] we are. given our ability to seamlessly integrate hardware, software, data, financing, and service and support,” he said.

Meanwhile, financing remains a key component of the move to autonomous solutions, with the 8R’s expected starting cost of $500,000 representing a sizable bill for farmers considering leaving the industry. John Deere’s online financing calculator, which uses default terms of 2.75% interest and 48 months, shows estimated payments of $11,012 monthly; $33,107 quarterly; $66,428 semi-annually; and $133,710 annually.

Managing industry concerns

Still, Deere believes the potential savings in input costs, which are the costs such as seeds, fertilizer and machinery that farms face to begin each planting season, in addition to the labor solution, outweigh the cost of the 8R, Padwick said.

“Input costs are what drives a lot of ‘ costs, so reducing input costs [is] highly desirable,” he said.

Input costs remain the largest concern for farmers heading into the next year, according to the 2024 Ag Barometer.

Still, the digital transformation of the agriculture industry is far from automatic, with some resistance to change persisting, Praveen Penmetsa, chief executive officer and co-founder of Monarch Tractor, said during a March 20 panel at Nvidia GTC.

“Software in ag is a tough conversation because the industry has not gone through that transformation before,” he said. “So far, nobody has been able to convince the farmers of the value that they get from the digital transformation.”

Registration is now open for Equipment Finance Connect, the nation’s only dealer-centric equipment lending and leasing event, which will take place May 5-7 in Nashville, Tenn. Learn about the event and free dealer registration at EquipmentFinanceConnect.com.