Equipment industry dealers and lenders are optimistic about 2024 after a year spent navigating a difficult economic environment caused by declining equipment values, increasing interest rates and rebuilding inventories.

While some trends will continue, industry leaders expect macroeconomic conditions to improve throughout the year.

Here are Equipment Finance News’ top trends to watch in 2024:

Ag, construction, transportation equipment inventory rising, values falling

Rising inventories and declining values plagued several segments of the equipment industry through much of 2023, including agriculture, construction and transportation. While some economic indicators point to a better 2024, those negative trends will likely continue into the early part of the year as inventory continues to rebuild, pushing down the prices of used equipment.

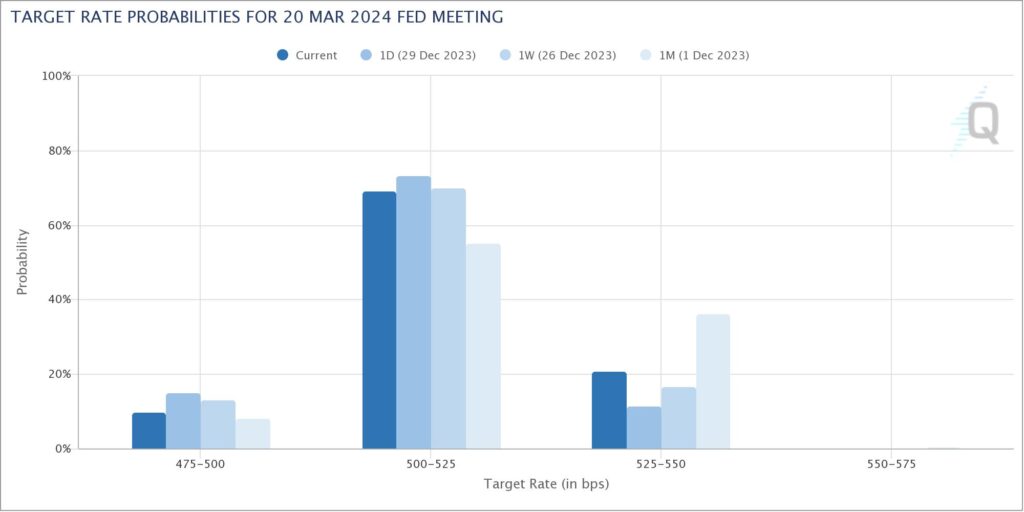

Federal Reserve interest rate moves

Declining interest rates in 2024 should also serve as tailwind for the industry as the Federal Reserve works to achieve target inflation. Interest rate cuts are expected, Fed Chair Jerome Powell said during a Dec. 13 press conference. There’s a 99.5% probability that interest rates will ease by the Fed’s May 1 meeting, according to data research firm CME’s FedWatch Tool, which “calculates unconditional probabilities,” based on projected Federal Open Market Committee outcomes.

While the nationwide injunction halting the implementation of Section 1071 of the Dodd-Frank Act will help lenders and vendors avoid the increased pressure of collecting business and demographic information for small business lending in 2024, the regulation is coming for the equipment finance industry and financial institutions. Florida, Georgia and Connecticut have disclosure laws going into effect this year, and several other states have legislative bills in the works. The U.S. Supreme Court is expected to decide by June on the constitutionality of the Consumer Financial Protection Bureau‘s funding structure in CFPB v. Community Financial Services Association of America, with the decision standing as a key component in the future of Section 1071.

Equipment, software investment growth expected

As capital begins to free up following the expected easing of the tight monetary policy of 2023, companies are likely to resume investing in improved operations, according to the Equipment Leasing and Finance Foundation (ELFF). Real investment in equipment and software is expected to grow by 2.2%, according to ELFF’s U.S. Economic Outlook report released Dec. 20. Much of the growth is estimated to come in the second half of 2024, with third- and fourth-quarter investment levels estimated to rise 3.5% YoY and 4.5% YoY, respectively.

AI, automation rise brings pros, cons

The growth of artificial intelligence and automation across the globe became a major talking point in 2023, and its growth is projected to continue in 2024 as more people familiarize themselves with the applications in the equipment industry, such as technician training. Meanwhile, the increase in commonality of AI and automated systems also creates opportunities for fraudsters and criminals to better understand and take advantage of the systems.