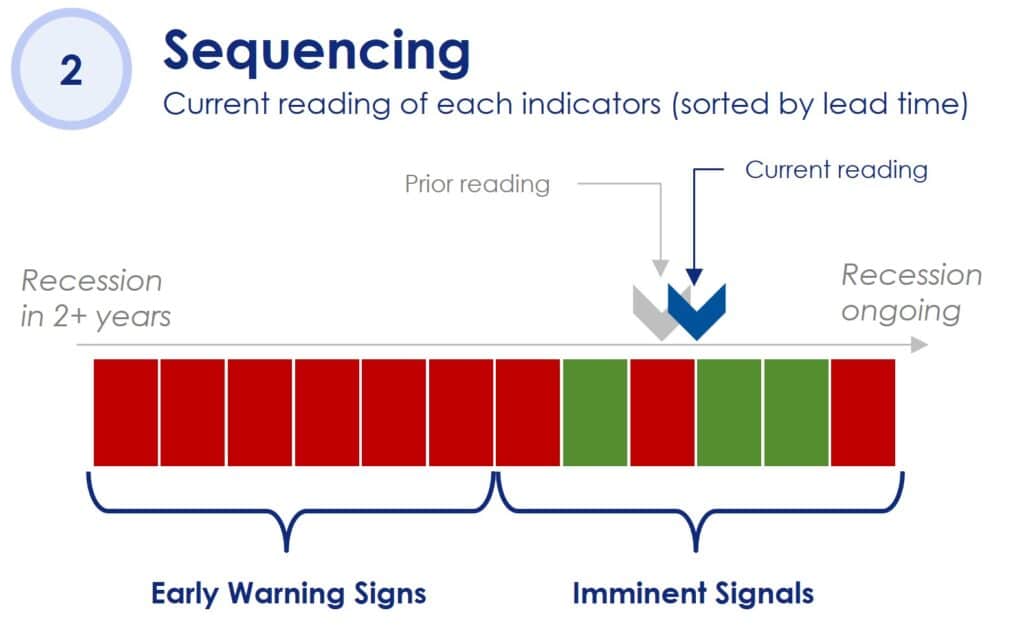

Nine of 12 indicators of the Equipment Leasing and Finance Foundation – KeyBridge Equipment Finance Industry Recession Monitor point to a recession over the next six to twelve months, as markets continue to tighten.

The monitor was developed by the Equipment Leasing and Finance Foundation (ELFF) and KeyBridge and has a focus on industrial activity and manufacturing. The indicators suggest a recession is likely to begin in the second half of the year, Jeff Jensen, vice president at KeyBridge, said during the Equipment Leasing and Finance Association’s (ELFA) Credit and Collections Conference on June 8.

Real equipment and software investment growth — one of the metrics tracked by the monitor— declined 2.2% in the first quarter of 2023 from Q1 2022, according to the U.S. Bureau of Economic Analysis. The ELFF and KeyBridge expect real equipment and software investment growth to remain negative for the remainder of the year, Jensen said.

“Business investment has really cooled down: Most of the growth that you’re seeing is being driven by structures, which is commercial real estate, but also oil derricks and things like that and intellectual property, which is also a lot of software,” he said.

“If you look at equipment, it’s actually negative in terms of the real growth that we’ve seen, according to the latest GDP report … most of [the equipment types] are in a kind of contractionary phase of their cycle.”

Real equipment and software investment growth is expected to hit a peak decline of 6% quarter over quarter in Q3 2023, Jensen said.

Some metrics are still performing satisfactorily and have not exceeded the monitor’s safe zone threshold. For example, the C&I Loan Delinquency Rate was down 5 percentage points, the Consumer Confidence Index divided by unemployment rate was down 1%, and the University of Michigan: Household Durable Goods Purchasing Sentiment Index landed at 10.5%. Jensen said these three indicators reflect a strong labor market and resilient U.S. consumers, despite other economic pressures.