Equipment dealers and lenders are showing ingenuity to support the construction industry’s “little guys” as credit blemishes and economic hurdles impede their path to financing.

Dealers are expanding their finance operations to accommodate specific credit profiles and structure unique deals that lower monthly payments. Meanwhile, lenders are guiding customers in their search for affordable equipment, embracing leasing models in the wake of economic pressures and peeling back the layers to find creditworthy borrowers.

Nearly 23% of construction workers are independent contractors, according to the National Association of Home Builders. Equipment financiers denied or only partially approved 32% of small business loans in 2024, up from 27% in 2023, according to a Federal Reserve survey comprising roughly 7,600 responses.

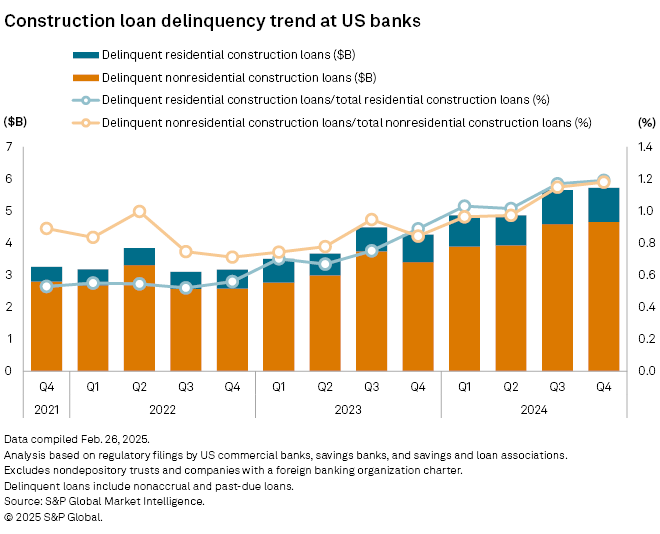

Moreover, delinquent construction loans at U.S. banks topped $4.8 billion in the first quarter of 2024, the highest level in three years, according to S&P Global, and the level rose over the year, with delinquent construction loans totaling $5.7 billion in Q4.

Getting financed ‘tougher today’

With large financial institutions becoming increasingly conservative, “it’s tougher today for small contractors to get financing than two years ago,” Mark French, president of Atlanta-based Crest Capital, told Equipment Finance News, highlighting the domino effect this has had on the industry.

“The financing environment for new construction equipment favors established credits while lingering elevated rates and tight underwriting standards challenge smaller contractors. This has transformed the used-equipment market into a pressure release valve for the entire industry.”

— Mark French, president, Crest Capital

Minimal time in business is one challenge that small and independent contractors often face in securing equipment financing, John Gougeon, president of Ann Arbor, Mich.-based UniFi Equipment Finance, told EFN.

“You may have a guy that’s just starting out or has worked for a contractor for years and decides that he wants to take it in a different direction, and he doesn’t really have the pay net or the years in business necessary to secure financing,” he said. “That’s always a challenge, and those tend to be the guys that are going to go after that first tier of more recent used equipment.”

And while overall credit performance is stable in the construction equipment finance segment, newer operators are showing “mixed results,” Crest Capital’s French said.

Charge-offs in the equipment finance industry rose to 0.6% in March, their highest level since September 2020 and hinting at a potential jump in financial stress, according to the Equipment Leasing and Finance Association.

Dealer-lender collaboration

Dealers can help contractors address these challenges by building a diverse lender network, Kris Realander, sales manager at Morrisville, N.C.-based Triangle Equipment Group, told EFN. But dealers must be meticulous in their searches to find the right lenders to support startups, small businesses and higher-risk borrowers.

“I try to ask [lenders] questions about situations that I’m in all the time, and how they’re going to help that, and then see if they’re going to be trustworthy enough for my client,” he said. “So, when it comes to lenders, I like to make sure that I do my research. … I try to see if they can help certain credit-tier levels, and if they can do that, then I may give them a shot.”

Asking other dealerships about the lenders they work with is another effective way to expand finance operations, he said.

While large banks and captives typically have more stringent lending standards, dealers can still rely on some of these players to accommodate the construction industry’s “little guys,” Matthew Isgrig, a sales representative at Landmark Equipment in Fort Worth, Texas, told EFN.

“If I’m selling a Takeuchi [construction equipment] and I feel like the customer has strong credit or just does a lot of volume, we’ll typically go through their financing arm,” Isgrig said. “If they don’t, then a lot of times I’ll go through CNH Industrial Capital and try to sell Case or New Holland. They will finance individuals, and they’ll do the standard rate.”

Dealers and lenders should also collaborate to focus on “bank deposit consistency, contract quality and even equipment utilization data through telematics to structure successful deals,” Crest Capital’s French said, “especially for in-demand compact equipment like mini-excavators and skid steers.”

Digging deeper for creditworthiness

In some cases, a borrower may be denied instantly due to a few blemishes on their credit report. But after doing their due diligence, lenders often realize that there’s more than meets the eye, UniFi’s Gougeon said.

“We look at credit and we look at stories. In the construction space, it’s not uncommon for contractors to have liens on their equipment, and a lien might pop up from 10 years ago that’s long been resolved, but it shows up in their credit report. A larger player isn’t going to take the time to understand what the lien was for or the story behind it, and we do that.”

— John Gougeon, president, UniFi Equipment Finance

Gougeon said these types of borrowers can speak directly to Unifi’s director of credit about their credit history, which builds rapport and sets the stage for a successful business relationship.

In addition, lenders help dealers close deals by assisting smaller contractors and higher-risk borrowers in finding the most affordable equipment, Paul Fogle, managing director at Carmel, Ind.-based Quality Equipment Finance, told EFN.

“We, as lenders, look at the big picture, and we make suggestions and we want to do business,” he said. “If somebody wants to buy a $250,000 piece of equipment when they can’t really afford it from our perspective, or it’s a little bit too risky, we’ll say, ‘We can approve you for $125,000, and you can go out and look for a piece of equipment that is less or from the same dealer. I want to help, you’re certainly creditworthy.’”

Flexible financing and understanding seasonality are other ways to strike successful deals with small businesses, Gougeon said.

“Here in Michigan, not a lot of construction happens in February,” he said. “The contractors stop making money in January and February. So, if you can do skip-payments for them, 90 days same as cash to get them started, those are some helpful tools.”

Overcoming tariffs, high rates and inflation

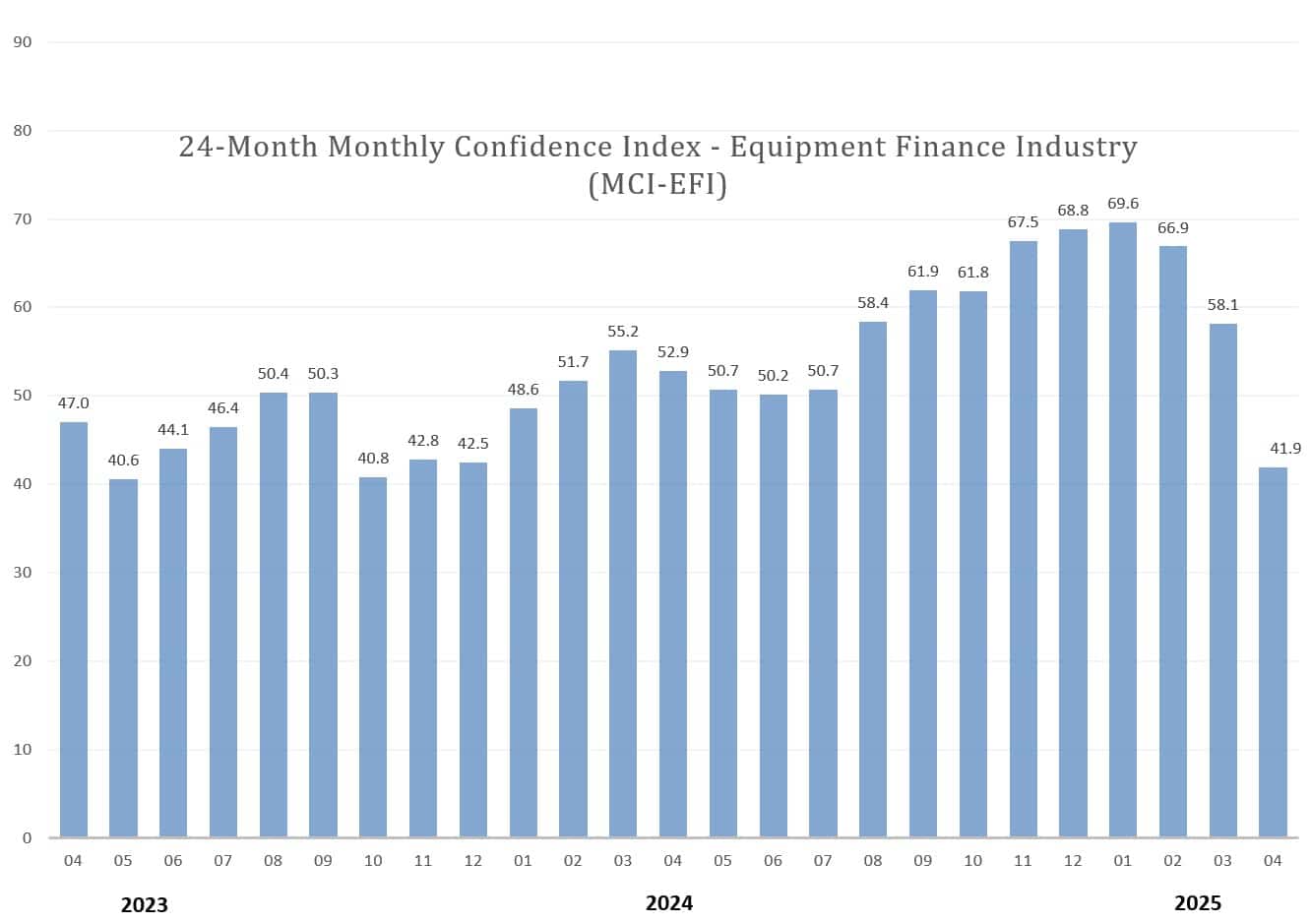

President Donald Trump on April 2 imposed a baseline tariff of 10% on all imports, contributing to equipment lenders’ confidence dropping to a 19-month low in April, according to the Equipment Leasing and Finance Foundation (ELFF). In an ELFF survey, 7.7% of equipment lenders expect increased access to capital over the next four months, down from 21.4% in March.

After several rate cuts at the end of 2024, the Federal Reserve in March decided to keep its federal funds rate in the range of 4.25% to 4.5%, anticipating higher inflation and slower economic growth.

Adding to challenges facing the industry’s little guys, construction input prices increased 9.7% at an annualized rate in Q1 largely because of tariffs, according to the Associated Builders and Contractors.

If tariffs yield higher new equipment prices and disrupt supply chains, used-equipment demand could surge and drive up used prices as well, Triangle Group’s Realander said. Helping small contractors and subprime borrowers sign up for incentive programs to lower monthly payments is one way to give them a path to affordability while mitigating risk for lenders, he said.

“Another thing that helps people is leasing. Don’t take the full burden of the $100,000 piece of equipment. Take the 55%, 60% and keep your payments to an absolute minimum, and go make your money, establish your business.”

— Kris Realander, sales manager, Triangle Equipment Group

Gougeon agreed, noting that businesses are likely to turn to “true” leasing during times of economic hardship. A true lease is a contract in which the lessor grants the lessee exclusive rights to use the equipment for a specific period, without transferring ownership.

“They’d rather keep their equipment off the balance sheet,” he said. “So, there’s an opportunity to do true leases. … We’re seeing more and more requests for 24-month leases or 36-month leases. A true lease of 24 months — you can pretty much guarantee that contractor is sending that equipment back.”

Such a lease allows lenders “not only to price the deal right today, but then the opportunity to make money on that equipment two years down the road,” Gougeon said.

The third annual Equipment Finance Connect at the JW Marriott Nashville on May 14-15, 2025, is the only event for both equipment dealers and finance providers. Learn more and register here.