Farmers are facing rising financial concerns as the markets surrounding the industry tighten and as February farm equipment sales slip.

With the planting season kicking off in several parts of the United States, commodity prices are slipping, Jim Ryan, equipment lease and finance manager at Sandhills Global, told EFN.

“Things are tighter on the ag side right now, and obviously, we’re going to see this [as] planting season is essentially getting ready to start, some pockets are already going, and the commodity prices have not been that strong recently,” he said. “Commodity prices are the underlying drive as far as farmers’ day-to-day life and their income flow, what they can afford, and what they can do now.”

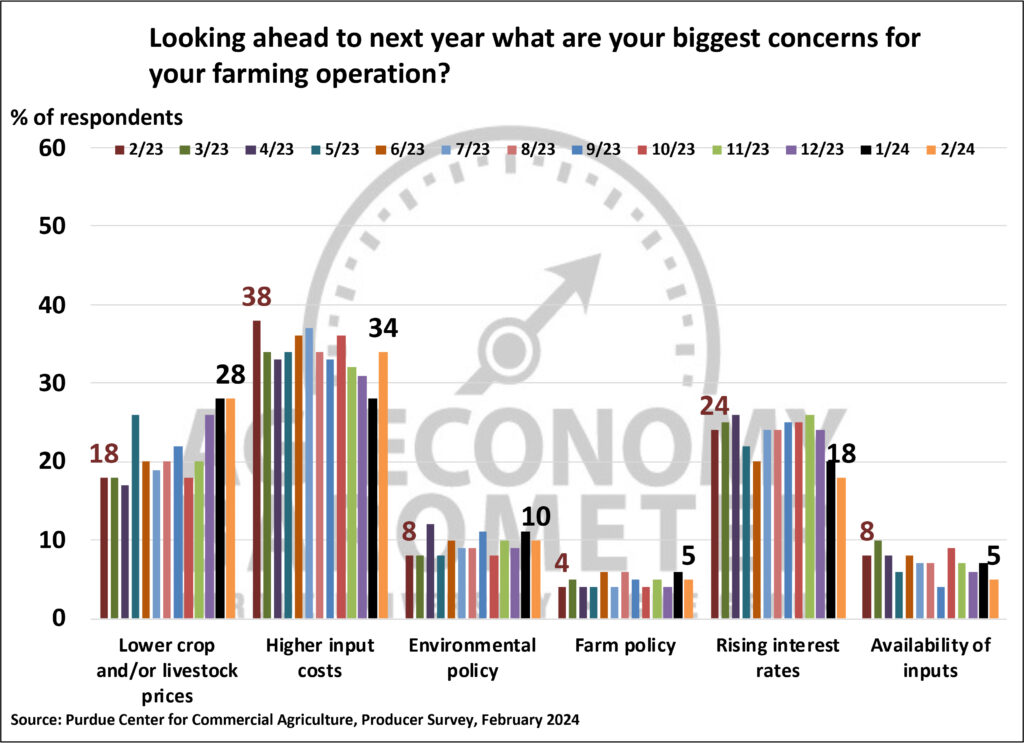

In addition, rising interest rates and higher output costs continue to be major concerns for the farm economy, according to the Center for Commercial Agriculture at Purdue University.

Growing farmland pressures

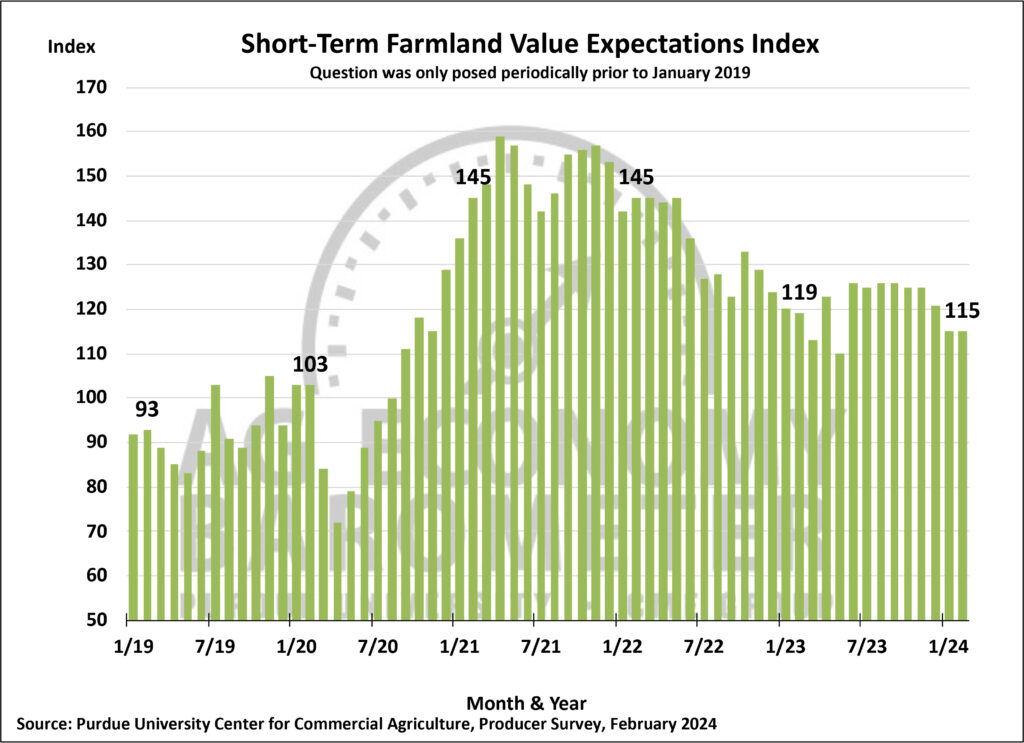

Another potential problem looming for farmers is the state of farmland values and margins, Michael Langemeier, professor of agricultural economics and associate director at the Center for Commercial Agriculture at Purdue University, told Equipment Finance News.

“Over 80% of the agricultural balance sheet is farmland holdings, and farmlands, very similar to equipment,” he said. “If just 2024 has low net margins, we don’t have that much downward pressure on land values. If this continues for two or three years, we’re going to start seeing downward pressure on land values, and the analogy is we’ll see [similar] downward pressure on used machinery.”

OEMs such as John Deere and Toro began to feel the impact of the tightening farm market on guidance at yearend, according to a William Blair research note on monthly farm data for February.

“Fourth-quarter results and 2024 guidance from many of the ag OEMs came in below expectations as the ag market has softened over the past few months,” according to the note. “Despite lower expectations for farmer income, demand across the ag equipment industry continues to be supported by elevated fleet ages and positive farmer income.”

Declining farm income, equipment sales

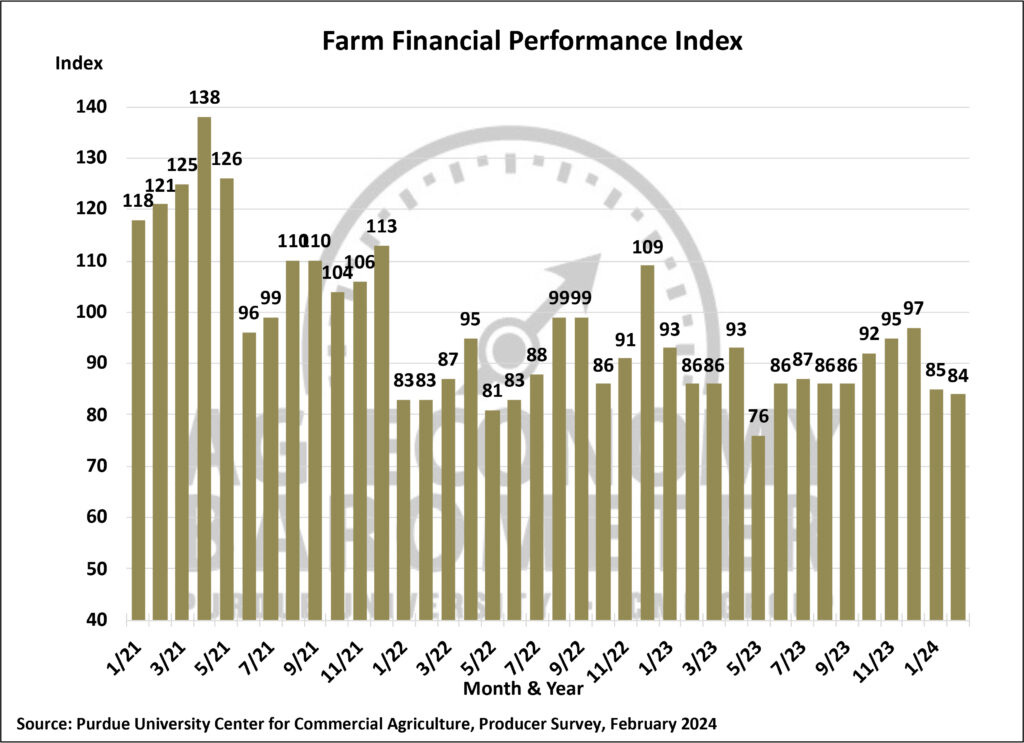

Although farmer income remains positive, a 25.5% decline in net farm income in 2024 forecasted by the U.S. Department of Agriculture (USDA) contributed to a slight drop in the Farm Financial Performance index, Purdue’s Langemeier said.

Demand for agricultural equipment shows signs of strength: Sales of tractors and combines dipped in February, according to the Association of Equipment Manufacturers. Total farm tractor sales in February landed at 13,080 units, down 6.9% year-over-year and self-prop combine sales totaled 363 units, down 31.5% YoY.

Farm capital investment weathering the storm

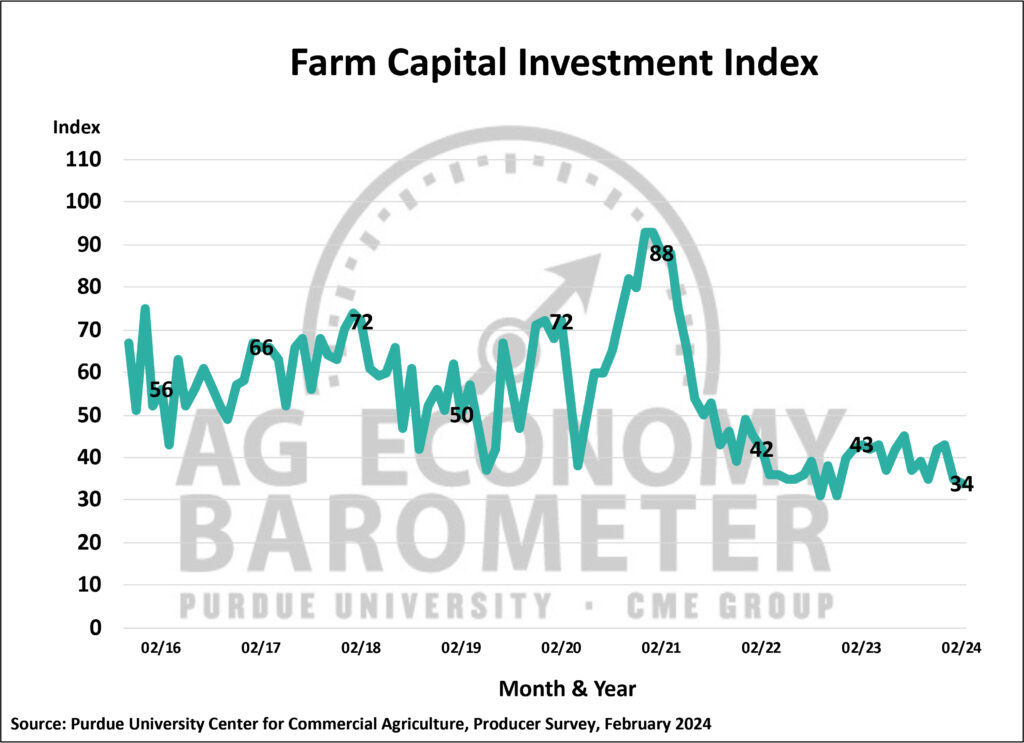

With all the concerns facing farmers, pandemic-induced assets and liquidity could still open the door for some capital investment, Purdue’s Langemeier said.

“If producers wanted to make capital investments this year, they probably could,” he said. “It’s just a question of whether they’re going to use [their] liquidity to withstand some tight margins the next couple years, or they’ll use a portion of that liquidity to buy machinery.”

Ultimately, margins and commodity price concerns could change farmers approach to 2024, Langemeier said.

Registration is now open for Equipment Finance Connect, the nation’s only dealer-centric equipment lending and leasing event, which will take place May 5-7 in Nashville, Tenn. Learn about the event and free dealer registration at EquipmentFinanceConnect.com.