Wabash lease income up 79.3% despite weaker demand

Industry trailer orders rose 144% YoY in June

Commercial trailer and truck body manufacturer Wabash saw lease income spike in the second quarter despite declining net sales and weaker demand for new equipment.

Wabash continued to face a soft transportation market in Q2 as broader economic uncertainty and reduced customer capital spending led to slower industry activity, President and Chief Executive Brent Yeagy said during the company’s July 25 earnings call.

“Industry analysts have continued to lower their forecast for the remainder of the year, and for this quarter, we saw additional confirmation as several carriers revised their CapEx plans downward,” he said. “These trends reflect a transportation market environment that remains under pressure rather than any product-specific or segment-driven softness.”

Despite weaker equipment demand, Wabash’s parts and services segment delivered strong year-over-year growth, with record performance from its upfit team and momentum in trailers-as-a-service and preferred parts network initiatives, Yeagy said. As a result, the truck and trailer OEM added 29 locations in the first half of the year for a total of more than 110, and “more coming online every month,” he said.

By the numbers

Wabash saw declines in most segments in Q2, despite increases in parts and services and lease income.

The OEM reported the following on its 10-Q SEC filing:

- Net sales decreased to $458.8 million, down 16.7% YoY;

- Transportation Solutions sales declined to $400.2 million, down 19.7% YoY;

- Parts and Services sales grew to $59.7 million, up 8.8% YoY;

- New trailers shipped totaled 8,640 units, down 6.5% YoY;

- New truck bodies shipped landed at 3,190 units, down 18.7% YoY;

- Total new units shipped fell to 11,830 units, down 10.2% YoY;

- Used trailers shipped were 30 units, up 50% YoY;

- Total backlog was $954 million, down 26.7%; and

- Wabash lease income jumped to $1 million, up 79.3% YoY.

Total trailer market

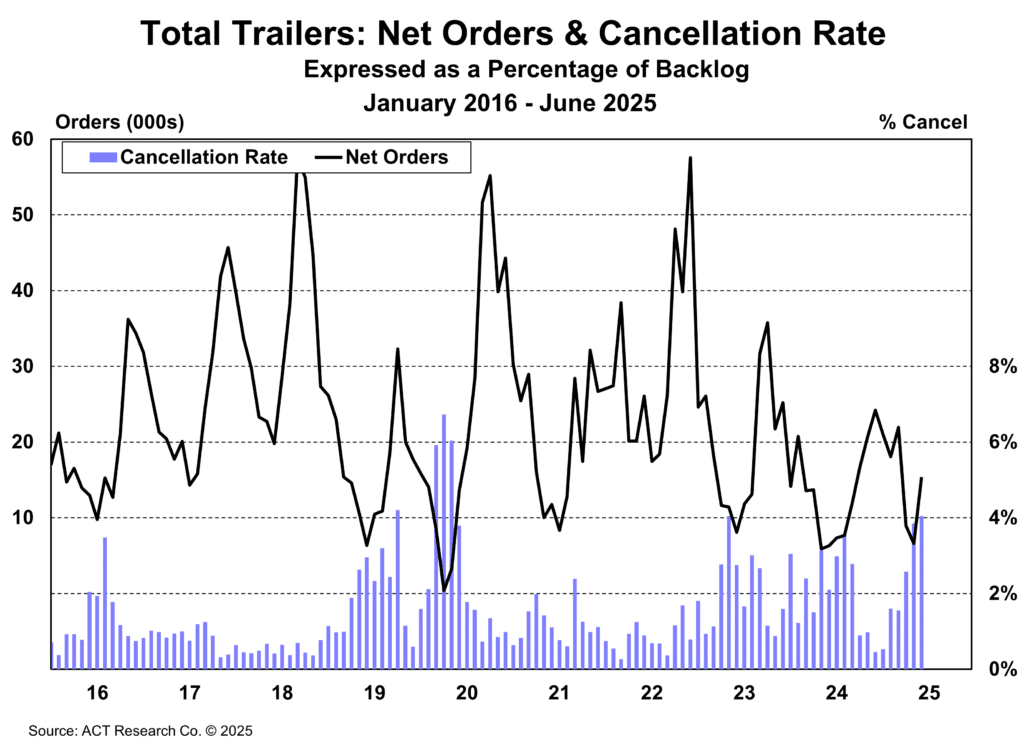

While Wabash slumped to end Q2, net trailer orders in June surged to nearly 15,400 units, marking a 133% increase from May and a 144% jump from June 2024, according to a July 23 release by transportation research firm ACT Research. The second-quarter total reached 30,900 units, bringing year-to-date orders to 92,000, a 24% increase compared to the first half of 2024.

The spike in orders is partly attributed to pull-forward activity ahead of expected tariff-related price hikes, according to the release. Meanwhile, cancellations, particularly in tanks and dry vans, pushed the overall rate to 4.2% of backlog.

Despite strong insulation from supply chain volatility through 95% domestic sourcing and U.S.-based manufacturing, Wabash continues to face inflation-driven cost increases in key inputs and services, which may result in price increases, Yeagy said.

“To date, we’ve been successful in holding off on price adjustments, and we remain focused on operational efficiency and cost discipline to offset as much pressure as possible,” he said. “However, based on the current trajectory, we expect that pricing for 2026 orders will need to be adjusted to reflect the rising cost environment.”

MARKET REACTION: Shares of Wabash National Corporation (NYSE: WNC) were down 6.5% or 42 cents to $9.97 as of market close July 25. Wabash shares fell again today, down 5.3% or 55 cents to $9.91 as of market close today. It has a market capitalization of $428.1 million.

Check out our exclusive industry data here.