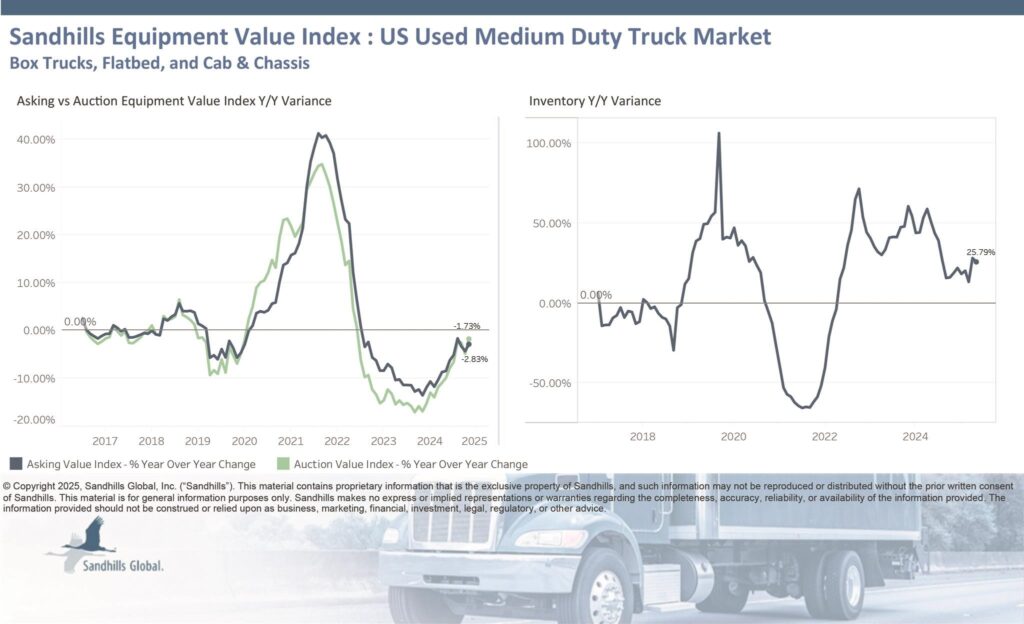

Used medium-duty truck inventory soars 26%

Used heavy-duty inventory dropped 21.8% YoY in May

Economic challenges dealt a blow to the used-truck market last month, with the medium-duty sector bearing the brunt.

Used inventory climbed month over month in every major category last month as tariffs affected supply chains and consumer sentiment, Sandhills Global Equipment Lease and Finance Manager Jim Ryan told Equipment Finance News.

A surge in used medium-duty inventory, driven by an 85.9% year-over-year increase of reefer box trucks, reflects the impact of low spot rates on small fleet companies, Ryan said.

“There are a lot of repossessions in that medium-duty space right now,” he said. “A lot of mom-and-pops, those smaller local-ish delivery services, there’s just not a way to make this work right now. … You even look at some of the larger players, Penske, Ryder [System], stuff like that, there’s a ton of that box truck-type inventory that’s on the market right now.”

In the heavy-duty sector, however, there is optimism that late-model trucks with warranties will continue to attract buyers and push values up, allowing dealers to increase their bottom lines, Ryan said.

The used-truck market continued to show pricing stability in May as values changed marginally MoM, according to Sandhills Global’s monthly indices.

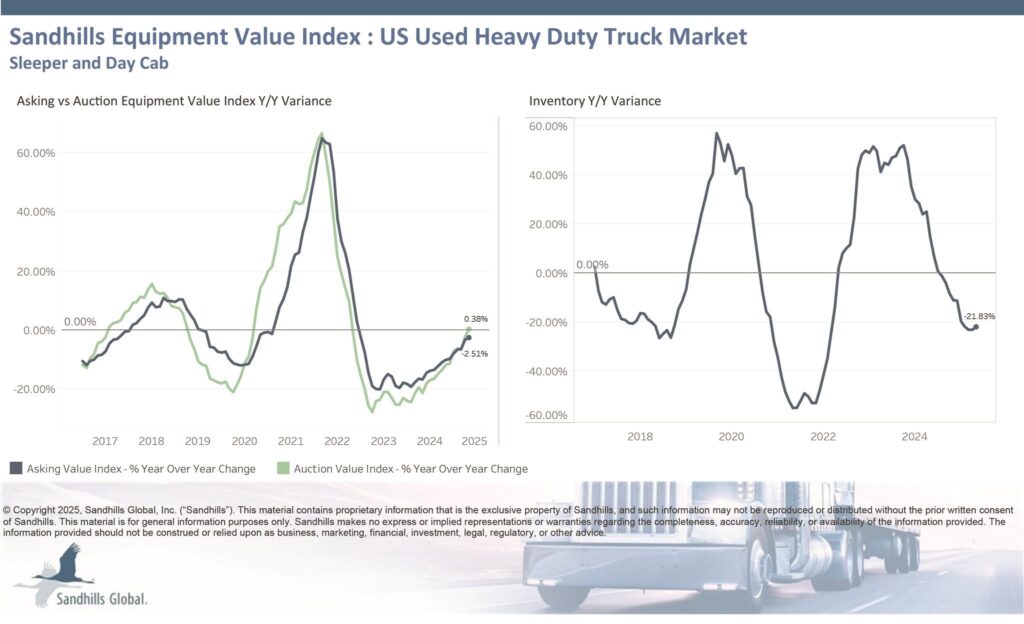

Used heavy-duty trucks

- Inventory fell 21.8% YoY, but rose 3.9% MoM;

- Asking values declined 2.5% YoY, but rose 0.2% MoM; and

- Auction values increased 0.4% YoY and 0.7% YoY.

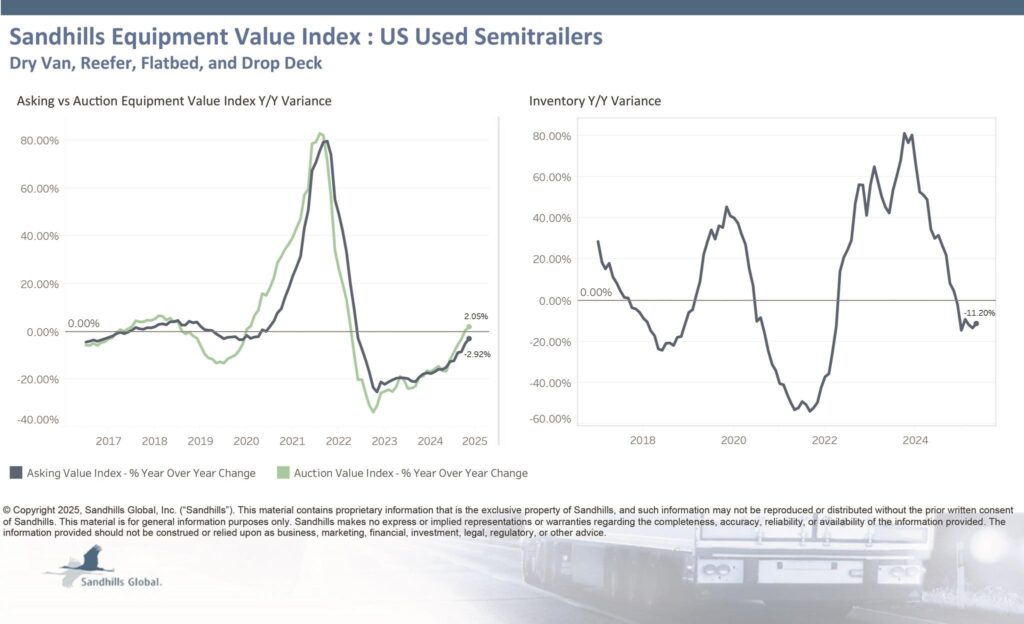

Used semitrailers

- Inventory dropped 11.2% YoY, but jumped 3.4% MoM;

- Asking values fell 2.9% YoY, but rose 0.9% MoM; and

- Auction values increased 2.1% YoY, but fell 0.8% MoM.

Used medium-duty trucks

- Inventory increased 25.8% YoY and 1.8% MoM;

- Asking values dropped 2.8% YoY and 1% MoM; and

- Auction values declined 1.7% YoY and 0.6% MoM.

Lenders urge large down payments

To alleviate challenges including high interest rates and operating costs, truck lenders are helping owner-operators find the lowest-mileage used truck they can afford while encouraging them to make significant down payments, Chris Grivas, president of Chadds Ford, Pa.-based CAG Truck Capital, told EFN.

“When I say significant, I’m talking at least 25%,” he said. “And then finance it for the shortest period of time you can afford. So, if you’d love to finance it for 48 months but can … afford 36, do 36. … Then you have options. You have equity. It’s a form of reserves on top of whatever else you should be saving.”

Register here for the free Equipment Finance News webinar “Technologies to Advance Your Equipment Financing Business” set for Thursday, July 17, at 11 a.m. ET.