Equipment dealers and asset managers continue to navigate the challenges of the used-truck market, amid fluctuating values, inventory and prices.

Some dealers are stocking excess used inventory for sale in order to meet consumer inventory demand, Sean Walsh, vice president of finance and insurance at East Coast Peterbilt retailer The Pete Store, told Equipment Finance News.

“We’ve started having [excess] stock inventory in the fourth quarter of last year, and that’s carried over to the first quarter,” he said. “We’re going to see a pretty substantial amount of stock in our lots, so we’ve had more used trucks and inventory than we’d probably like.”

The turbulence of the last few years created depreciation issues for used-truck inventory, Dan Osterhout, vice president of asset recovery at Revelation Machinery, said during a panel discussion at the National Equipment Finance Association’s spring conference in Huntington Beach, Calif., March 27.

“We didn’t see the normal depreciation that you normally see in those industrial assets,” he said. “You had a couple of factors contribute to that,” he said, listing OEM supply chain issues, demand for used equipment and low interest rates.

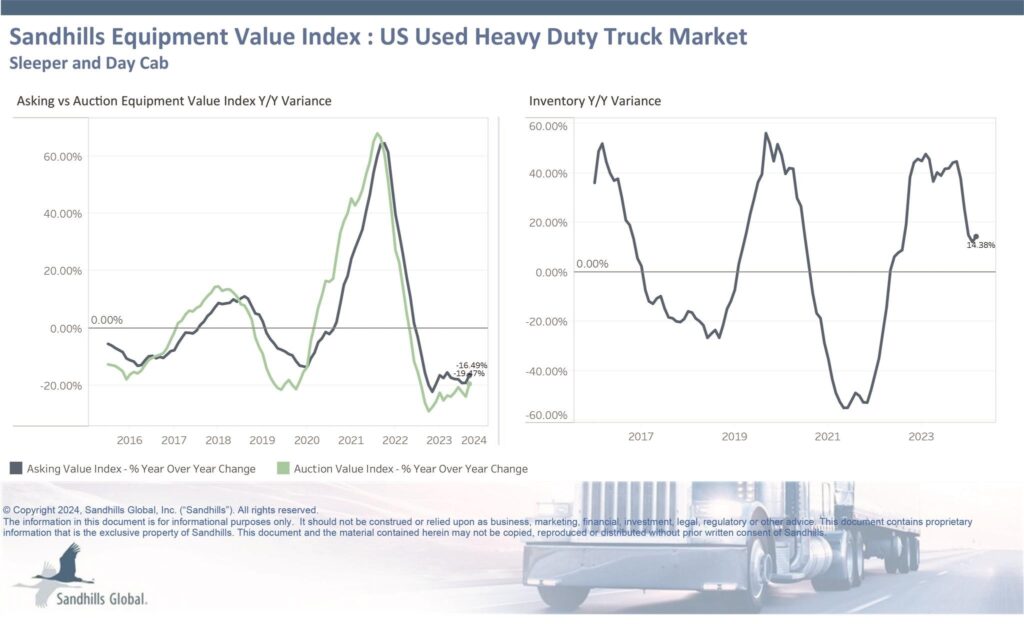

Post-pandemic era depreciation

During the height of the pandemic in 2021 and 2022, truck depreciation slowed, but in 2023, truck depreciation neared 20%, and the same number appears likely for 2024. Osterhout said.

“Starting off 2024, we’re seeing close to another 20% decrease in depreciation value of the industrial assets,” he said.

OEMs are now contributing to affordability and price normalization by offering discounts, Osterhout said.

“They’re giving heavy discounts to the buyer, so that’s starting to drive down the prices of the used equipment,” he said. “If there’s any excess surplus equipment that’s coming out of the market, where in the past [manufacturers] were holding it because manufacturing orders were high in 2021 or 2022 … that’s no longer the case.”

Depreciation should continue, but will help stabilize the market, Rush Enterprises Chairman, Chief Executive and President W.M. “Rusty” Rush said on the company’s Feb. 14 earnings call.

“Through the high interest rates and soft freight rates, demand for used trucks was weak, and used-truck values declined throughout 2023,” he said. “In 2024, we expect that demand for used trucks will remain flat, but the rate at which used trucks are depreciating will continue to decrease, and the used-truck values will stabilize somewhat over the course of the year.”

Register for the 2024 Equipment Finance Connect, which focuses on best practices in equipment finance, on May 5-7 in Nashville, Tenn. Learn about the event and free dealer registration at EquipmentFinanceConnect.com.