Defaults and delinquencies continue to plague the equipment finance industry, and the transportation segment is still feeling it most.

While many segments of the equipment finance industry continue to face challenges in the tight lending environment created by higher interest rates, the trucking industry remains hardest hit as worse conditions lie ahead, Kit West, business development director at Wyoming-based lender C.H. Brown, told Equipment Finance News.

“It’s across the board, in every industry; it’s across the board and in the trucking industry it’s going up,” he said. “Trucking is in an industry-specific recession.”

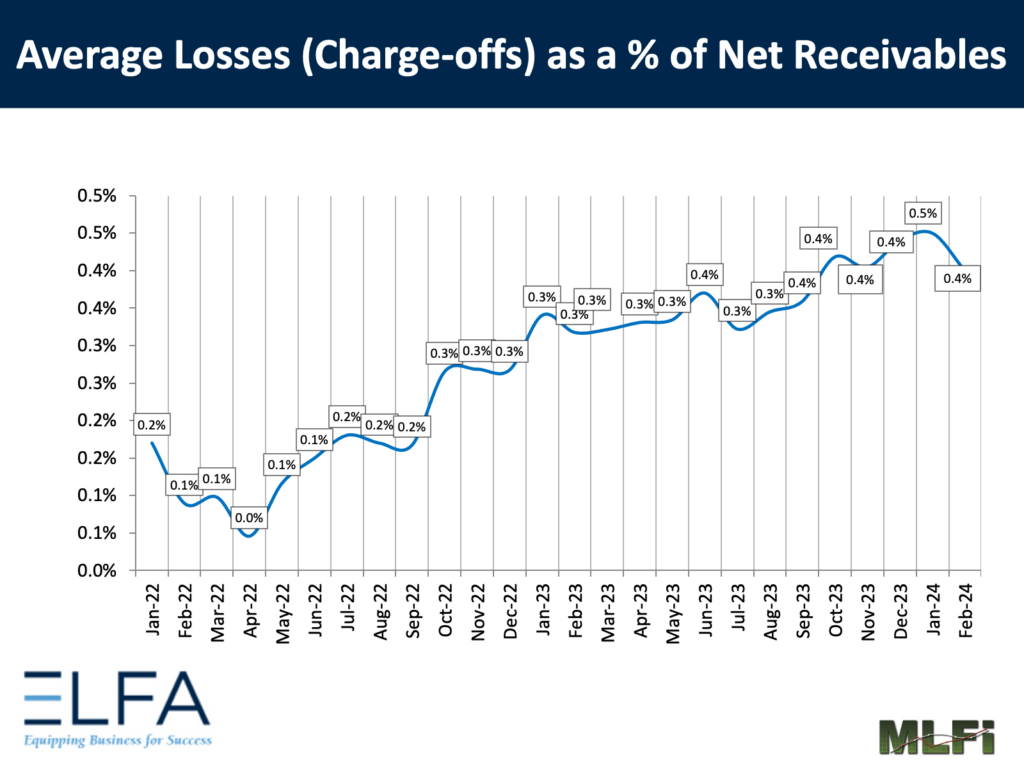

Meanwhile, charge-offs in February were 0.4%, up 10 basis points year over year, according to the Equipment Lease and Finance Association’s monthly lease and finance index. Transportation represents the largest segment of equipment finance at 24.7%, according to the ELFA’s 2023 survey of equipment finance activity.

Defaults, delinquencies not done

Elevated delinquencies and defaults will likely persist, Jim Ryan, equipment lease and finance manager at Sandhills Global, said during a panel discussion at the National Equipment Finance Association’s spring conference in Huntington Beach, Calif., last week.

“If you look at the transportation side, the [voluntary and involuntary] defaults … are not done,” Ryan said. The potential for more defaults comes as trucking companies such as Pride Group and Yellow filed for bankruptcy in the past year.

As a result of the trucking industry turmoil, lenders must be more selective in delinquency management, Kirstin Elmer, vice president of collections business development at Orion First Financial, said during the panel.

“We are also being more particular in the involvement that that borrower has in responsiveness — where they are in delinquency, the likelihood of their actual ability to repay — so being really particular with those modifications,” she said. “If they’re not likely to repay or they’re not responsive, the equipment is the fastest way to make up that gap, and there haven’t been major drops in most equipment that we’re seeing; it’s mostly in the transportation space.”

Navigating rising defaults

Coming off the record-low default rates during the pandemic, many organizations need to adjust their practices as traditional default rates return to normal, Mike Mroszak, vice president of strategic partnerships at financial services firm Dedicated Financial GBC, said during the panel.

“If defaults picked up, then what capacity do they have [to adjust] as we’re moving the market?” he said. “You have an internal team, you might have an outside service or party to enforce for you, you might have a third-party collection for you, and you’re moving things around.”

Depending on what collection methods lenders use, they need to prepare for the increased volume, as higher default rates remain in place, Mroszak said.

“If you have an increase in volume, you either increase your internal team members, outsource with the first party, you might send files out to the third party sooner, and you might work with files and prioritize those differently,” he said. “You have to be ready to move those things around.”

One other way to combat default rates is to make modifications to loan agreements, Orion’s Elmer said.

“In June 2022 to June 2023, we did just over 2,500 modifications, and then from June ’23 to January ’24, we were just over 2,000 already, so in half the time, creeping up on the same number,” she said. “There are definitely more modifications being done.”

Register for the 2024 Equipment Finance Connect, which focuses on best practices in equipment finance, on May 5-7 in Nashville, Tenn. Learn about the event and free dealer registration at EquipmentFinanceConnect.com.