North American heavy-duty plummeted 45% in May, while medium-duty truck orders also fell as the traditionally weak period suffered even more due to macroeconomic conditions.

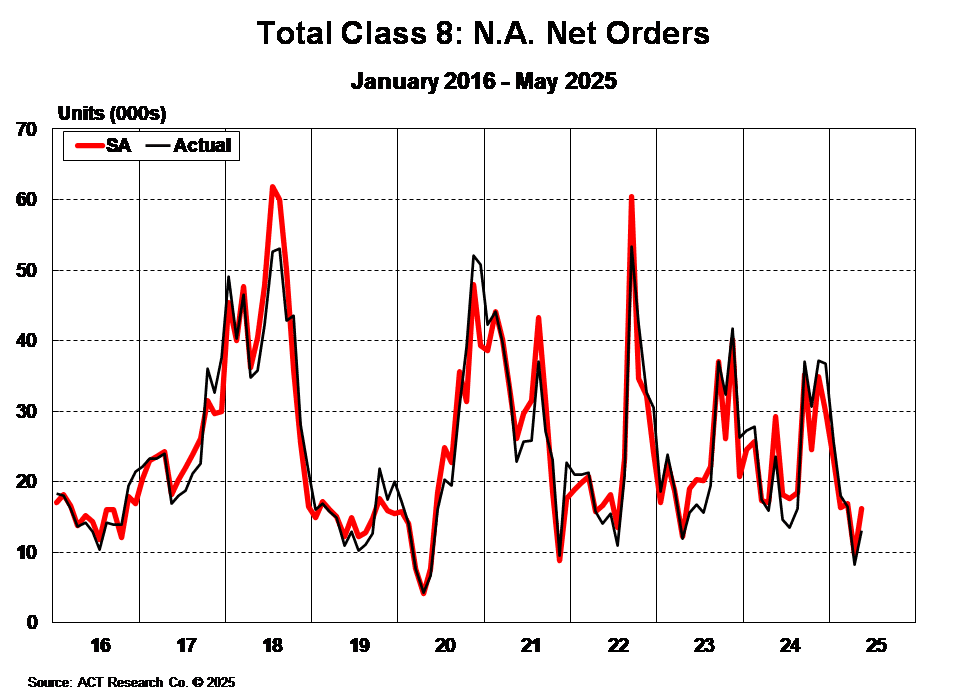

North American Class 8 truck net orders dropped 45% year over year in May to 13,000 units.

Heavy- and medium-duty commercial truck orders plummeted, according to a report June 19 by ACT Research. Tractor orders fell 43% YoY to 8,439 units, while vocational truck orders declined 48% YoY to 4,584 units.

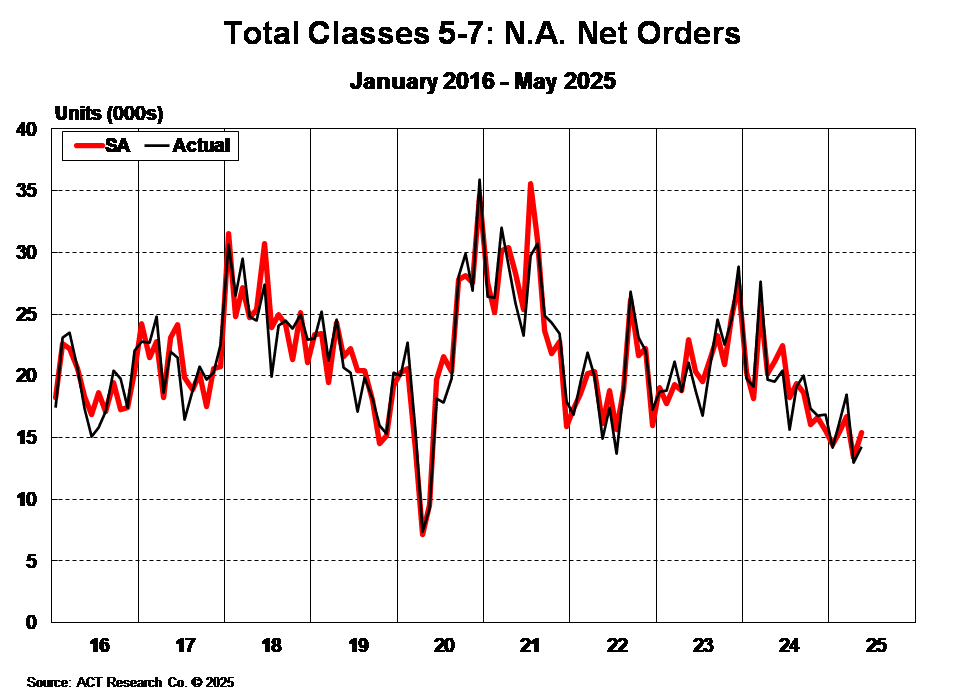

Meanwhile, medium-duty Class 5 to Class 7 orders also plummeted, falling 27% YoY to 14,264 units, according to the report.

Economic conditions crash truck orders

Weakening economic conditions put pressure on both the heavy-duty and medium-duty truck markets, Carter Vieth, research analyst at ACT Research, said in the report.

“Entering the weakest period seasonally for new business, Class 8 orders continued to decline in May, as weak fundamentals and broad uncertainty pressure demand,” he said. “[Medium-duty] orders have slowed across the past six months, as current bloated inventories and a weaker economic outlook weigh on new orders.”

Another part of the weaker economic outlook limiting the trucking industry is the uncertainty around tariffs that continue to limit inventory and value upside, Sandhills Global Equipment Lease and Finance Manager Jim Ryan told Equipment Finance News.

“Obviously, the whole tariff piece is affects probably trucking more than anything else because all the new manufacturing is coming from Mexico, or the majority of it,” he said. “That’ll kind of be the linchpin on what happens here through the rest of the year and early part of next year.”

In addition, the bloated inventories and weakened economic outlook also come as higher prices make it more difficult for customers to buy trucks and for dealers to move inventory, Kirk Mann, executive vice president and head of transportation at Mitsubishi HC Capital America, told EFN.

“The biggest challenge with rising truck prices has been what it costs the operator in terms of monthly payments,” he said. “Rising truck prices have been a real challenge, and it’s not just a challenge for the operator, it’s a challenge for the dealers too, because they’re holding the inventory to sell.”

Register here for the free Equipment Finance News webinar “Technologies to Advance Your Equipment Financing Business” set for Thursday, July 17, at 11 a.m. ET.