Medium-duty truck values dip again despite heavy-duty stability

Used medium-duty truck values dropped 2% MoM in October

Used medium-duty truck values declined again in October, but heavy-duty truck values improved slightly.

Despite higher new-truck costs, the truck market is being dragged down by a glut of 5- to 10-year-old inventory that dominates listings and lacks financed buyers, keeping values softer than expected even as newer unit prices hold up, Sandhills Global Equipment Lease and Finance Manager Jim Ryan told Equipment Finance News.

“That’s what’s killing the trucking market right now,” he said. “No one wants to finance those, and values are extremely low on those.”

While medium-duty box truck inventory has shown slight improvement, significant backlogs — especially in Canada and among large fleets such as Ryder and Penske — suggest that the trend will continue, making the recovery far from complete, Ryan said.

“The older stuff, we flush a lot of that stuff out, but it doesn’t mean that there’s still not a lot of inventory there,” he said. “We just may not have a lot of that inventory hit the market yet, so it’s going to be something to watch in the next year.”

Funding issues

With the inventory concerns, the truck market is being squeezed as buyers struggle to get financing and face steep depreciation on high-priced new models, creating a resale environment overwhelmed by devalued late-model units and persistent price inflation that’s resulting in some truck lender hesitancy amid a specialty finance market correction, Ryan said.

“You’ve got to have some stability in that trucking market as a company before anybody’s really going to touch you,” he said. “You’re also seeing this drop be extreme between your asking and your auction value.”

As funding issues persist, some lenders have chosen to exit the truck finance space amid broad stress across both trucking and the truck broker finance channels, despite steady deal flow, Kit West, business development director of broker relations at truck financier C.H. Brown, told EFN.

“We’re not seeing as many deals from each vendor, but I have a large enough broker network that we are absolutely inundated with deals,” he said.

Despite broader market strain, the recent deal flow suggests improvements in the heavy-duty market, resulting in fewer denials and overall healthier submissions, West said.

“The credit quality seems to be fine, but for some reason … it’s very fragmented, as far as deal flow from the broker side of things. It’s something we’ve never seen before, and it’s very odd.” — Kit West, business development director of broker relations, C.H. Brown

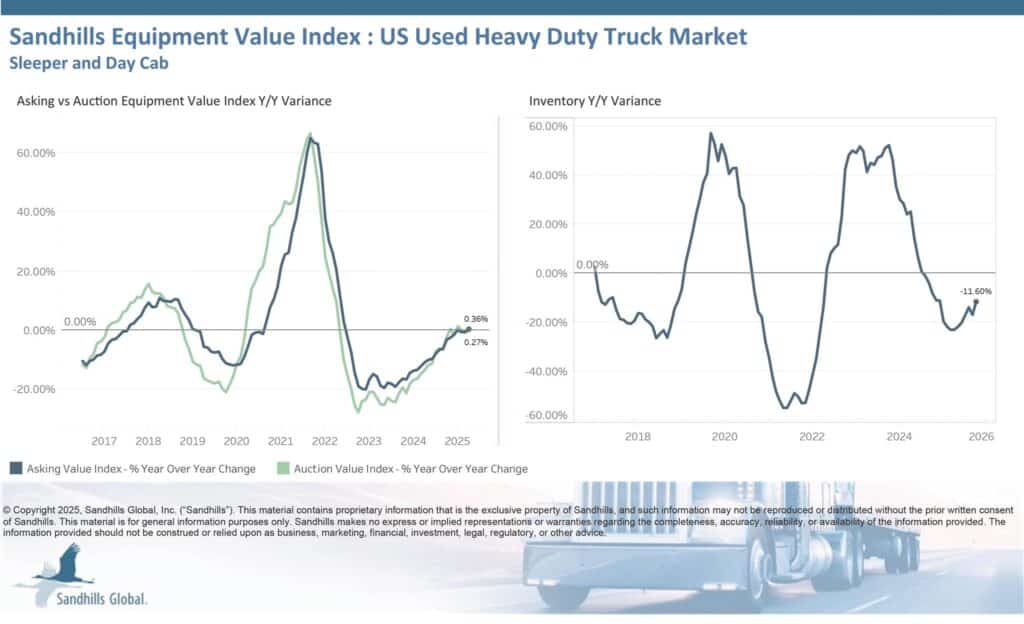

Auction performance for used heavy-duty trucks

- Inventory declined 11.6% year over year but rose 5.1% month over month;

- Asking values increased 0.4% YoY but decreased 0.4% MoM; and

- Auction values rose 0.3% YoY but dipped 0.1% MoM.

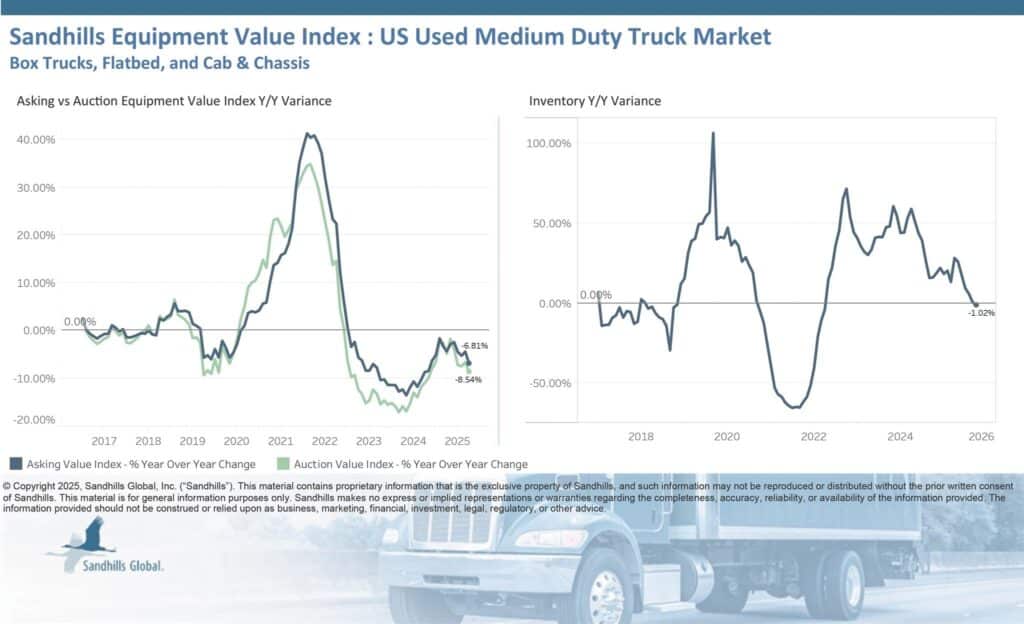

Used medium-duty trucks

- Inventory fell 1% YoY and 1.4% MoM;

- Asking values declined 6.8% YoY and 2.4% MoM; and

- Auction values dropped 8.5% YoY and 2.3% MoM.

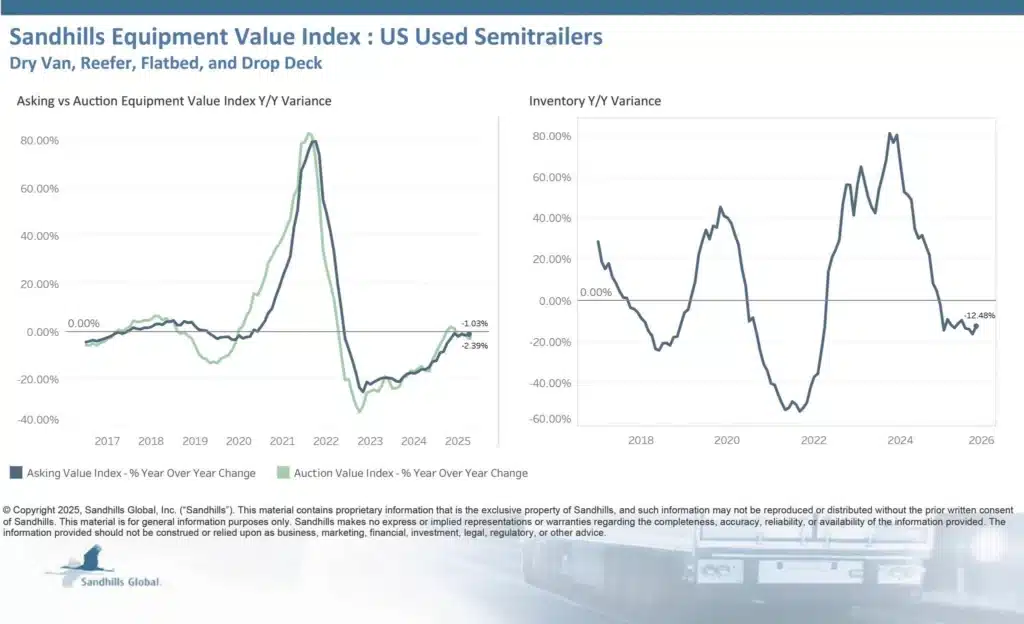

Used semitrailers

- Inventory fell 12.5% YoY and 0.7% MoM;

- Asking values slid 1% YoY and 0.6% MoM; and

- Auction values were down 2.4% YoY and 3.1% MoM.

Register here for the free Equipment Finance News webinar “Tech-driven risk management: How innovation is reshaping equipment finance” set for Tuesday, Dec. 9, at 11 a.m. ET.