Auction values for heavy-duty trucks, medium-duty trucks, and semitrailers decreased in May as the transportation industry adapts to pandemic-related supply constraints.

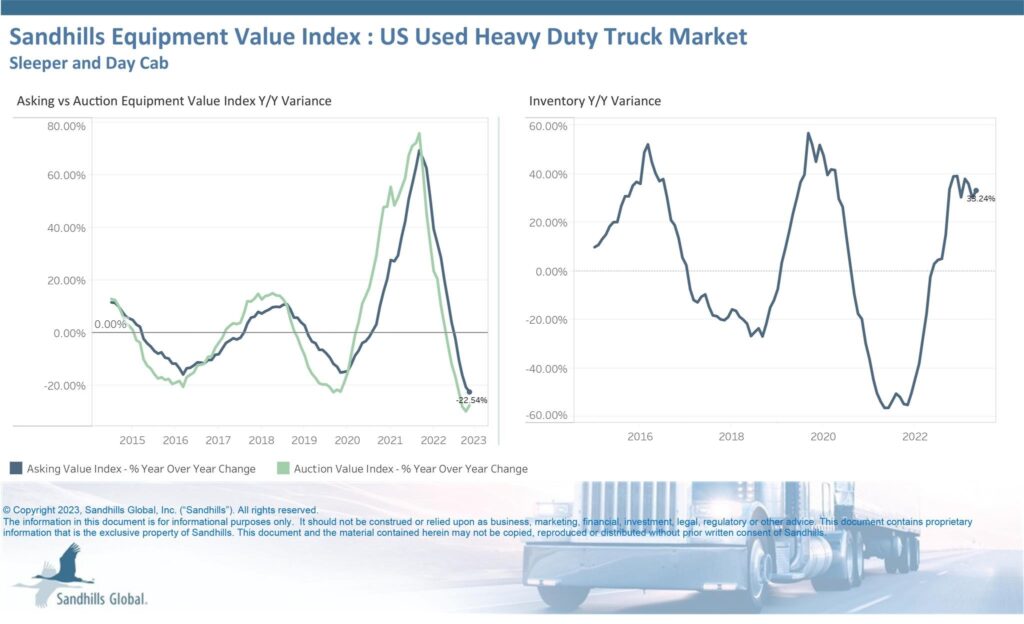

Asking and auction values for used heavy-duty trucks declined in the month of May, with asking values declining 22.5% year over year and auction values declining 27.7% YoY, according to Sandhills Global market reports. Meanwhile, inventory for used heavy-duty trucks increased 33.2% YoY in May.

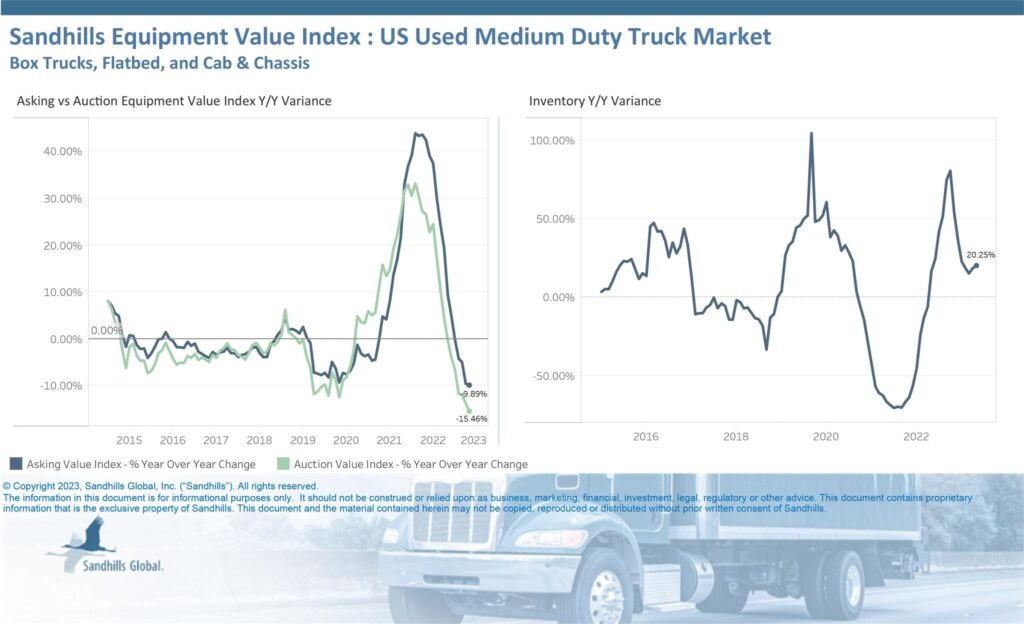

Asking and auction values for used medium-duty trucks also declined in the month of May, with asking values declining 9.9% YoY and auction values declining 15.5% YoY, according to Sandhills. Inventory for used medium-duty trucks increased 20.3% YoY in May.

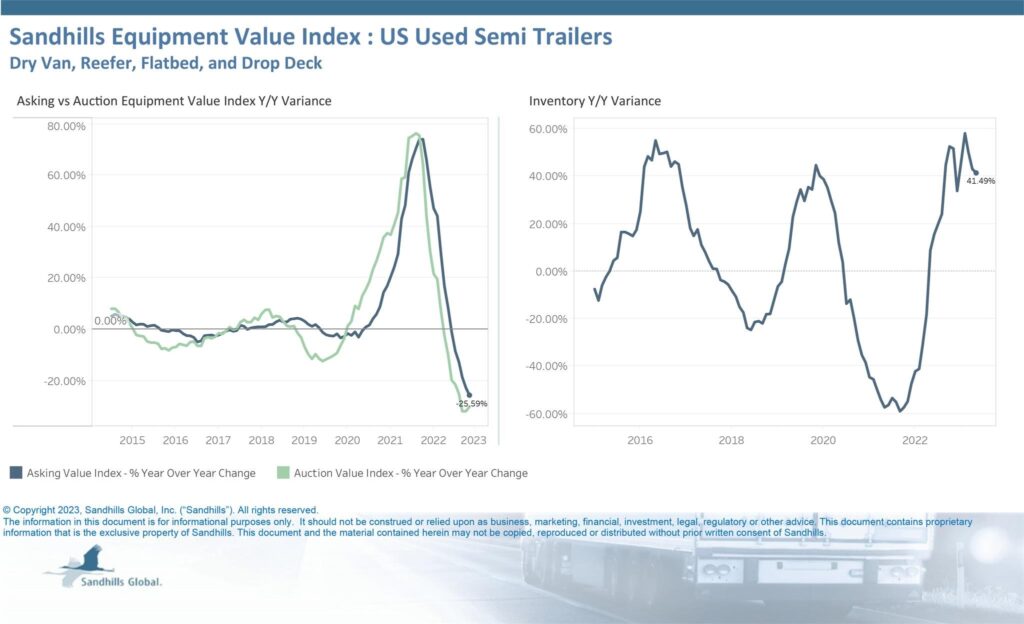

Asking and auction values for used semitrailers decreased in the month of May, with asking values decreasing 25.6% YoY and auction values decreasing 30.1% YoY, according to Sandhills. As with heavy-duty and medium-duty truck inventories, used semitrailer inventory rose 41.5% in May.

“I don’t think we’ll ever get back to pre-pandemic, the world is different now than it was back then, but it’s going to be more of the new normal on [the value] side,” Jim Ryan, equipment lease and finance manager at Sandhills Global, told Equipment Finance News. “It’s such a drastic fall from where we came from during the pandemic with values being at an all-time sky-high on everything and inventory levels being low.”

As the transportation industry normalizes, the current inventory and value trends are expected to continue, Ryan told EFN.

“This curve was coming … there’s nothing else you can put your finger on except for inventory levels,” he said. “If their inventory is there, the values are going to be down, so you’re going to continue to see that curve, probably for the rest of 2023.”

Supply chain improvements impact transportation

“The transportation space is the most volatile right now, as you typically always have your auction values, your wholesale values and your retail value as well, but there’s a middle ground,” Ryan said. “Now, there’s not a lot of wholesale out there … the volume increase is obviously rapidly dropping the retail price point, and it’s dropping the auction price point.”

An increase in lease returns, repo activity, and large fleet companies returning high-mileage inventory are all contributing to increased auction volume, Ryan said.

“The biggest thing that’s really affecting the pricing is not only the sheer volume, but just what’s coming back,” he said. “During the lack of production or lack of inventory, a lot of these fleet companies were holding on to trucks way longer than normal, so now that they’re being returned, their higher mileage trucks compared to what it used to be, and that’s going to decrease the value as well.”

Supply chain constraints during the pandemic led to a lack of production and inventory, but supply chain improvements in the transportation industry are leading to more inventory at auction, Ryan said.

“As far as inventory goes, the numbers that we’re seeing on truck paper are getting back closer to the normal, pre-pandemic numbers, but May was a big swing on the transportation side,” Ryan told EFN. “It all works hand in hand on the transportation side, as those [inventory] numbers and sheer volume increases, price is affected with it.”