Federal Reserve officials paused on Wednesday following 15 months of interest-rate hikes but signaled they would likely resume tightening to cool inflation, projecting more increases than economists and investors expected.

“Holding the target range steady at this meeting allows the committee to assess additional information and its implications for monetary policy,” the Federal Open Market Committee said in a statement released in Washington Wednesday.

Policymakers also adjusted the language in their post-meeting statement, referring to how they would determine “the extent of additional policy firming that may be appropriate,” rather than “the extent to which additional policy firming may be appropriate.”

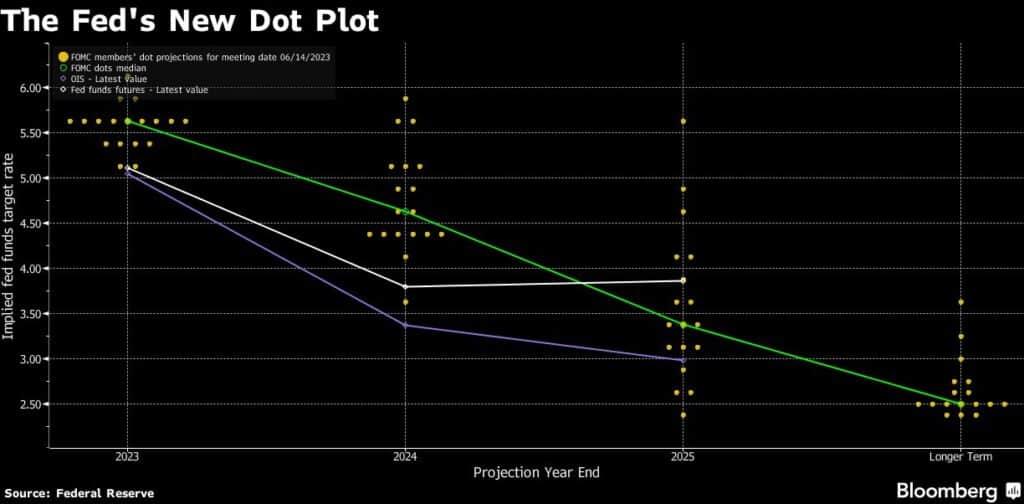

The decision left the benchmark federal funds rate in a target range of 5% to 5.25%. Fresh quarterly Fed forecasts showed borrowing costs rising to 5.6% by year end, according to the median projection, compared with 5.1% in the previous round of projections.

The FOMC vote was unanimous. Of the 18 policymakers, 12 penciled in rates at or above the median range of 5.5% to 5.75%, showing most policymakers agree further tightening is needed to contain price pressures.

The S&P 500 index of stocks declined immediately after the decision. The dollar pared declines against a basket of currencies. Yields on two-year Treasuries surged to the highest since March.

Swaps traders lifted where they see the Fed’s peak policy rate, up to around 5.34% in September.

Powell Briefing

Chair Jerome Powell will add further guidance to the outlook at a 2:30 p.m. press conference.

Wednesday’s hold is the first pit stop in the central bank’s most aggressive tightening campaign in decades to curb inflation that saw rates lifted from levels near zero starting in March 2022.

Earlier this year, stock and bond markets were roiled and four regional banks collapsed as policymakers raced to catch up after being slow to respond to mounting price pressures.

Yet the job market has remained sturdy and the inflation rate is still more than twice the Fed’s 2% target.

Both Powell and Fed Governor Philip Jefferson — nominated for vice chair by President Joe Biden — signaled they supported skipping a rate move in comments before this meeting, arguing they could afford to wait for more data as they assess the evolving outlook.

Other officials, including Fed Governor Christopher Waller, indicated they could go along with a skip but were cautious about calling an end to rate hikes with inflation stubbornly high.

US central bankers are counting on slowing demand and less robust hiring to help temper price pressures, which have run above their 2% target for more than two years.

Mixed Signals

Yet signals on the economic slowdown anticipated by Fed officials are mixed.

Consumers in May were less confident about the economy, according to a survey, but their spending picked up in the latest reading for April.

The labor market remains strong with employers adding 339,000 to payrolls in May while job openings remain high.

The inflation rate has declined from last year’s peak but is still elevated: Prices rose 4.4% for the 12 months through April, according to the personal consumption expenditures index, the gauge preferred by the Fed.

A separate measure, the Labor Department’s consumer price index, cooled further in May and the details showed encouraging signs of a slowdown, according to data out just before Fed officials gathered on Tuesday morning.

New Projections

At this meeting, Fed officials also updated their economic forecasts.

For 2023, the median estimate for gross domestic product growth was marked up to 1% from 0.4% in March.

Unemployment is forecast to average 4.1% in the fourth quarter, compared with 4.5% projected in March. The official jobless rate stood at 3.7% in May.

The PCE inflation rate was expected to be 3.2% this year, down from 3.3% projected in March, but the core inflation projections increased.

–With assistance from Vince Golle, Sophie Caronello and Liz Capo McCormick.