Orders placed with US factories for business equipment rebounded in August, suggesting resilient investment despite elevated borrowing costs.

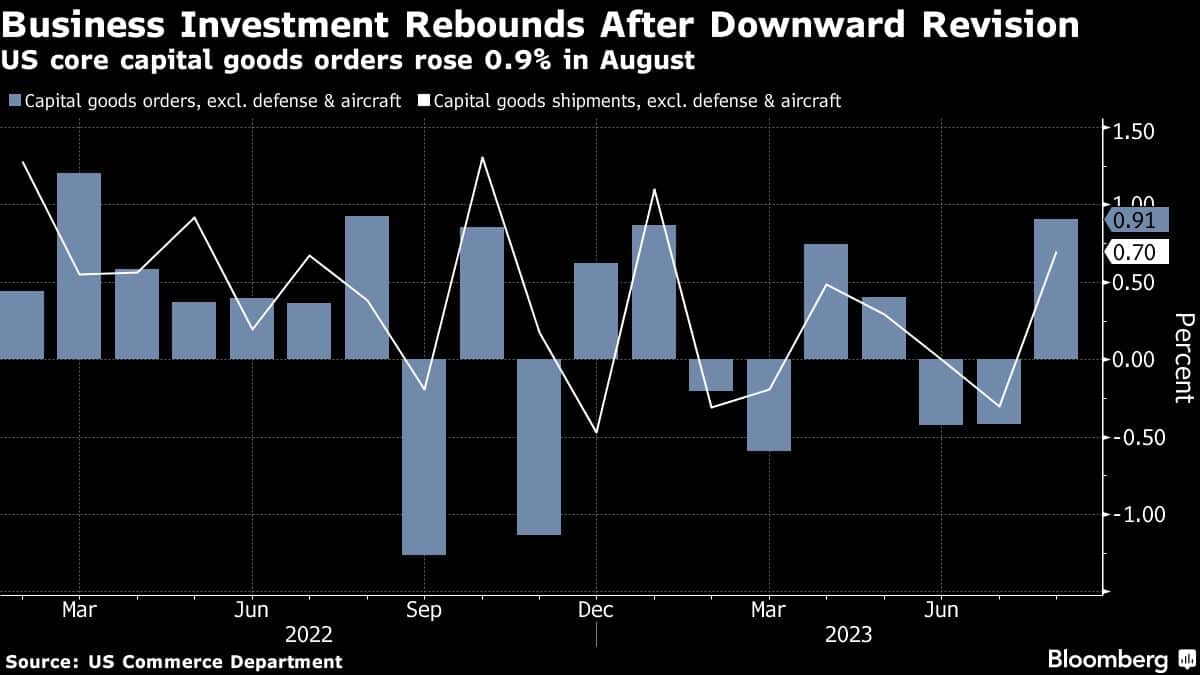

The value of core capital goods orders, a proxy for investment in equipment that excludes aircraft and military hardware, rose 0.9% last month after a downwardly revised 0.4% decline in July, Commerce Department figures showed Wednesday. That was the most since the start of the year.

Bookings for all durable goods — items meant to last at least three years — climbed 0.2%, also after the prior reading was revised lower. Excluding transportation equipment, orders advanced 0.4%. The data aren’t adjusted for inflation.

| Metric | Actual | Estimate |

|---|---|---|

| Durable goods orders | +0.2% | -0.5% |

| Capital goods orders excl. defense & aircraft | +0.9% | +0.1% |

| Capital goods shipments, excl. defense & aircraft | +0.7% | +0.0% |

The increase in orders was led by computers, electrical equipment and machinery. Total durable goods bookings were boosted by a roughly 19% increase in military aircraft.

The report indicates firms are still focused on long-term improvements despite elevated borrowing costs and an uncertain economic outlook. Though the pace of investment has slowed, companies are now taking advantage of easing inflation and normalizing supply chains.

Core capital goods shipments, a figure that is used to help calculate equipment investment in the government’s gross domestic product report, rose 0.7%, the most since the start of the year. The first estimate of third-quarter GDP is due in late October, but it could be delayed in the likely event of a government shutdown.

Wall Street and Federal Reserve economists alike are growing more optimistic about economic growth in the near term. Forecasters surveyed by Bloomberg now see GDP rising 3% in the third quarter — well above the pace projected last month — and that’s in part because of stronger private investment.

The Commerce Department’s report showed bookings for commercial aircraft, which are volatile from month to month, fell about 16% after slumping in July.

Boeing Co. reported 45 orders in August, the fewest since April. While often helpful to compare the two, aircraft orders are volatile and the government data don’t always correlate with the planemaker’s monthly figures.

While manufacturing has been in a slump for the better part of the last two years, the pace of declines has started to moderate. That said, a historic strike against the three largest US automakers — now in its second week — could act as a drag on the sector just as supply chains and prices were finally stabilizing.

— With assistance from Chris Middleton (Bloomberg)