As equipment inventories continue to spike and values drop amid a tightened financing environment, the transportation finance industry is gaining traction following three years of pandemic-related problems, including supply chain bottlenecks, labor shortages and shipping company closures.

One of the largest remaining challenges for dealers and lenders is handling the drop in value of trucks that were financed with extended terms during pandemic-era supply shortages, Steven Geller, owner and general manager of equipment finance intermediary and management consulting firm Leasing Solutions, told Equipment Finance News. Some borrowers can’t make their payments, which, coupled with high loan-to-value ratios caused by declining used truck values, is pushing up losses, he said.

“The major issue in the trucking industry is that banks that were heavy into truck financing were financing owner-operators with bad credit based on the value of the trucks, and they were financing used trucks over longer terms,” Geller said. If a customer has “48 months left on a 2017 truck that needs a new engine, he’s going to walk away from it [because] he’s not going to be able to make the payments.”

Repossession activity picking up

Repossession agencies have been adding staff in response to rising delinquencies and repossessions, Jason Spates, chief executive of Truck Lenders USA, told EFN.

“Repo companies’ feedback to me is that they’ve quadrupled their staff and quadrupled their repo agent relationships, and they’re busy as all get out,” Spates said.

Lockport, N.Y.-based Great Lakes Asset Solutions continues to add agents and volume to its nationwide commercial recovery business, Nick Walker, director of sales and marketing at Great Lakes Asset Solutions, told EFN.

“In 2023, we have literally doubled in amount of placements and revenue,” he said. “As far as agents that we’ve added… we can never have too many agents and we are always looking for more.”

Meanwhile, Rich Whittaker, owner of Salt Lake City-based automotive and equipment repossession agency West Coast Recovery Services, told EFN that the repo growth follows a contraction of agencies and independent agents during the pandemic. Four agencies in Florida closed in one day during the slowdown, he said.

Supply, meet demand

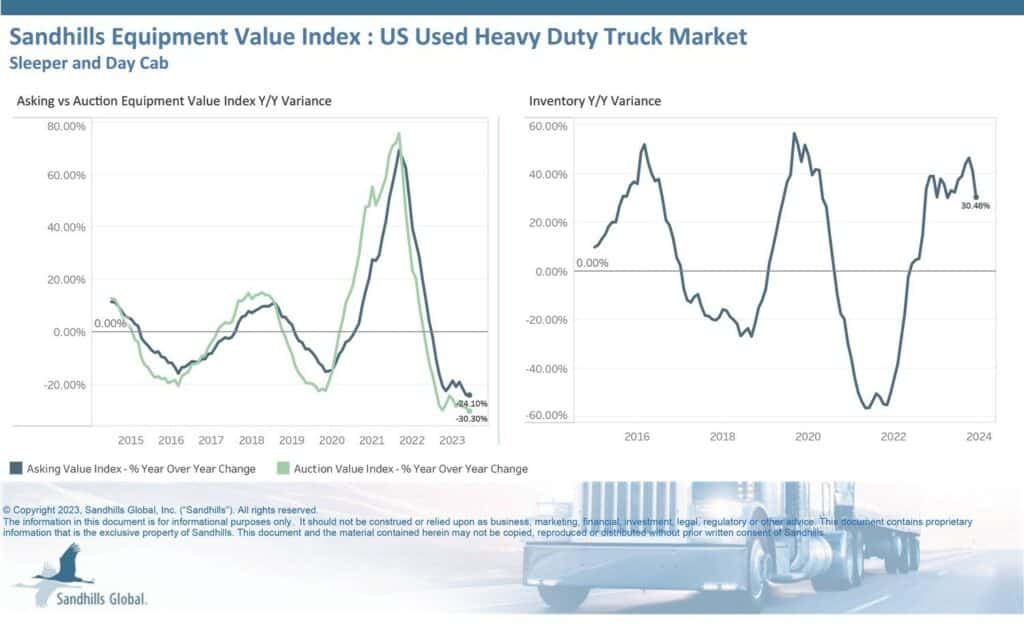

Trucks that customers abandoned or turned back to lenders and repo agents are worth a fraction of what they originally financed them for, Spates said.

“If you pick up a truck that you financed for $60,000 or $80,000, you’re going to get $20,000 to $30,000 for that truck,” he said. “The values are so low.”

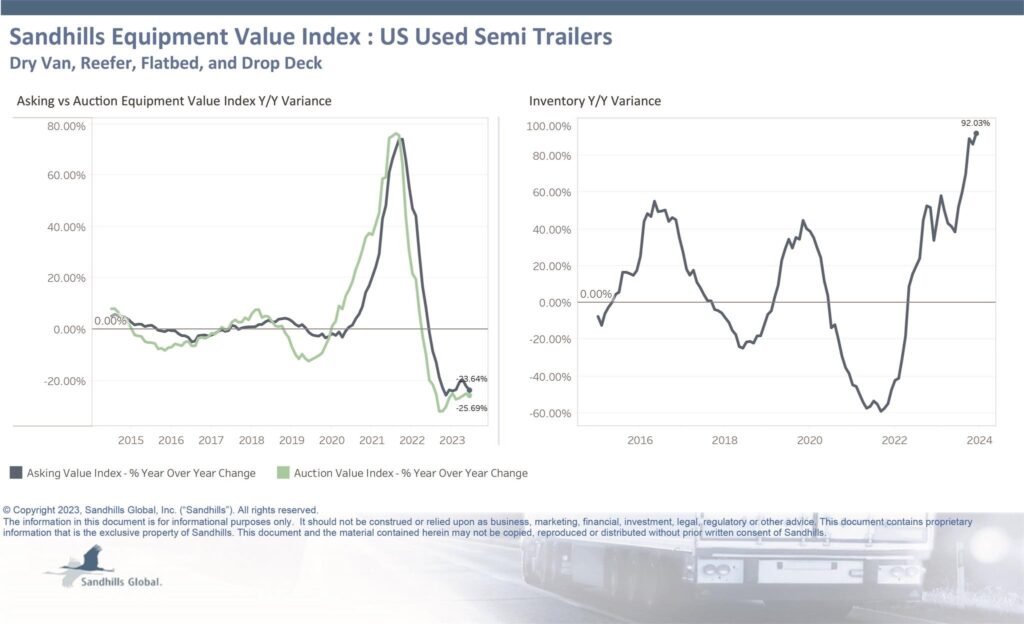

The semitrailer market — which includes dry vans, reefer trailers, flatbed trailers and drop-deck trailers — experienced a significant inventory increase in 2023, Sandhills Global Equipment Lease and Finance Manager Jim Ryan told EFN. The spike resulted in retail or asking values falling 23.6% year over year and auction values dropping 25.7% YoY, he said.

“The inventory levels of trailers [in December] are almost double the inventory we had this time last year,” Ryan said. “There is just so much inventory on the trailer side, particularly dry van trailers, that asking values and auction values went down in December compared to the month before. There’s an extremely low demand and there’s a ton of inventory out there.”

The inventory of several collapsed trucking companies, including Yellow, is starting to make its way to auction, where it joins repossessions, Spates said.

Excess supply will have to work its way out of the system before trucking prices stabilize, Ryan said.

“It’s typical supply and demand,” he said. “If the supply is there, the demand is not going to be there. That’s traditionally what you see, and you’re seeing it at historic levels in transportation.”

Equipment recovery efforts rising

Some lenders and OEMs continue to make efforts to improve recovery rates and retain more collateral value post-repossession, Chris Macheca, president and chief operating officer of Littleton, Colo.-based GPS provider PassTime GPS, told EFN.

“We’ve seen more than 100% increase in the last 12 months from that market, mainly because the risk factors are growing,” Macheca said. “We’ve seen GPS used on a lot of bigger assets, and as the technology has evolved, it’s opened the door for tracking just about anything that is financed, so I think it’s a trend that seems to be continuing.”

The increase in GPS use comes as lenders look to protect not only high-risk loans but also high-value equipment like commercial trucks, Kevin Carr, vice president of financial services at PassTime, told EFN.

At the start of the year, many commercial truck and equipment finance companies tightened up on over-the-road loans, Carr said.

“Many of them were backing away from startups as they wanted a little more stability,” he said. “Those that were still buying in that C or D credit space were being cautious because pricing on these trucks was high and the values were going to be coming down.”

Truck Lenders USA puts GPS systems in all vehicles they finance, Spates said, noting that about 20% of their customers had their trucks parked.

Finding the equipment and recovering the equipment present different challenges, said Whittaker, whose West Coast Recovery Services has used GPS systems to recover, among other things, several pieces of logging equipment in Georgia.

“Most recovery companies aren’t set up to [repossess] equipment because they’re all dependent on those big forwarding companies,” he said. “Getting equipment transports is not like calling a tow truck, there’s not one on every corner, and a lot of us will not do repossessions.”

Turning around in 2024

A return to normal could follow rising interest rates, supply chain shortages, inventory spikes and value drops that caused challenges for the equipment industry, Truck Lenders’ Spates said.

“During COVID, people weren’t making payments for 60, 90, and some, 120 days,” he said. “It was essentially a perfect storm coming off COVID with more equipment and more trucking companies that were new eating into the profits of the bigger companies. All that bad debt needed to work out of everyone’s portfolios through 2024.”

As the supply chain continues to improve and interest rates begin to drop, shipping activity should increase and help the transportation industry rebound, Kit West, business development director/broker relations at equipment lender C.H. Brown, told EFN.

“There’s going to be an uptick in 2024 of goods moving around. Imports aren’t quite there yet, and we rely on a lot of the imports coming in,” West said. “When you see the industry start to pick up, we’ll see more companies come back online and more independent truckers go back to driving themselves instead of working for companies or working other jobs.”

Registration is now available for Equipment Finance Connect. The dealer-centric equipment lending and leasing event of the year offers opportunities for dealers to learn new strategies, foster valuable partnerships and emerge with ideas to immediately apply to their businesses. Learn about Free Dealer Registration at EquipmentFinanceConnect.com.