Heavy-duty and medium-duty trucking sectors landed on opposite ends of the spectrum in December, highlighting the industry’s recent improvements and ongoing challenges.

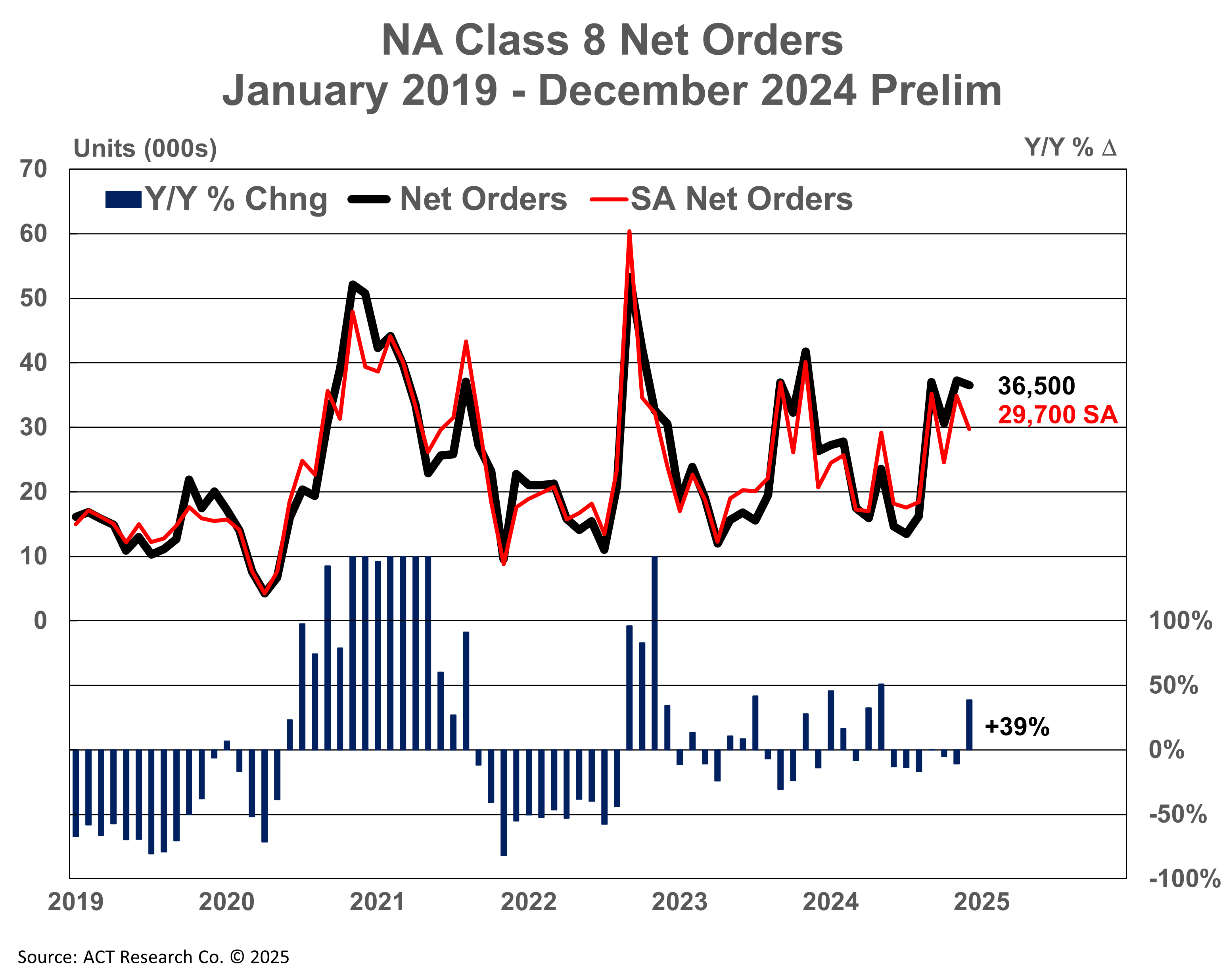

Preliminary Class 8 truck orders in North America were 39% higher in December 2024 than they were in December 2023, but the total of 36,500 was down 2.1% month over month, according to a Jan. 3 report by ACT Research. That followed an 11% year-over-year decrease and a 21% MoM increase in November.

Heavy-duty retail truck sales also rose 0.4% YoY and 6% MoM in November to 491,000 units, according to Equipment Finance News’ U.S. Heavy Duty Retail Truck Sales Index.

Meanwhile, medium-duty Class 5 to Class 7 orders fell 40% YoY and 1.9% MoM in December to 16,800 units, according to ACT. Preliminary medium-duty orders were down 30% YoY in November.

The YoY jump in Class 8 orders shows that dealers are able to “order any trucks for stock or for speculative purposes” now that supply chain issues have eased post-pandemic, allowing them to cater to a wider customer base, ACT Research Vice President Steve Tam told Equipment Finance News.

“One could argue that [dealers] don’t necessarily want to hold inventory right now,” he said. “But the reality is, given the competitive landscape, that it is a strategy that some dealers are choosing to employ.”

While higher order volumes reflect increased demand, it’s also possible that some OEMs are “pushing inventory onto the dealers that they may not want,” Tam said.

With regulators pushing manufacturers to make and sell more zero-emission vehicles, dealers may also be upping their intake so they can offer relatively low-priced trucks compared to the EVs that might flood the market in the coming years, he said.

The average price of a new heavy-duty truck is roughly $140,000, according to EFN’s Current Truck Pricing Distribution data. A comparable EV truck typically costs more than $400,000, according to the American Trucking Association.

Credit performance better, lenders still ‘scared’

While commercial trucking is gradually bouncing back from its yearslong slump, the industry is working through several lingering challenges, including subpar credit performance, Chris Grivas, president of Chadds Ford, Pa.-based CAG Truck Capital, told EFN.

“Credit performance is improving, and lenders have cleaned up their portfolios,” he said.

“The weak links to the chain are gone. But unfortunately, there were many weak links to the chain. …

— Chris Grivas, president, CAG Truck Capital

This storm lasted for 2½ years. We’re talking record repossessions. Lenders are still scared, but they’re optimistic.”

The third annual Equipment Finance Connect at the JW Marriott Nashville in Nashville, Tenn., on May 14-15, 2025, is the only event that brings together equipment dealers and lenders to share insights, attend discussions on crucial industry topics and network with peers. Learn more about the event and register here.