The effect of President Donald Trump’s proposed tariffs on equipment financiers will largely depend on the heavy-equipment industries that they serve.

“Some industries have a heavier reliance on China and Asia-Pacific, others in Europe, some in Mexico,” Daryn Lecy, chief operating officer at West Chester, Pa.-based Oakmont Capital Services, told Equipment Finance News.

“Depending on the success of reshoring attempts in the U.S., over time there will be new opportunities stateside to finance construction projects and the equipment with those before the fruits of the manufacturing plants will be ready for the market,” he added.

While it’s too early to tell how tariff policies will affect the manufacturing landscape, increased domestic production would benefit the industry, with stronger trade relations “resulting in potential advantageous terms where demand or volume could improve under enhanced pricing or other terms,” Lecy said.

Stymied short-term growth?

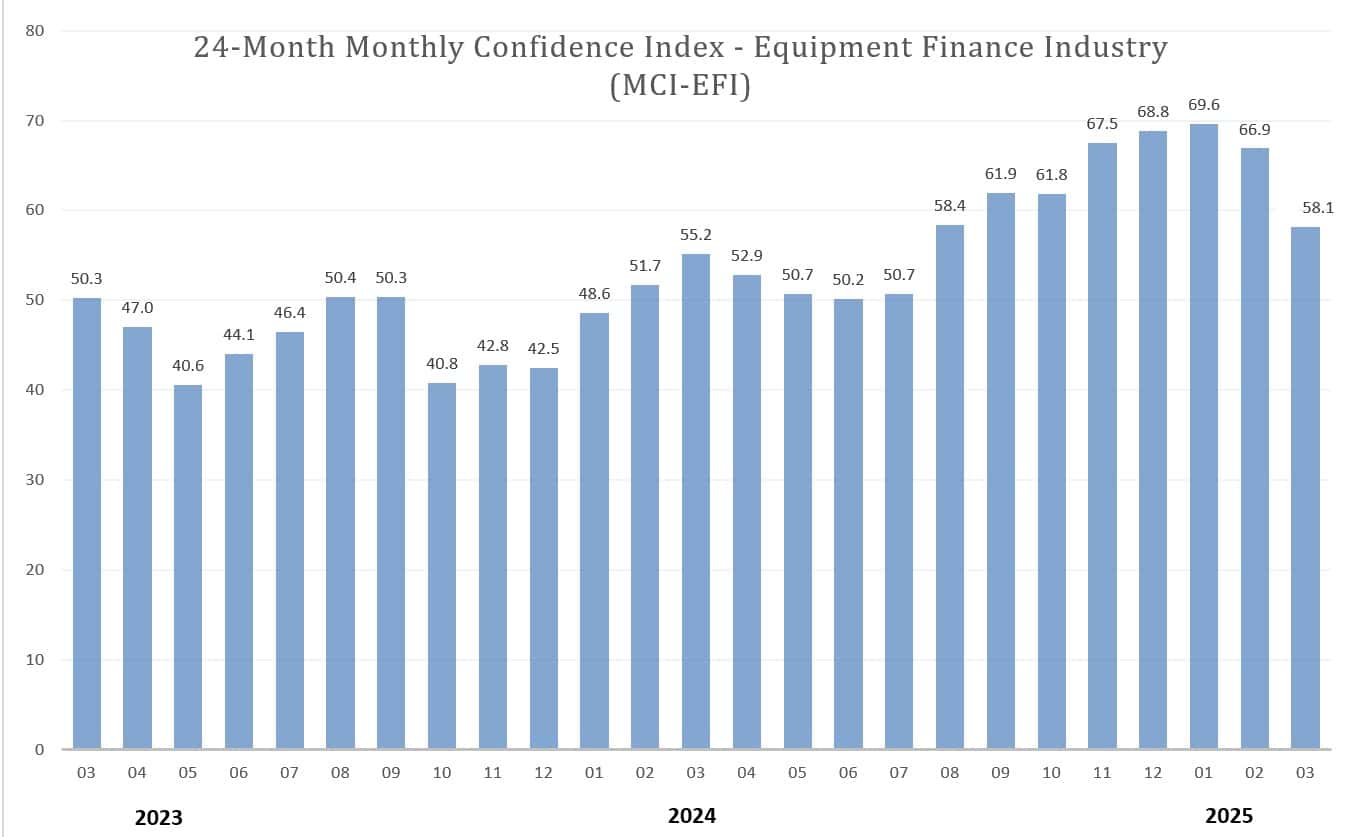

Meanwhile, the Equipment Leasing and Finance Foundation’s monthly confidence index fell from 66.9 in February to 58.1 in March, its lowest mark since July 2024 and the largest month-over-month drop since October 2023, according to the March 20 report.

The decrease comes two months after the index reached a 30-month high in January, driven by lower interest rates and expectations of pro-business policies under Trump, including full bonus depreciation and other tax breaks.

While these expectations remain, tariff uncertainty could stymie equipment finance growth in the short term, Donna Yanuzzi, executive vice president at Exeter, Pa.-based 1st Equipment Finance, stated in the report.

“Weeding through the noise, the Trump administration appears to be pro-business and regulatory realistic.”

— Donna Yanuzzi, EVP, 1st Equipment Finance

“This combination should drive investment and growth,” she said. “However, the concerns of tariffs may impact business growth in some fashion. Now, more than ever, strategic planning will be key in navigating the opportunities and risks ahead.”

Of roughly 30 equipment financiers representing banks, captives and independents surveyed, 28.6% expect business conditions to improve over the next four months, down from 53.6% in February. Just over 32% of lenders believe lease and loan demand will increase over the next four months, down from 46.4%.

Where are interest rates headed?

After three Federal Reserve rate cuts at the end of last year, resulting in a full percentage point drop to a range of 4.25% to 4.5%, many in equipment finance anticipated a low interest-rate environment in 2025 relative to previous years.

Now, with a fast-moving political landscape and potential major tariff implications, “there is more uncertainty than in the past 12 to 24 months as to how rates will be affected,” Oakmont’s Lecy said.

“While we didn’t know with 100% confidence in the recent past, there weren’t as many new variables to manage,” he said. “We are hopeful rates will, at a minimum, stay flat with the opportunity for gradual reductions by late [second quarter] or Q3 this year.”

The number of equipment lenders anticipating increased access to capital over the next four months fell to 21.4% from 25% in February.

Early-bird pricing for the third annual Equipment Finance Connect ends March 28. Taking place at the JW Marriott Nashville on May 14-15, 2025, this is the only event for both equipment dealers and finance providers. Learn more and register here.