Leveraged loan market decline presents financing opportunity

Market down 23% in Q1

As the leveraged loan market continues to decline and banks tighten lending, an opportunity presents itself for equipment and commercial financiers to grow.

Issuance in the leveraged loan market decreased 24%, from 2021 to 2022, and it was down again by 23% year over year in Q1 2023, Brian Rosa, president of commercial finance at Mitsubishi HC Capital America, told Equipment Finance News. Leveraged loans target companies or individuals with high debt or poor credit, and typically go to small- and medium-sized businesses.

“This means there are fewer financing options for small- to medium-sized businesses, so these companies look to alternative financing options,” Rosa said. “We, Mitsubishi HC Capital America, are an independent commercial finance company, and we’re seeing an increase in demand for our products and services.”

The rolling 12-month growth rate for the U.S. leveraged loan market has seen a sharp decline over the past year, according to Morningstar’s LSTA US Leveraged Loan Index, which is a snapshot of the leveraged loan market size.

With the value of the markets still higher than pre-pandemic levels, alternative lenders can capture the demand, Rosa said.

Strengthening markets

Beyond the leveraged loan markets, demand for technology, clean energy, and transportation and construction assets is growing, Rosa told EFN.

“We’re experiencing growing demand in all industries, but there seems to be especially strong demand for technology assets across all industries,” Rosa said. “We’re also seeing an increase in demand for clean energy assets and products and the transportation and construction sectors have also been very strong. I think overall, we’re seeing a number of companies with solid business models and strong industry positions, taking advantage of supplier consolidation, and landing new contracts.”

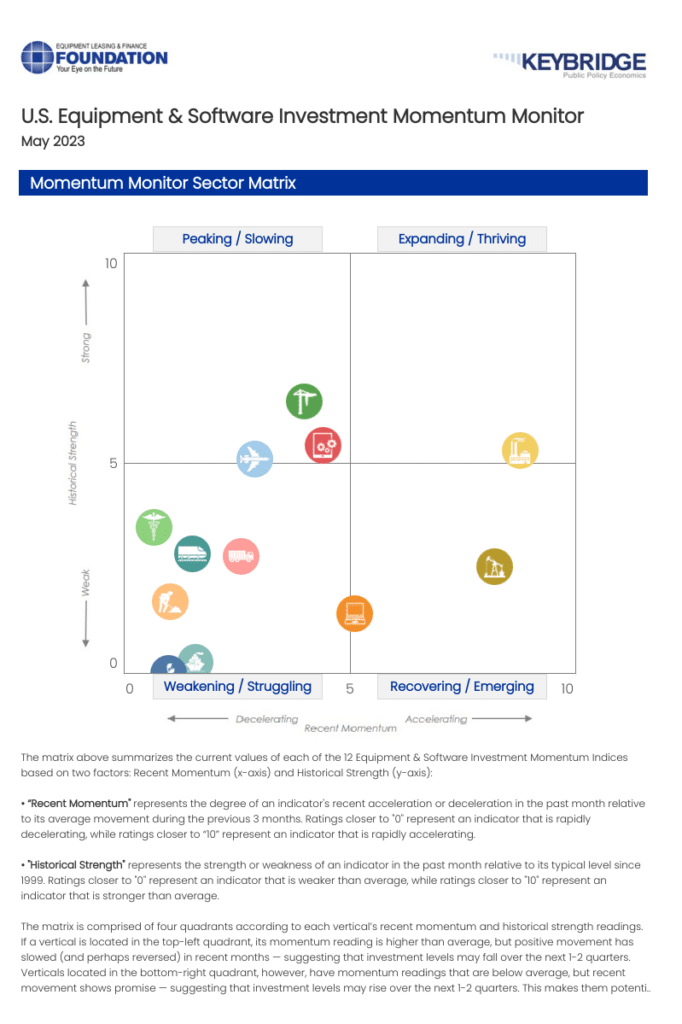

Computers and software are two sectors gaining momentum, according to the Equipment Leasing and Finance Foundation’s (ELFF) Foundation-Keybridge U.S. Equipment and Software Investment Momentum Monitor. The monitor includes indices for 12 equipment and software investment verticals, according to ELFF.

Navigating rising interest rates

While there are opportunities for growth in commercial finance, rising interest rates present a hurdle for companies looking to make purchases, investments and acquisitions, Rosa said, although some companies prepared for the market tightening.

“I will say rising rates have probably raised the hurdle for whether or not they move forward with their equipment purchases, new investments or acquisitions,” he said. “Fortunately, many businesses have made investments over the last several years, when government capital was plentiful and inexpensive, which put them in a stronger financial position today.”

The secured overnight financing rate (SOFR) also provides a means for financiers to facilitate deals, as the publicly available rate represents a level of transparency for customers in the current rate environment, Rosa said.

“Customers don’t like higher interest rates, but especially commercial finance. We price off the swap rate curve, so there’s a good level of transparency since SOFR swaps are publicly available,” he said. “Our customers have been generally understanding of rates going up, and I’d say our customers’ CFOs are well aware of the current interest rate climate and are planning accordingly.

Outlook for 2023

Despite some optimism about the current state of the commercial and equipment finance industry, Rosa expects rates to remain elevated, which will have a negative impact on banks.

“We don’t see interest rates declining anytime soon due to persistent inflation, even though higher interest rates will probably affect bank balance sheets, so I think the primary trend we see right now is going to be more of the same,” he said.

“There’s going to be asset sales, financing restrictions and unavailability unless there is an unexpected external event that changes the calculus for the Federal Reserve Bank, so just what we’re starting to see over these past few months, I think we’ll probably see similar and maybe more of it in the future.”