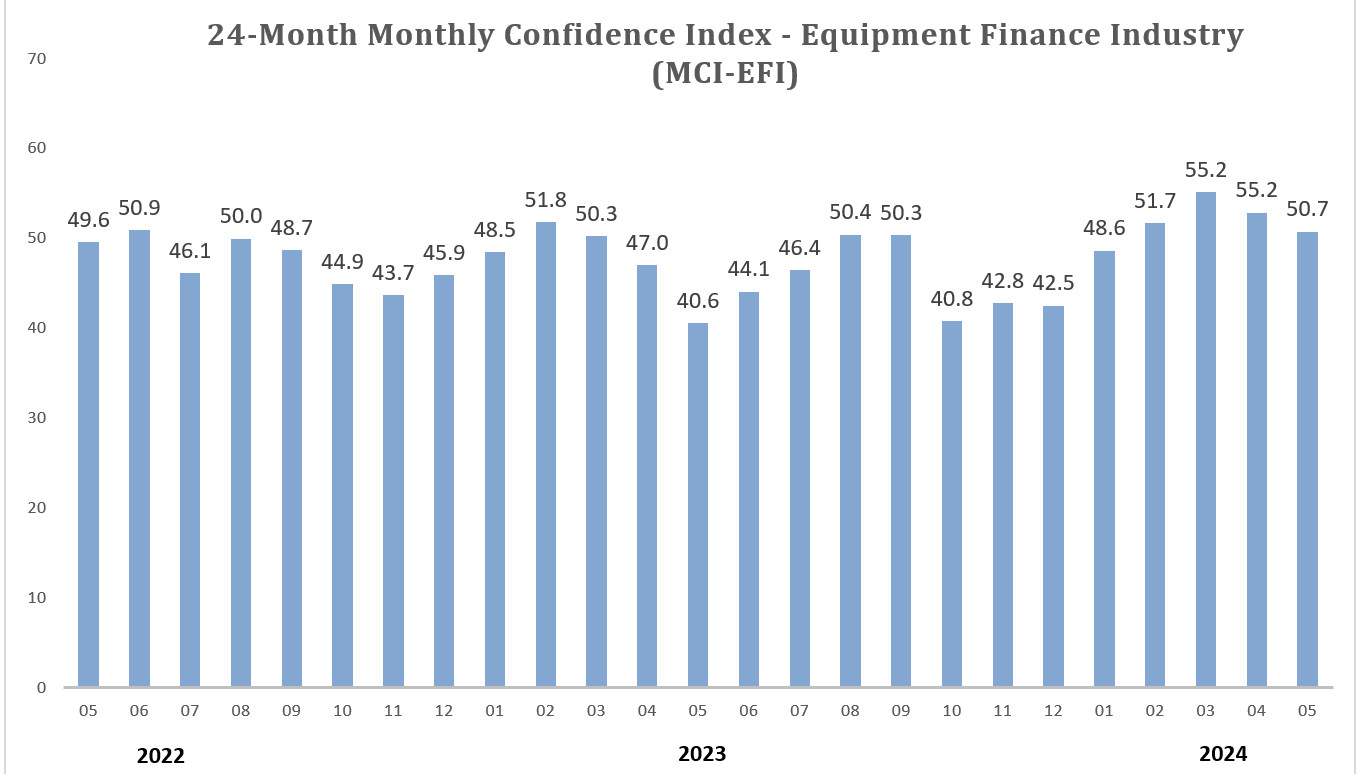

Confidence in the equipment finance industry dropped two points on a month-over-month basis as lenders reevaluate their operations’ availability of funds.

The Equipment Leasing and Finance Foundation’s monthly survey of lender sentiment for May found that overall confidence in the industry dropped 2.2 points MoM to 50.7.

A “lack of liquidity” is challenging lenders, said Bruce Winter, survey respondent and president of Maryland-based lender FSG Capital. He told Equipment Finance News that he’s also noticed talent shifting in the industry as lending operations restructure — or exit the equipment financing market altogether.

“There’s very few people that are looking for substantial new volume, they’re looking to take care of the customers that they already have,” Winter told EFN.

Tides in the industry’s talent pool are shifting as well, he said.

“What we’re seeing is there’s a number of folks that are very unhappy in the industry, with their employer,” Winter said. “The smarter ones are making sure they have a place to land first [before quitting], because there certainly aren’t as many opportunities as there were two years ago in our industry.”

Poll results

The May ELFF poll found:

- 11% of the 28 survey respondents said they expect business conditions in the industry to worsen in the next four months compared to 3.6% in April. A further 11.1% said they expect business conditions to improve over the next four months, up from 10.7% in April; 77% believed business conditions would remain the same, down from 85.7% in April.

- 7.4% of lenders surveyed said they expect demand for equipment loans and leases to fund capital expenditures to decline in the next four months, up from zero the prior month. Meanwhile, 11.1% said they expect this activity to increase, up from 7.1% in April, and 81.5% of lenders said they anticipate demand to remain the same, down from 92.9% in April.

- Of the executives surveyed, 77.8% expect capital access to remain the same in the next four months, up from 71.4% in April. And 14.8% of respondents said they expect more access to capital in that time frame, up slightly from 14.3% last month. Meanwhile, 7.4%, expect less access to capital this month, down from 14.3% in April.

- 11.1% of lenders said they expect their firms to spend more money on business development in the next six months, down from 17.9% in April. The majority – 81.5% – said they expect there will be no change in spending, up from 78.6% in April. A further 7.4% of lenders said they anticipate a decrease in spending, up from 3.6% last month.

- 22.2% of executives said they expect to hire more staff in the next four months, up from 17.9% in April. Meanwhile, 74.1% said they expect “no change” in headcount in that time frame, up from 71.4% last month. And 3.7% of executives surveyed said they expect to hire fewer employees in coming months, down from 10.7% in April.

Nationwide economy troubles lenders

None of the leadership surveyed by ELFF rated the current United States economy as “excellent,” unchanged from April.

“The delay of expected or hoped-for interest rate reductions seems to be leading some entities to reconsider capital projects,” Minneapolis-based Farm Credit Leasing President Jason Leuders stated in the survey. “To date, volume and credit quality have held up, but it’s not clear what the future will hold.”

FSG Capital’s Winter said that he’s noticing interest rates’ impact on the market, but added the high rates aren’t completely dissuading purchasers.

“I haven’t run into one customer that said things like, these interest rates are deterring me from moving forward with a capital acquisition,” he said.

Winter acknowledged, “we were at 4% [interest], two years ago, and we’re 8% today; yeah, it’s a substantial change.”

He added that since FSG Capital prioritizes facilitating larger loans with five- to seven-year financing terms, he views his business as slightly insulated.

“When you look at a five- or seven-year term, which is typical for us in our space, it’s not typically going to change dramatically, the return on investment [for] that piece of equipment,” Winter said.

But the changes are being felt on the side of the borrower, Winter noted.

“We’ve seen substantial disruption in funding marketplaces, which some customers are confused by, such as when their bank doesn’t respond to them for a credit request,” he said. “It’s because the banks are quietly not looking to lend right now, but they necessarily don’t want to make that public.”