Equipment finance confidence improves in June

Confidence landed at 44.1

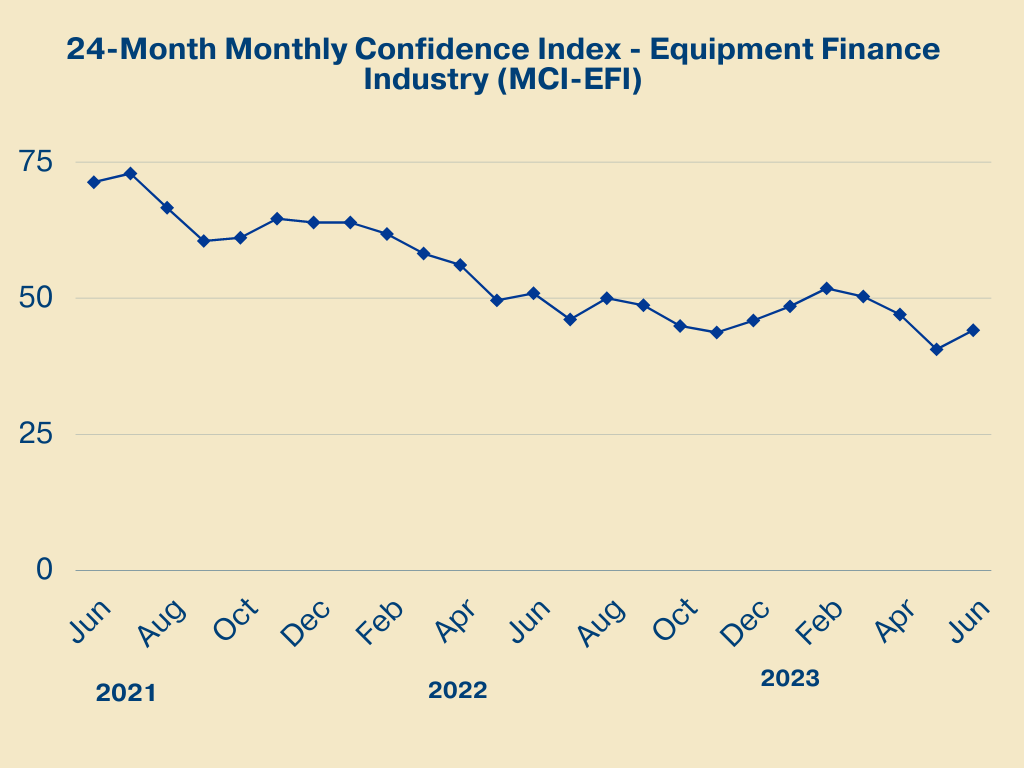

Confidence in the equipment finance industry improved for the first time since February, as the market stabilized amid tightening credit.

The Monthly Confidence Index for the equipment finance industry (MCI-EFI) landed at 44.1 in June, up from 40.6 in May but down compared with 50.9 in June 2022, as a growing number of executives expect the industry to weather tightening credit markets while business conditions improve, according to the Equipment Leasing and Finance Foundation (ELFF), the foundational arm of the Equipment Leasing and Finance Association (ELFA).

ELFF’s MCI-EFI surveys key executives from lenders of different sizes about the state of the industry and expectations for the near future, according to the foundation’s website. A median score of 50 generally indicates optimism, with the index remaining below 50 for nine of the past 12 months.

In June, 66.7% of equipment finance executives indicated that they believe demand for capital expenditure (CapEx) loans and leases will remain the same for the next four months, up compared with 53.6% in May. Meanwhile, 6.7% of executives expect CapEx loan and lease demand to improve in the next four months, up from 3.6% in May. Lastly, 26.7% of respondents believe demand will decrease, down from 42.9% in May.

May’s new business volume was $9.5 billion, up 1% year over year, according to a monthly ELFA report. Year-to-date new business volume was up 0.9% through May.

Preparing for tightening credit

“The equipment leasing and finance industry has always outperformed all other asset classes regardless of market conditions; I expect the next 12 months to be no different,” Dave Fate, co-founder and chief executive of Stonebriar Commercial Finance, told Equipment Finance News. “The unprecedented, accelerated rise in interest rates has created higher borrowing costs for everyone.”

Even so, Stonebriar has funded over $800 million year-to-date and has over $4 billion of deals on its pipeline report,” Fate told EFN.

“All good indicators of robust business activity,” he said.

Tightening credit standards can also present an opportunity for lenders to fill the capital needs left by larger banks, Jonathan Albin, chief operating officer of Nexseer Capital, said.

“We believe that as banks’ senior credit facility lending tightens, there will be more opportunity for equipment lessors to supply supplemental capital,” he said. “We are seeing evidence of this today.”

Stonebriar’s Fate said that the evidence also indicates that equipment financiers can endure the current climate.

“I expect the industry to continue to persevere during this point in time as well,” he said. “The consumer is well positioned to navigate credit tightening, with household assets increasing over $3 trillion in Q1 2023 alone.”

The Federal Reserve paused interest rate increases in June, but the expectation is that more tightening will come, Fate said. He said he expects tightening to continue “until a recession of some level is underway.”