Lower borrowing costs and expectations of loosened regulations under a new presidential administration drove up equipment financiers’ confidence this month.

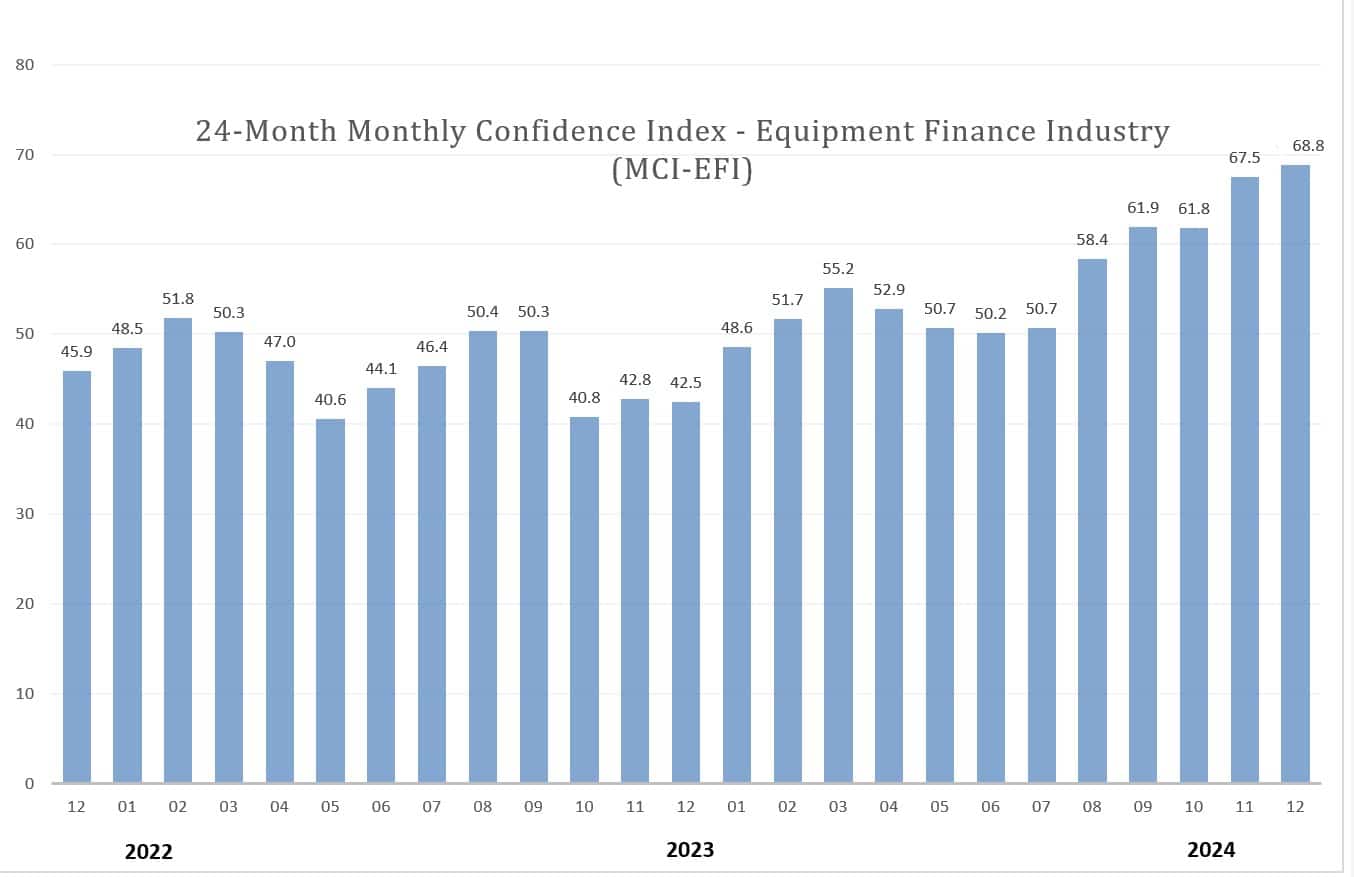

The Equipment Leasing and Finance Foundation’s (ELFF) monthly confidence index, released today, rose to 68.8 in December from a three-year high of 67.5 in November. The index has increased in five of the past six months.

Potential policy changes under President-elect Donald Trump could spur equipment finance demand in 2025, Jody Ray, relationship manager at Chicago-based BMO Bank North America, told Equipment Finance News.

“We are optimistic that with the uncertainty of the election behind us, a pro-growth stance from the new administration, including steady or lower corporate tax rates, a lighter regulatory touch and low energy costs, the backdrop is in place for solid macro growth and increased business investment,” he said.

A softer political stance on Section 1071 of the Dodd-Frank Act, which requires lenders to report data from small-business loan applications to the Consumer Financial Protection Bureau, could also “lead to a more robust environment,” 1st Equipment Finance Senior Vice President Charles Jones stated in the ELFF report.

Fed cuts spur business

Recent Federal Reserve rate cuts have also generated “steady flow” for lenders, BMO’s Ray said. The Fed on Dec. 18 lowered its benchmark interest rate for the third time since September to a range of 4.25% to 4.5%.

“Equipment finance seems to be in a good place with an optimistic customer base,” Ray said. “I certainly hear that from my dealers and their customers as I interact with them.”

Just over 53% of equipment financiers expect loan and lease demand to increase over the next four months, up from 48.3% in November, according to an ELFF survey of about 30 financiers. Roughly 57% of respondents expect business conditions to improve over the next four months, up from 43.3%.

However, the number of lenders anticipating greater access to capital for equipment acquisitions over the next four months fell to 28.6% in December from 37.9% in November.

Shorter loan terms

Equipment lenders are becoming more inclined to offer shorter loan terms as interest rates drop, Ray said.

“Savvy business owners have one goal in mind, it seems, when borrowing money — to pay it back quickly and with the least amount of interest possible,” he said. “I’m seeing a decrease in loan terms simply because the recent rate reductions from the Fed have translated to lowered lender rates. These reductions allow a comfortable payment at 48 months, whereas before, the customer considered 60 months.”

Manufacturers are also working with lending partners to offer limited-term plans and incentives for new equipment, Ray said.

The third annual Equipment Finance Connect at the JW Marriott Nashville in Nashville, Tenn., on May 14-15, 2025, is the only event that brings together equipment dealers and lenders to share insights, attend discussions on crucial industry topics and network with peers. Learn more about the event and register here.