Equipment finance companies are less optimistic about the industry than last year, according to a new study from the Equipment Leasing and Finance Association, which published its annual 2024 forecast survey today.

This was the second consecutive year that ELFA’s study, “The What’s Hot/Not Report: Equipment Market Forecast,” recorded a negative downturn in results following 12 years of positive responses.

“The What’s Hot/Not Report identifies key factors driving the top ranking of construction equipment among ELFA members,” ELFA Chief Executive Leigh Lytle told Equipment Finance News. “Pent-up demand for highway, commercial and civil projects, and funding from the Inflation Reduction Act all contribute to the positive outlook for this market.”

The survey tracked 15 equipment markets based on responses from 130 lessors, asset-backed lenders, financial advisors and service providers throughout the U.S..84% of the respondents were lenders, 30% of which manage large portfolios; all added between $100 million and $500 million to their books in 2023. The survey was produced in partnership with researchers Alta Group.

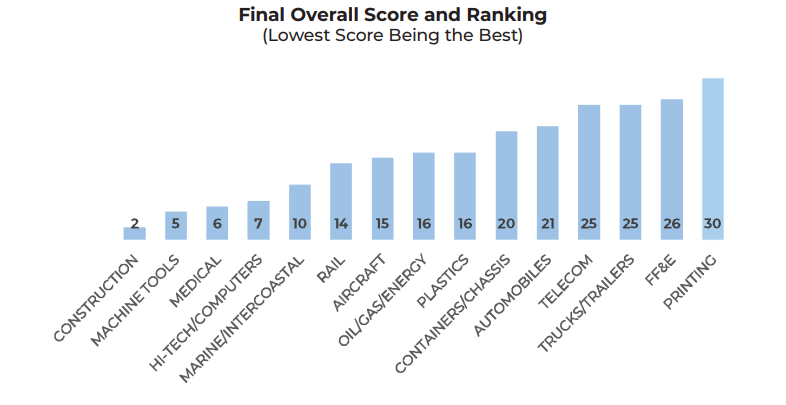

The markets ELFA examined for the survey were diverse, not all related to heavy equipment. The index tracks 15 equipment markets based on replies from equipment managers and consultants throughout the U.S. The ranking is with the goal of numerically quantifying the equipment finance industry’s confidence in the market. The survey tracks the amount of future financing volume and the best and least favorable equipment financing opportunities. ELFA’s index counts a score of 20 points or greater as a “strong preference” for adding equipment to lease portfolios.

In order of confidence ranking:

- Construction

- Machine Tools

- Medical

- Hi-tech/Computers

- Marine/Intercoastal

- Rail

- Aircraft

- Tie: Oil/Gas/Energy, Plastics

- Containers/Chassis

- Automobiles

- Tie: Trucks/Trailers, Telecom

- Furniture, Fixtures & Equipment

- Printing

Confidence in construction

The construction market received the top ranking by lenders with regard to terms of future financing volume and favorable equipment financing opportunities, ELFA reported. Its score of 81 was the highest of all 15 segments, surpassing machine tools by three points as the most solid industry for lender confidence.

Also fueling this trend is increased investment in nationwide infrastructure mandated by President Joe Biden’s bipartisan Infrastructure Investment and Jobs Act passed in November 2021.

“Increased demand from prospective homebuyers for new construction over pre-owned homes has also provided a lift to construction,” Lytle said. “It’s noteworthy that construction equipment has historically been favored among ELFA members: This year was the 11th consecutive year it was the top-ranked equipment type as the industry finds the rather ‘standard’ equipment designs, long useful lives, broad demand in domestic and global markets, and its large and ‘transparent’ secondary market attractive.”

Construction also saw an increase in net residual value sentiment, meaning the industry is confident in the value of assets as they reach the end of their lease terms of life cycle. The machine tools segment was the only other one with rising residual values.

Lenders feel conservative as residuals dip

Overall, the study found lenders feeling conservative and averse to risks as almost all equipment types – 12 of the 15 surveyed – recorded lower residuals.

“This illustrates the impact of the previously noted outlook and other major concerns, especially the weakening economy and rising interest rates, not to mention increasing equipment regulations, on residual value assumptions,” the report notes.

Values for heavy-duty construction were up 1.4% year over year in January, per data from analysts at Sandhills Global.

Some analysts think the worth of construction equipment might be over-inflated. In February, Sandhills’ Equipment Lease and Finance Manager Jim Ryan told EFN, “during the pandemic, some of those sky-high prices were not the norm, it was not what equipment was worth, it was completely overvalued.” Auction values of used equipment could fall before asking and retail prices drop concurrently, he added.

Chassis and containers face demand crush

The chassis and container segment ranked 10th in confidence this year, down two places from 2023. The industry continues to face very heavy demand and struggles to keep up, ELFA said.

Average new prices of shipping containers rose sharply, in the range of 45% to 130% in 2021 during the pandemic, also pushing shipping charges up as much as six times pre-pandemic levels that year. But ELFA and its lenders are optimistic a change is coming for the industry: In 2023, global new container sales dropped 48%, and prices fell 25%.

Trucking in trouble?

While construction is inspiring lender confidence, the heavy transportation industry is not.

ELFA recorded a drastic shift downward in the trucks and trailers market this year. The industry was ranked third in confidence last year, and finished 12th this year, marking the second-largest drop in the survey’s 34-year history, the trade group said.

“The trucks/trailers market has been volatile since the height of the pandemic, when transportation was white hot, few new trucks were available and used truck prices surged. Since that time supply chains have eased and we’ve seen a massive influx in inventory,” Lytle said.

“Lower demand and other factors, including the bankruptcy of a large trucking company last summer, have further increased inventories.”

She added: “The values we saw over the last couple of years were inflated, and now prices are back to ‘normal,’ and in some cases they are lower because there was a bit of a ‘bubble.’”

Heavy duty trucking stalls

Sales of new class 8 trucks sank 7% in 2023, while average used retail prices fell 36%, ELFA reported.

“There will be more used inventory this year as fleets receive higher volumes of new equipment and continue to retire trucks that they extended during the pandemic,” said Steve Oliver, vice president of business development at Fremont, Neb.-based trucking auctioneer Taylor and Martin. “Couple that with a pre-buy environment ahead of new emissions regulations and there will be more used tractors coming to market.”

Although orders for new trailers were up nearly 50% in 2020, they fell by 33% in 2023.

Tonnage is also lower. In 2023, tonnage was down 1.7% from 2022 levels and spot rates continued their trend of annual decline, down 19% in 2023. Contract rates were down also, falling 7% in 2023 and bucking a previous trend of upward momentum in the previous two years.

“The outlook remains challenging,” ELFA notes in the report. “The plunge of trucks/trailers is disturbing, falling from third place last year to 12th place this year, the second largest drop in popularity in the history of this survey.” The association further questioned if this could be seen as an “opportunity or a problem.”

Registration is now open for Equipment Finance Connect, the nation’s only dealer-centric equipment lending and leasing event, which will take place May 5-7 in Nashville. Learn about the event and free dealer registration at EquipmentFinanceConnect.com.