Inventory levels and values remain mixed across all segments of the construction market, according to new data from analytics firm Sandhills Global.

The subset of the used–construction market that experienced the greatest value change in the past month was heavy-duty equipment, especially excavators. Overall, inventory levels are decreasing in the sector, putting more pressure on values.

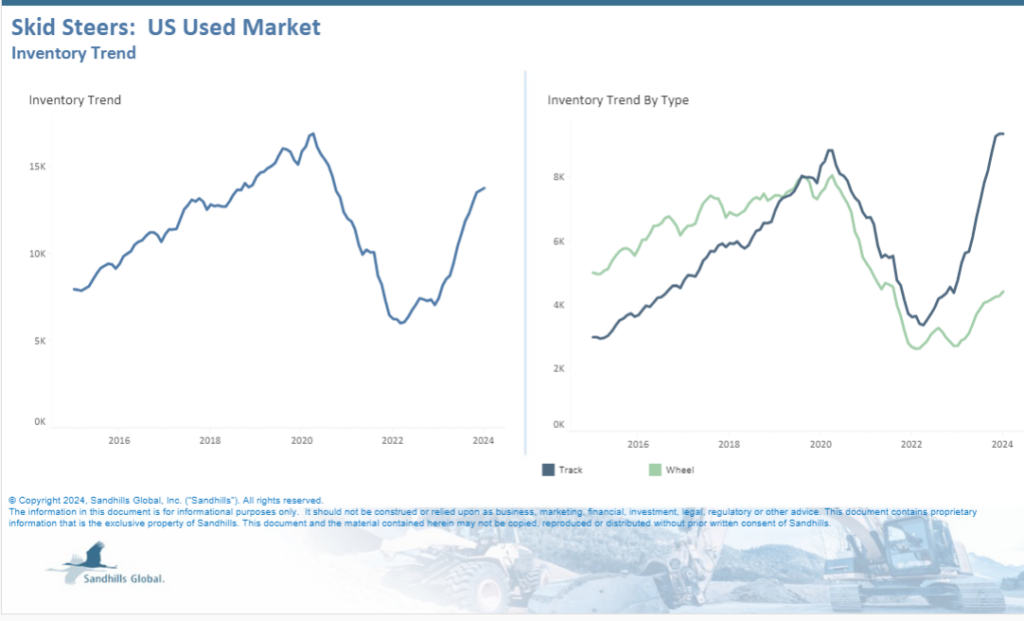

The mini excavator and track skid steer markets are seeing an “extreme boom” right now, Sandhills Equipment Lease and Finance Manager Jim Ryan told Equipment Finance News.

“You can see the inventory hike,” Ryan said. “Manufacturing has caught up on that. … On the construction side, medium-duty is very much affected by the rental fleets, and they’re finally getting new inventory in [so] they’re looking to liquidate a lot of their used assets on the rental side, so that has been the big [driver of] inventory increase.”

In addition to excavators, bulldozers, highway trucks and rock trucks are starting to record an increase in off-lease returns, Ryan said.

“Construction can be seasonal, you’re going to get a shot in the arm here on some pockets in the next few months as contractors are gearing up for summer jobs,” he said, adding that some of the equipment is expected to be new, but the majority will be lease returns and rental fleets.

Rate cuts could also prompt a shift in strategy for lenders and leave more opportunity for financing directly from dealers, John Boy, finance and sales administration manager for East Coast-based construction dealer Anderson Equipment, told EFN.

“Banks are looking toward the future of rate cuts, and I think that could reduce the number of banks with specific equipment finance programs,” Boy said. “This will enhance the importance of strong partnerships with our lenders and emphasize our need to continue to build new partnerships.”

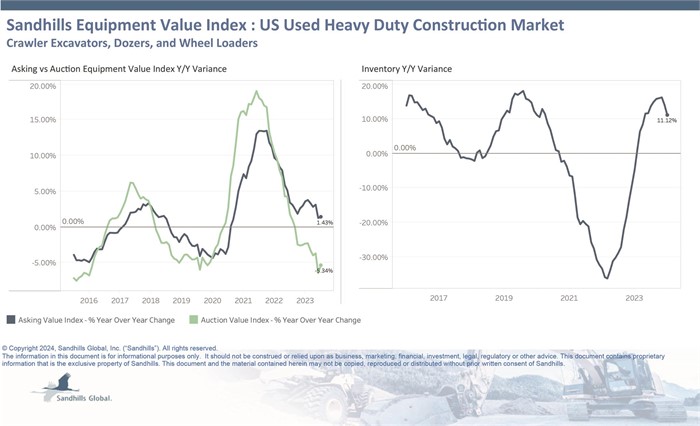

Heavy-duty inventory levels climb to double digits

- The U.S. used market saw inventory levels increase 11.1% year over year in January. Inventory is “trending sideways,” following a 2.2% month-over-month decrease, according to Sandhills.

- Asking values were up 1.4% YoY but auction values were down 5.3% annually.

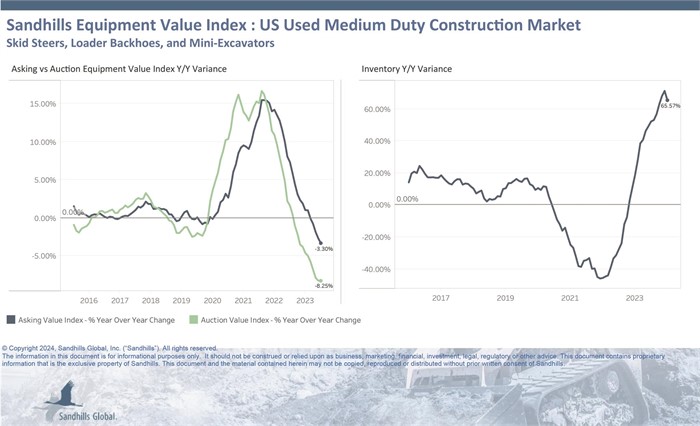

Medium-duty construction inventory more than doubles annually

- The sector saw a 65.6% YoY increase in inventory levels.

- Asking values for medium-duty equipment were down 3.3% YoY,

- Auction values were down 8.2%YoY, indicating a “downward pressure on prices,” according to Sandhills.

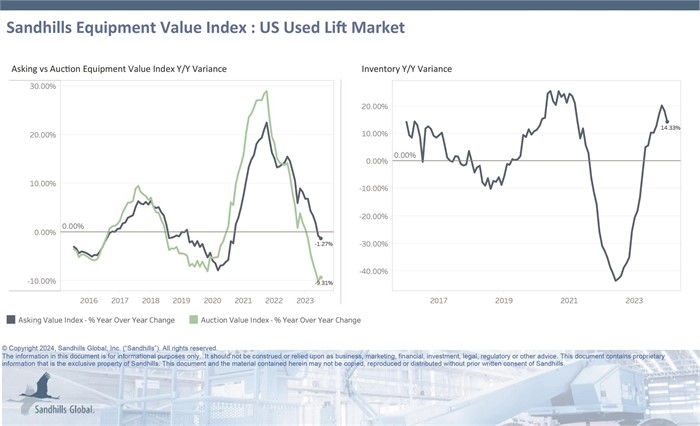

Used lift inventory levels also increase

- Inventory was up 14.3% YoY in January, with telehandlers spurring increases and putting pressure on values, according to Sandhills. Asking values of used lifts were down 1.3% YoY.

- Auction values were also down, 9.3% YoY.

Dealers react late to pricing

The disparity in asking values and auction values is in part because of dealers’ hesitancy to adjust pricing, Sandhills’ Ryan said.

“Dealers are typically always late to react on pricing, they’ll stick to their guns even as inventory levels rise until their hands are forced to drop those prices,” he said. “That’s why I always say in any industry, the auction market is really a barometer of where the industry is heading, because those asking values are going to be three to four months late to react to what’s truly happening in the market.”

Boy said he expects 2024 to be a busy year.

“We are hearing heavy workloads expected from all our customers across our entire footprint and across all industries – construction, forestry, and mining,” he said.

Anderson Equipment hasn’t struggled to secure inventory, Boy said.

“We had great success sourcing equipment throughout the pandemic from our manufacturers, which led to strong success during bizarre times,” he said, adding that he felt confident that if his manufacturers could meet demand during the pandemic, they’d always be able to.

Since the gap between auction and asking values is widening in the construction industry, Ryan expects dealers will begin to close it as they adjust pricing to better reflect the current worth of used equipment. Typically, Sandhills notices auction values fall first, then asking and retail, he said.

“During the pandemic, some of those sky-high prices were not the norm, it was not what equipment was worth, it was completely overvalued,” Ryan said.

While that caused some industries to suffer, the construction segment is “getting close” to pre-pandemic levels, he said. And as in the transportation industry, Ryan said the construction market has plenty of used inventory that needs to be “flushed out” for values to stabilize.

Registration is now open for Equipment Finance Connect, the nation’s only dealer-centric equipment lending and leasing event, which will take place May 5-7 in Nashville. Learn about the event and free dealer registration at EquipmentFinanceConnect.com.