Connecticut and Kansas are the most recent states to adopt disclosure laws as more states seek commercial financing regulations; the laws took effect July 1

Connecticut’s disclosure law applies only to sales-based financing of $250,000 or less, according to the statute, which also requires certain commercial financiers to register with the state.

Connecticut’s statute defines “sales-based financing” as:

“A transaction that is repaid by the recipient to the provider over time (A) as a percentage of sales or revenue, in which the payment amount may increase or decrease according to the volume of sales made or revenue received by the recipient, or (B) according to a fixed payment mechanism that provides for a reconciliation process that adjusts the payment to an amount that is a percentage of sales or revenue.”

Connecticut’s disclosure requirements do not apply to traditional loans or factoring, in contrast with California and New York, which adopted more comprehensive requirements.

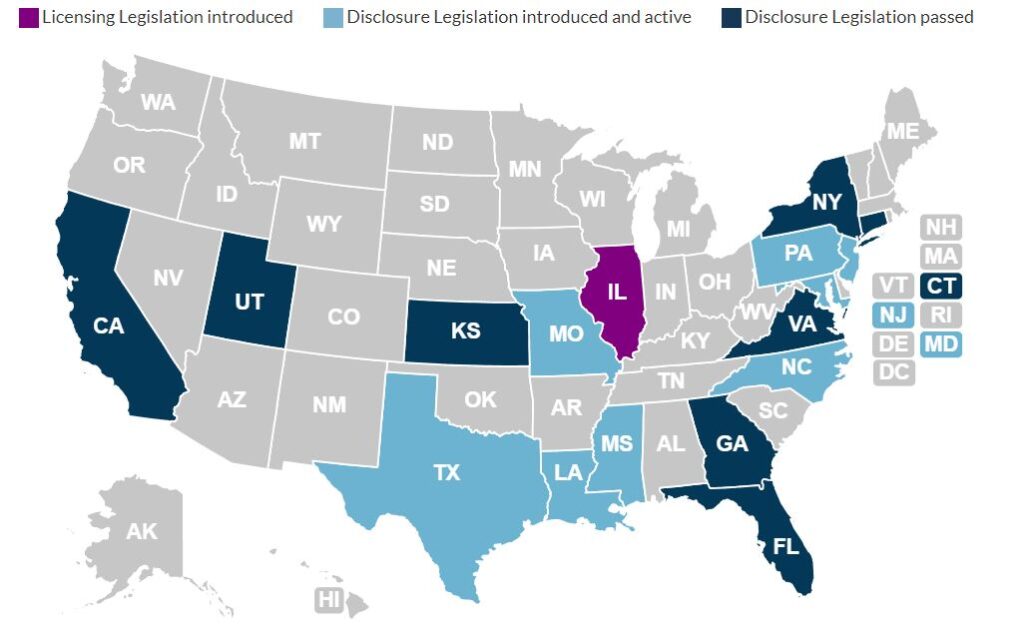

In total, eight states now have commercial finance disclosure laws in place, while another nine states have some form of legislation introduced, according to the Equipment Leasing and Finance Association. While each state developed similar disclosure laws, there are unique aspects to each state.

Meanwhile, the lack of uniformity in these commercial finance disclosure laws represents a challenge for equipment financiers, Mehul Madia, special counsel at Sheppard Mullin Richter and Hampton’s Washington office, told Equipment Finance News.

“Unfortunately, many of these commercial financing disclosure laws are not uniform, with each state covering different transactions or having different disclosure requirements,” he said. “Lenders should carefully review the laws in the states in which they operate to ensure their financing disclosures are compliant.”

Enforcement delayed

Commercial financiers will not face action for failing to provide adequate disclosures for specific offers of sales-based financing and requirements to pay off other commercial financing, or failing to obtain the recipient’s signatures until Sept. 30, according to guidance on the new law issued by the Connecticut Dept. of Banking on June 24 law.

Still, all other aspects of the law went into effect with required compliance on July 1.

Kansas laws

In addition, Kansas enacted its Commercial Financing Disclosure Act on April 12, which requires the disclosure of certain transaction information. Under the act, covered transactions include accounts receivable purchases, commercial loans and commercial credit plans equal to or less than $500,000.

According to the act, Kansas commercial financiers must disclose the following for covered transactions:

- The total amount of funds furnished;

- Total amount dispersed, if less than the amount furnished;

- Total amount borrowers will owe the provider in that agreement;

- Complete borrowing costs;

- the manner of each payment;

- Frequency of each payment; and

- Amount of each payment.

The statute only requires the completion of one disclosure form, even if any updates occur to the original agreement, according to a release by finance law firm Buckley.

“Providers will not be required to issue a new disclosure with every purchase of accounts receivable under the agreement,” the firm said. “Moreover, brokers of such transactions are prohibited from collecting an advance fee from a business, making any false representations, or omitting any material facts during the sale of the services.”

Equipment Finance News’ Lender Directory lists banks, captives and independent lenders. Each listing includes the sectors served, regions covered and more categories, allowing users to filter and search the right lender to meet their needs. Users are invited to add and update their own company information to the directory to provide dealers with the most up-to-date information available. Visit the Equipment Finance News Lender Directory here.