Inventory levels in all segments of the construction industry continued to climb in March, further pressuring values.

March data from Sandhills Global indicates the industry still has an oversupply issue that is likely to persist, equipment lease and finance manager Jim Ryan told Equipment Finance News this week.

“New home building is slowing down a little bit because of interest rates,” Ryan said, adding that lowers demand for equipment, especially in medium-duty construction and telehandlers.

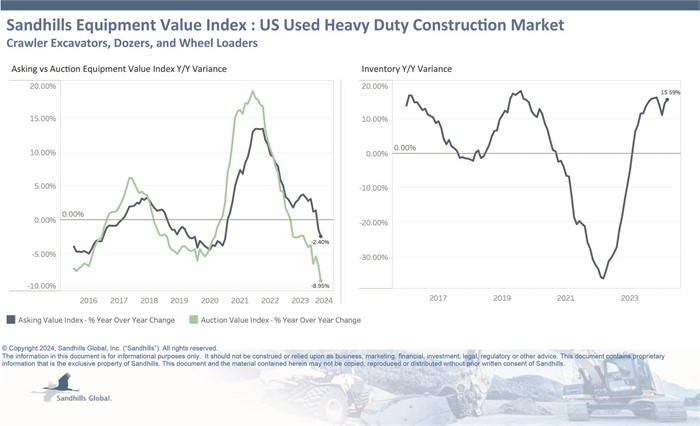

Used heavy-duty construction equipment

- Inventory rose 15.6% year over year in March;

- Asking values decreased 2.4% YoY; and

- Auction values dropped 9% YoY in March and decreased 2.4% month over month.

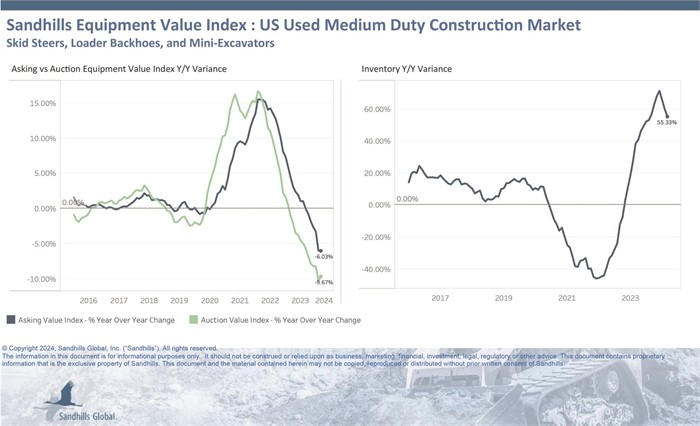

Used medium-duty

- Used equipment saw the largest rise of inventory YoY in the construction category this month, up 55.3%, “indicating a significant accumulation of stock,” Sandhills reported;

- Skid steers and mini excavators saw the largest shift in inventory and values;

- Asking values decreased 6% YoY; and

- Auction values were down 9.7% YoY.

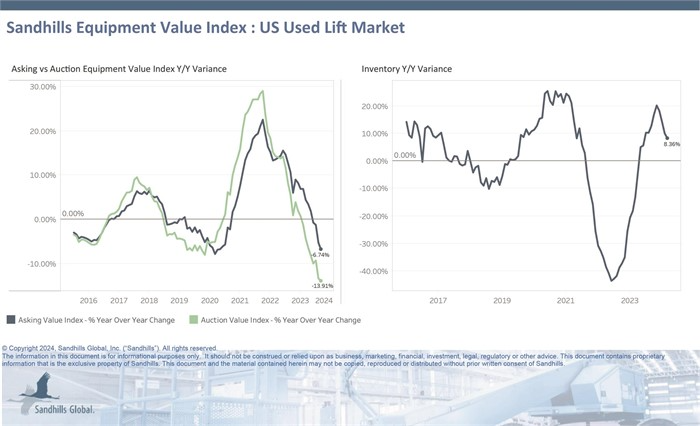

Telehandlers

- Used lift inventory was up 8.4% YoY in March, and the category is “exhibiting an upward trend, driven largely by increases in telehandler inventory,” Sandhills reported;

- Asking values dropped 6.7% YoY and continue to trend downward;

- Auction values continued to fall, dropping 13.9% YoY; and

- Inventory and value metrics for this segment indicate growing supply, but waning demand and value.

Demand for construction projects expected to continue

Ryan said that demand for “big commercial jobs,” including projects like roads and bridges, won’t slow, which could increase demand for some of the industry’s aging inventory.

Some areas of the country may still see an uptick in homebuilding but Ryan said the main driver for use of medium- and heavy-duty construction equipment will be infrastructure in the near future.

Lenders remain confident in the construction industry despite the inventory surplus, according to a lender survey published March 12 by the Equipment Leasing and Finance Association.

An increase in medium-duty construction equipment inventory is also finally hitting the market, Ryan said.

“Rental fleets that were waiting on equipment didn’t get their allotment last year, and you’re starting to see some of that backlog on the OEM side start hitting these rental fleets,” Ryan said. “It’s finally caught up on that side and you’re seeing some of the influx of new [equipment], which does nothing but create an influx of used [equipment].”

Register for the 2024 Equipment Finance Connect, which focuses on best practices in equipment finance, on May 5-7 in Nashville, Tenn. Learn about the event and free dealer registration at EquipmentFinanceConnect.com.