Inventory levels of used farm equipment continue to rise, up 45.3% year over year, according to the January report from Sandhills Global.

Values of used equipment and used combines were up YoY, while the values of used compact and utility tractors were down slightly.

Manufacturers’ strategy of pushing new purchases is the main reason for the inventory increase, Sandhills’ Equipment Lease and Finance Manager Jim Ryan told Equipment Finance News.

“What you’re seeing on the agriculture side is with this used inventory, especially late model inventory, these OEMs are [putting] a lot of pressure on the dealers to offer incentive-based financing and really low-interest rates to incentivize these buyers to buy new,” Ryan said.

That “leaves a lot of late-model inventory sitting on these dealer lots. … Manufacturers really put the market in a tough spot and dealer lots are getting fuller and fuller by the month,” he said.

For manufacturers, though, more inventory just means more to sell.

“Within used inventory in North America, we’ve seen year– over– year increases in both combines and tractors, most notably in the high horsepower tractor segment,” John Deere Director of Investor Relations Josh Beal said during the company’s first-quarter 2024 earnings call on Feb. 15.

“While levels are up from recent lows, they’re still in line with historical averages. Additionally, used prices have remained flat over the quarter. All in, we continue to feel comfortable with the U.S. inventory levels that we’re seeing.,”

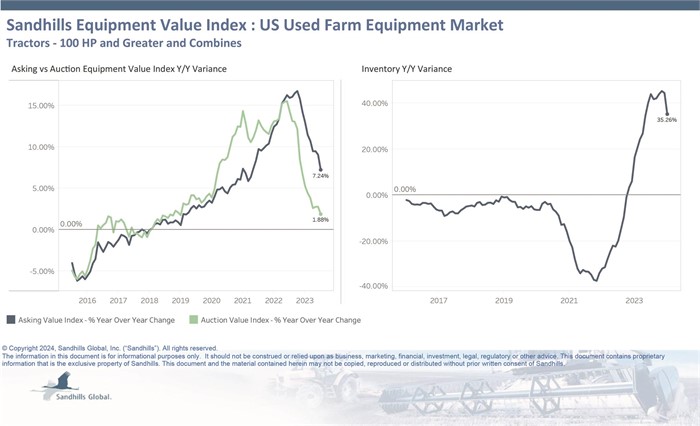

Used farm equipment

- Inventory levels have been on the rise for several months, increasing 35.3% YoY.

- Values have increased minimally compared with this time last year. Sandhills’ report found “pronounced growth in late-model farm equipment availability” as new equipment hits the market.

- New, higher horsepower (300 HP and greater) tractors and combines are pushing the overall value of farm equipment up, but individual assets are seeing lower asking and auction values YoY, according to Sandhills.

- Asking values rose 7.2% YoY and are trending up.

- Auction values increased 1.9% YoY and are trending up.

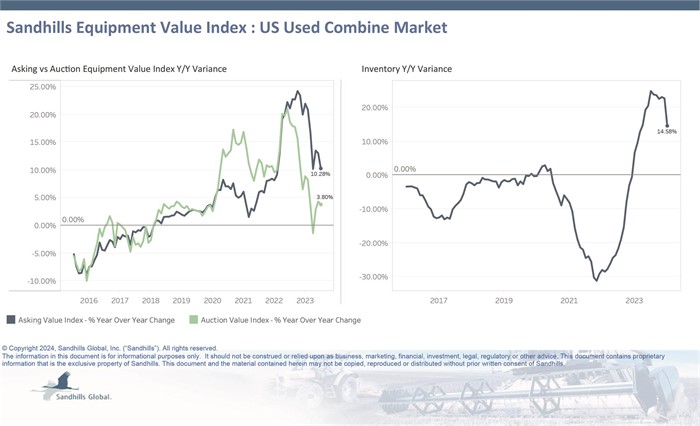

Used combines

- Inventory levels were up 14.6% YoY.

- Asking values increased 10.3% YoY and are trending up, according to Sandhills.

- New combines boosted overall equipment values, much like higher-powered horsepower tractors, Sandhills reported.

- Auction values were up 3.8% YoY and are trending upward.

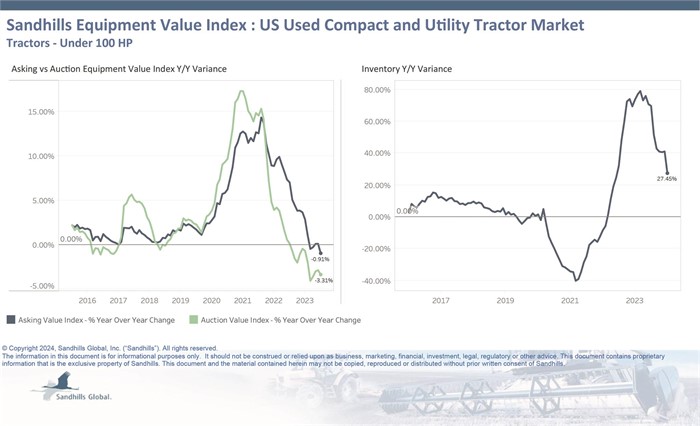

Used compact, utility tractor inventories

- Inventory levels were 27.4% higher YoY in January, according to Sandhills, which noted that it expects to see “similar elevated inventory trends” in upcoming months.

- Asking values were down 0.9% YoY.

- Auction values were also down, falling 3.3% YoY.

Values keep rising

Overall, values are trending up but Ryan said that Sandhills’ data has to catch up to determine why. Inventory levels weren’t as high six months ago and agriculture was “the last of the industries to really catch itself up to where the numbers were … holding strong as inventory was picking up — until inventory became pretty darn abundant,” he said.

Values are expected to catch up “real quick,” Ryan said, since agriculture is a seasonal market, and values should catch up to inventory trends by summer.

There’s a glut of newer equipment coming into the market, and the new to 5-year age group saw a “massive jump” this year, he said, making the influx a “key retail driver in auction right now.”

Utility compact tractors and combines are seeing the most depreciation, he said.

“There’s just such an abundance of those types of tractors right now, the values are really being affected,” he said. The combine market is facing difficulties as inventory continues to rise alongside falling values.

A backlog in manufacturing is mainly to blame, Ryan said.

“Agriculture seems to be one of the last to catch up as far as the manufacturing side and getting new inventory out there goes,” Ryan said. “All this new inventory is finally moving into the market, and you’ll see all these incentivized deals with lower interest rates,” which puts dealers in a difficult spot as they work to sell new inventory and flush out older equipment.

The U.S. Department of Agriculture’s Farm Income Forecast recently estimated farmer profits will be down for the next two years at least, and that will likely prompt used equipment prices to take a hit, Ryan said.

“I still think you’re going to see the new market thrive because there’s too many incentivized deals out there not to buy new,” he said.

With the projection that commodity prices remain low in the near future, “dealers are going to look to be aggressive and get off some of that floorplan,” which will have a big impact on used equipment pricing, Ryan said.

Registration is now open for Equipment Finance Connect, the nation’s only dealer-centric equipment lending and leasing event, which will take place May 5-7 in Nashville. Learn about the event and free dealer registration at EquipmentFinanceConnect.com.