Agricultural equipment inventory continues to build, further widening the gap between retail and auction values.

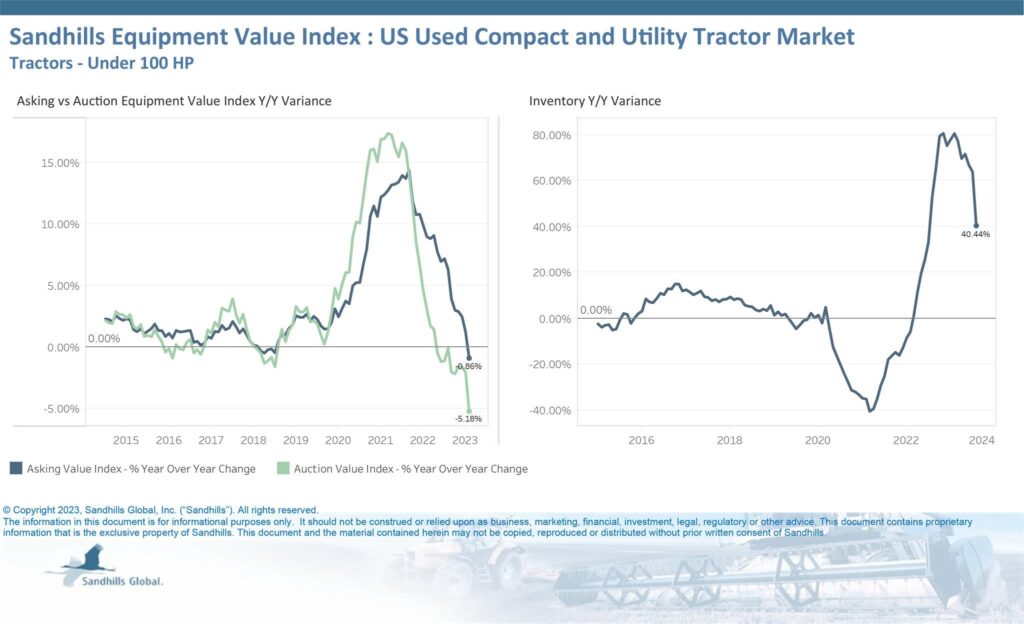

Used compact and utility tractors’ retail values increased 0.2% month over month but declined 0.9% year over year, while auction values declined 1.1% MoM and 5.2% YoY in August as retail values continued to trail auction values following pandemic highs, according to Sandhills Global market data.

Inventory for compact and utility tractors, defined as any tractors under 100 horsepower, increased 3.1% MoM and 40.4% YoY in August and continues to trend upward, with more 2020, 2021 and newer models coming to auction, according to Sandhills.

“On the tractor side, we were in a low, and anybody who deals with the ag side saw how the shortage of manufacturing really affected the inventory numbers during the pandemic and post-pandemic,” Jim Ryan, equipment lease and finance manager at Sandhills Global, said during a company presentation Sept. 12.

“Compacts and utility trackers [have seen] a huge jump in inventory,” he said. “As the new stuff comes out, you’re seeing those 2020 and 2021 model years increase as well.”

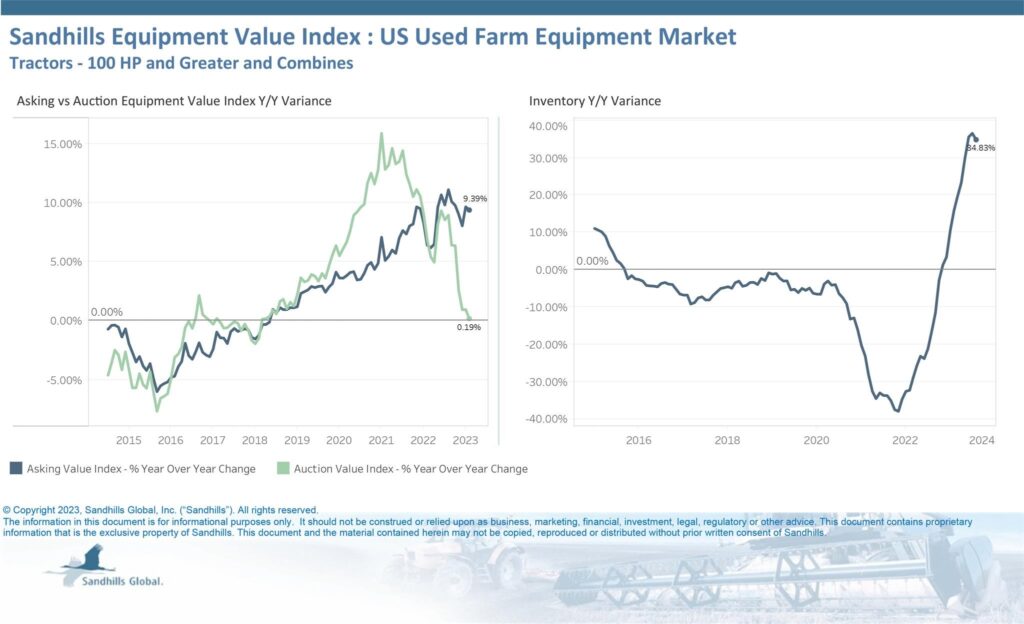

Farm equipment asking values increased 0.7% MoM and 9.4% YoY, while auction values increased 0.2% MoM and 0.2% YoY in August, according to Sandhills. Inventory for farm equipment, which includes tractors over 100 horsepower and combines, increased by 0.7% MoM but increased by 34.8% YoY, despite a drop in used combine inventory.

One key factor that affects the combine market, and the entire agricultural equipment market, is the location of the equipment auction, Ryan said.

“If you’re on the ag side, a combine here in the Midwest is going to have a different value than if you’re on the West Coast or you’re on the East Coast,” he said.

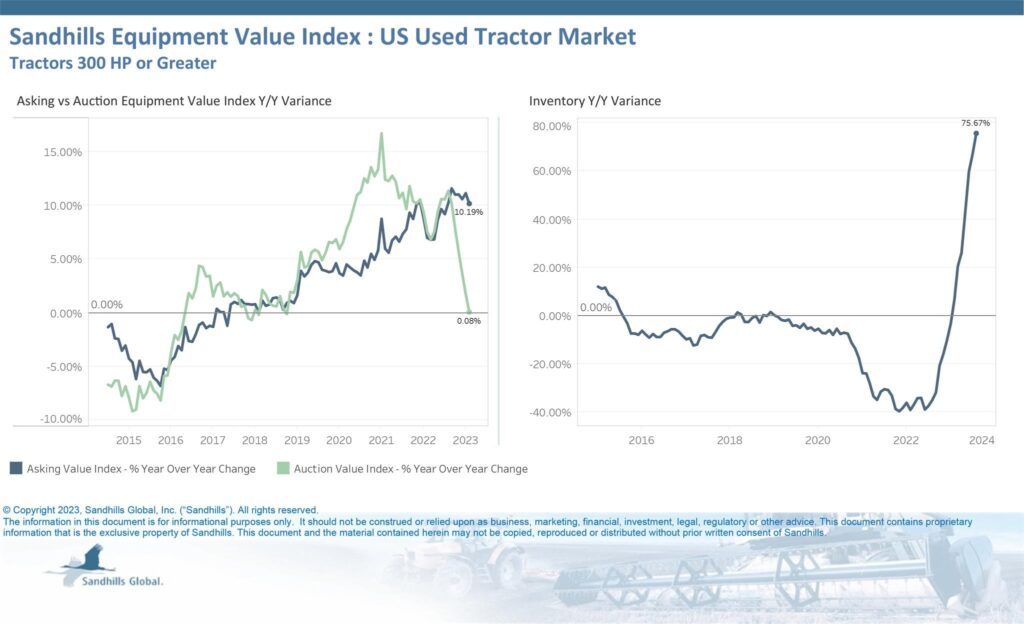

High-powered jump for high-horsepower tractors

Retail values for high-horsepower tractors, which Sandhills defines as tractors over 300 horsepower, rose 0.9% MoM and 10.2% YoY, while auction values rose 0.4% MoM and 0.1% YoY in August, according to Sandhills. Inventory for high-horsepower tractors increased 8.1% MoM and 75.7% YoY and continues to trend upward as 2022 units hit the auction market.

“We’ve seen the big jump in the 300-horsepower tractors as well,” Ryan said. “We’ve seen several months of increases on the high-horsepower tractors. We’re up a little over 8% just in August alone, and a lot of this acceleration is from the 2022 models. The two biggest inventory trends we’re seeing on the tractor side are compact utility tractors and high 300-horsepower-plus tractors.”