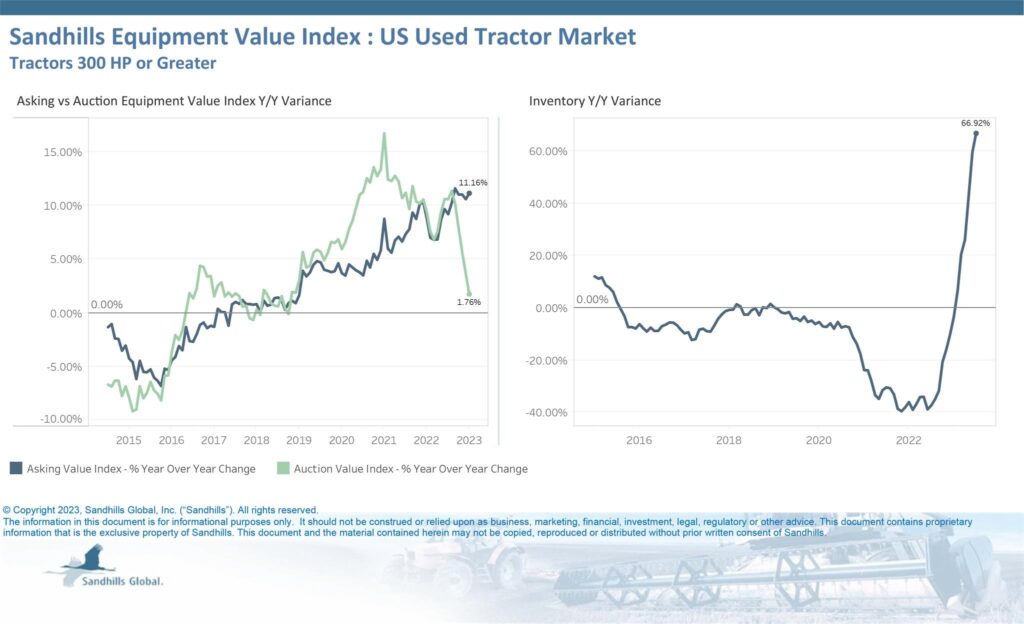

Auction and retail values for tractors with high horsepower increased year over year in July despite increased inventory.

Retail values, also known as “asking values,” for high-horsepower tractors rose 1% month over month and 11.2% YoY, according to Sandhills Global. Meanwhile, auction values declined 0.9% MoM but rose 1.8% YoY in July, widening the gap between the two values.

Sale listings for used high-horsepower tractors, which Sandhills defines as tractors over 300 horsepower, totaled $1.4 billion, up 7.7% MoM, according to Sandhills Global data provided to Equipment Finance News. Inventory for high-horsepower tractors trended upward, increasing 7.7% MoM and 66.9% YoY in July.

As inventory builds on dealer lots, the difference between auction values and retail prices is widening, Jim Ryan, equipment lease and finance manager at Sandhills Global, told EFN.

“For the high-horsepower tractors, the discrepancy between retail numbers and auction numbers continues to widen, and dealers are typically three to four months late to change their retail price based off of what the market’s doing,” Ryan said. “It’s always hard for a dealer to see $10 million on their lot and a month or two later, it’s worth $9 million. … There are changes going on as inventory levels are increasing.”

Lease returns on high-horsepower tractors are also typically higher in July, which contributes to rising inventories and value fluctuations, Ryan said.

“The linchpin in this whole deal is those high-horsepower tractors were hard to come by at the beginning part of this year when inventory levels were low,” he said. In July, “there were a lot of lease returns, so the higher-horsepower tractors became more readily available,” Ryan added.

Inventory exceeds pre-pandemic levels

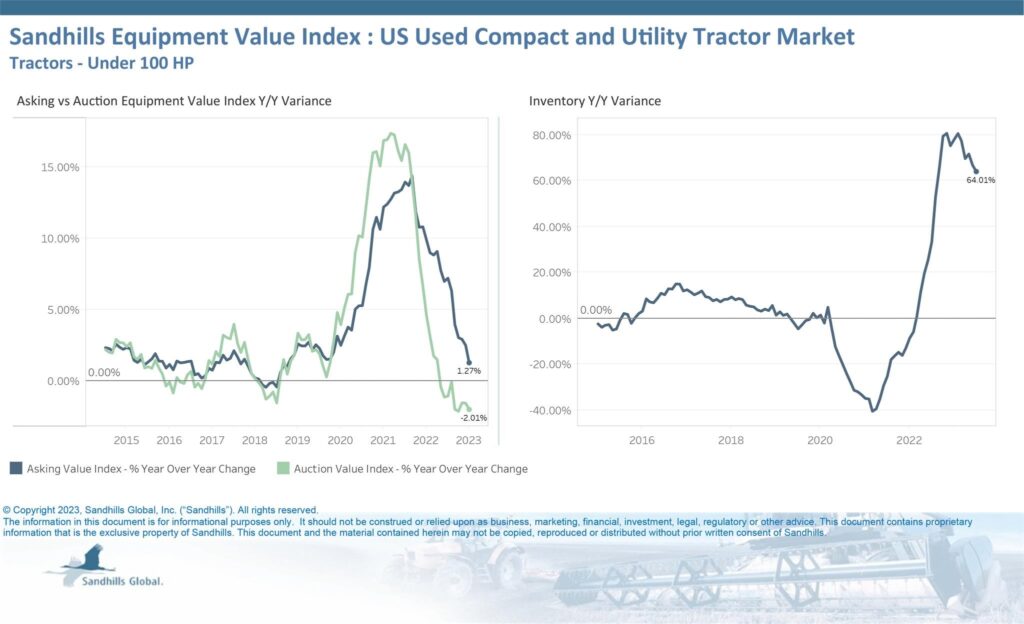

For used compact and utility tractors, or tractors under 100 horsepower, asking values declined 0.8% MoM but rose 1.3% YoY, while auction values declined 1% MoM and 2% YoY in July and continue to trend down as inventory reaches pre-pandemic levels, according to Sandhills. Inventory for compact and utility tractors increased 4.6% MoM and 64% YoY in July.

Sales listings for used compact and utility tractors totaled $309.1 million, up 4% MoM, according to data provided by Sandhills.

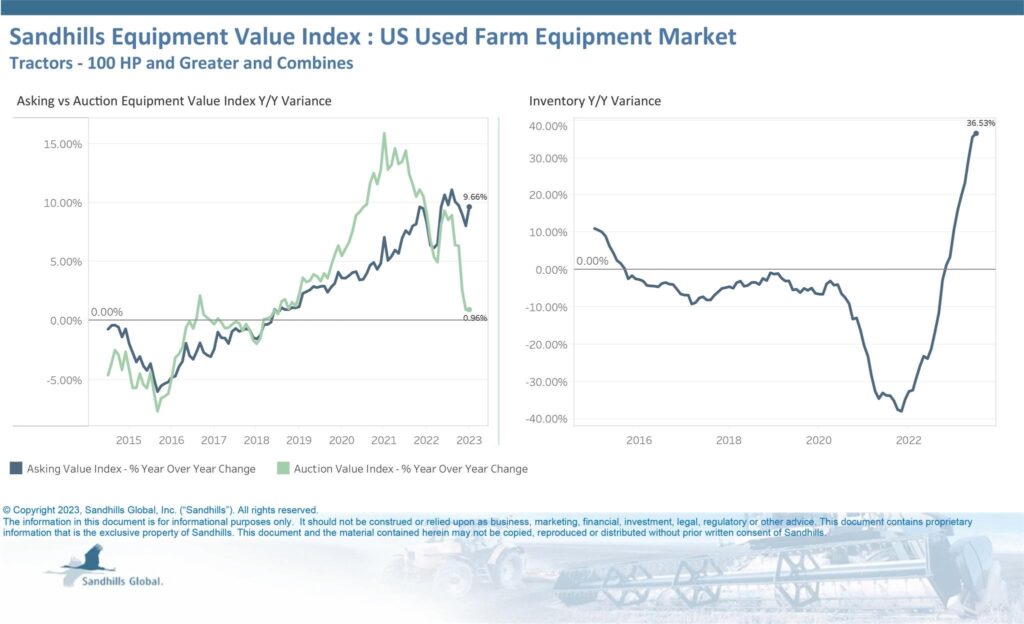

Farm equipment values rise 9.7% YoY

Asking values for farm equipment — the combination of tractors with 100 horsepower or greater and combines — rose 1.5% MoM and 9.7% YoY, according to Sandhills. Auction values inched up less than 0.1% MoM and 1% YoY in July, with asking values trending up and auction values trending down.

Inventory for farm equipment inched down less than 0.1% MoM but increased 36.5% YoY in July. Sale listings for farm equipment totaled $2.4 billion, led by John Deere’s $1.1 billion in used-combine listings.

“Trends have stayed pretty much the same on the farm side,” Ryan said. “The tractor inventory levels are recovering after the pandemic.”