Farm equipment industry faces prolonged downturn

First quarter farm tractor sales declined 13% YoY

Farmers continue to feel the impact of higher interest rates, lower commodity prices and rising costs, putting pressure on the equipment industry, with the downturn potentially lasting until next year.

Higher interest rates continue to put a damper on agricultural equipment customers’ sentiment, Josh Arnall, finance and insurance manager at 20 retail equipment dealerships for IH Case, New Holland, and Kubota in Western Kentucky, Tennessee, Mississippi, Northern Alabama, Southern Illinois, and Southern Indiana at H&R Agri-Power, told Equipment Finance News.

“Customer sentiment regarding equipment purchases is relatively low compared to prior years,” Arnall said. “Interest rates are still high enough to further suppress purchasing desires.”

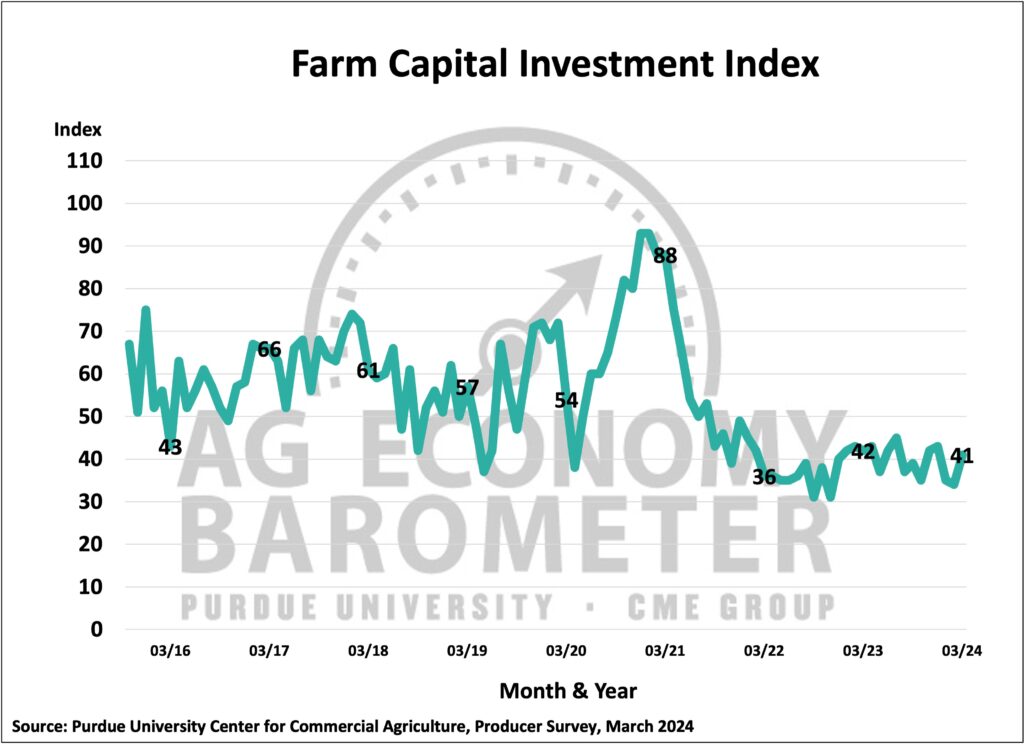

The Farm Capital Investment Index finished at 41 in March, down one point year over year, according to the Center for Commercial Agriculture at Purdue University. A neutral reading on the index is 55, with values below that representing unfavorable sentiment toward capital investment.

Farmers reducing their capital spending means fewer equipment sales for dealers and less financing, whether it be for equipment or land, for lenders, dragging the market closer to a standstill.

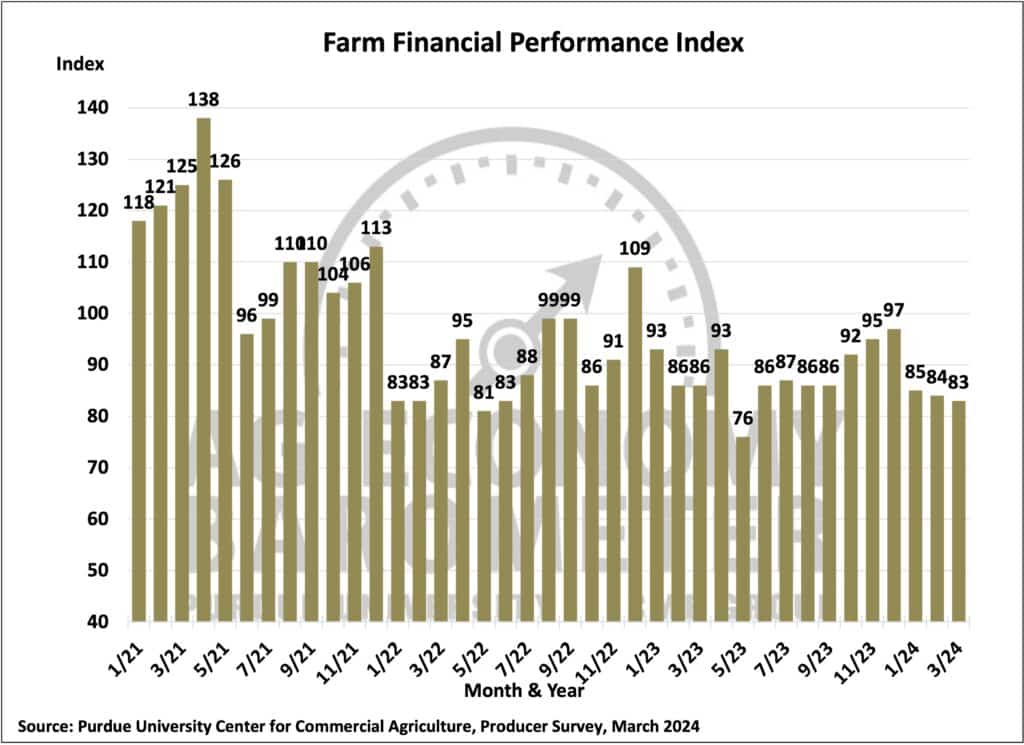

The Farm Financial Performance Index, on the other hand, measures farmer sentiment toward farm earnings and expenses; it fell to 83, down from 86 last March, according to the Purdue Ag Center. This index has declined every month in the first quarter 2024, as farmers have continued to make less money and further limit their capital expenditures.

Commodity concerns

Falling commodity prices are expected to depress farmer income over the next two years. In fact, net farm income is forecast to fall 25.5% YoY in 2024 to $116.1 billion, according to the U.S. Department of Agriculture.

Low commodity prices present a key concern for farmers as the lower prices limit net farm income following volatile pricing conditions during the pandemic, H&R Agri-Power’s Arnall said.

“With current grain prices, customers can’t pencil a break-even projection,” he said.

Commodity prices hit their lowest point in more than 15 years during the pandemic, according to the Federal Reserve’s Global Price Index of All Commodities. The index bottomed at 85 in April 2020 before spiking to a record index value of 241.9 in August 2022. Today, commodity prices sit in the middle of the index at 160.4 as of April 17, but inflation and higher interest rates are limiting the upside.

Should commodity prices remain at current levels or fall further, farmer incomes will drop sharply and continue to make it difficult for them to break even, increasing the risk of default.

As farm profits continue to dip, farm equipment dealers and lenders lose customers and further share the burden of the economic slowdown, especially with farmers looking to cut costs.

Unprecedented lows on horizon

Commodity prices could hit unprecedented lows this summer, which would force some operations to find ways out from under their equipment, Jim Ryan, equipment lease and finance manager for Sandhills Global, told EFN.

Commodity prices are “going to hit record lows or close to record lows at some point during the summer harvest this year,” he said. “That’s going to end and you’re going to see, unfortunately, some companies and some farmers possibly just get out of [the equipment], and those situations do nothing but increase inventory levels as well.”

As farmers try to sell more expensive units, the higher-priced inventory loads up the auction market with nowhere to go, Ryan Dolezal, sales manager of Sandhills Global-owned auction site TractorHouse, told EFN.

“There’s too much inventory out there … and now with commodities being down and interest rates being so high that a second buyer isn’t there for that like-new machine. … They can’t afford that trade up into that asset, so those assets are hitting our website at a very high clip.” — Ryan Dolezal, sales manager, TractorHouse

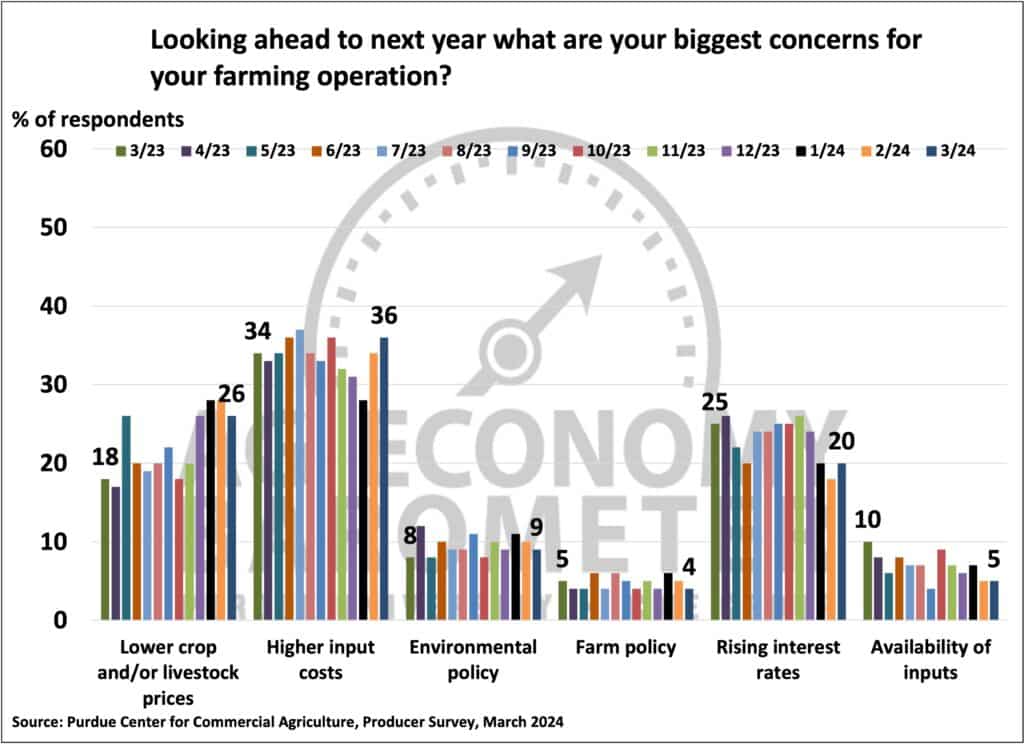

The combination of higher input costs — which include fertilizer, seed, energy and some machinery — and interest rates in addition to lower commodity and livestock prices present a compounding issue for farm financials, Michael Langemeier, professor of agricultural economics and associate director at the Purdue ag center, told EFN.

It’s not all doom and gloom though, Langemeier said.

“There’s also some confidence perhaps that input costs may not be quite as high down the road as they are today,” he said. “Input cost is still a big concern today, but certainly, they’re expecting a little bit of relief from higher input costs in a year or two.”

Farmer interest rate sensitivity

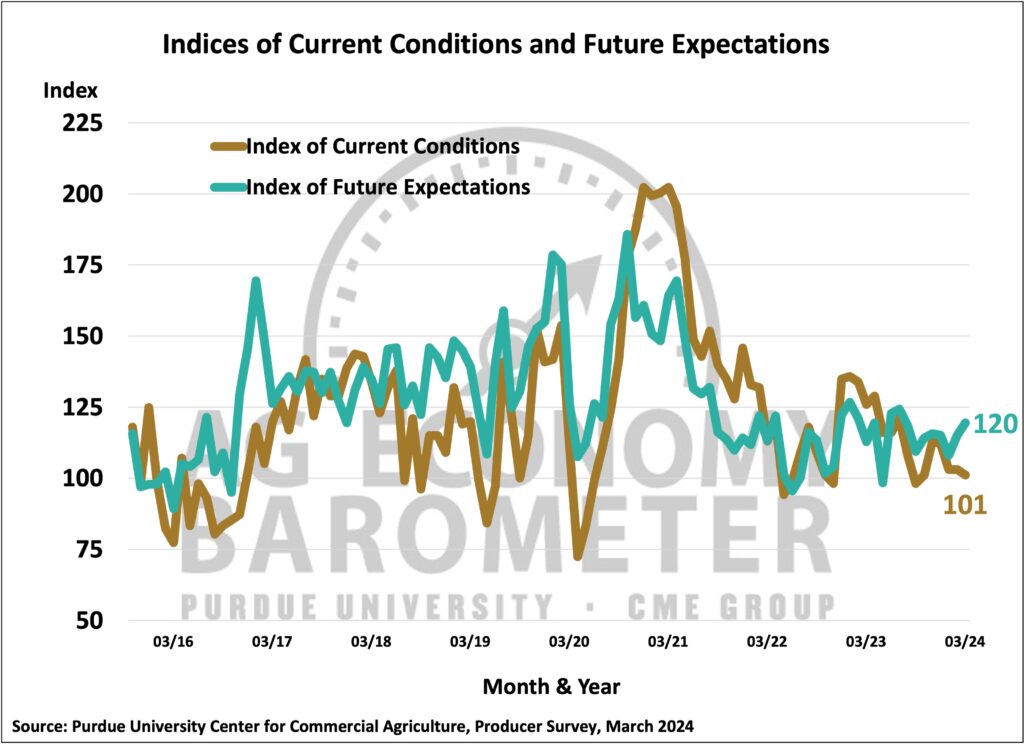

Still, some farmers’ outlook toward future interest rates and farm financial conditions improved in March.

The expectations of future conditions reached an index value of 120 in March, while current conditions reached an index value of 101 in March, according to the Center for Commercial Agriculture at Purdue.

“Producers’ expectations for interest rates have shifted, which could help explain why producers look for financial conditions to improve,” according to a Purdue University Center for Commercial Agriculture release. “This month, 48% of respondents said they look for the U.S. prime interest rate to decline over the next year. That’s up from 35% of farmers who said they expect rates to decline the last time this question was posed in December 2023.”

The farmer and producer expectation of interest rates also plays a key role in financing issues in the equipment industry, H&R Agri-Power’s Arnall said.

“The difficulty hasn’t necessarily been securing financing for customers, but rather customers agreeing to the financing available given higher rates and lower projected farm income.” —Josh Arnall, F&I manager, H&R Agri-Power

“Deciding lender partners depends on subsidized programming capabilities, rates, credit parameters, ease of doing business … the overall value proposition to us as the dealer that we can clearly communicate to the customer,” Arnall said.

H&R Agri-Power’s lending partners include CNH Capital, Kubota Credit, DLL, AgDirect, Wells Fargo, Farm Credit Express, Diversified Financial Services, Sheffield, Terrace Finance and Northland Capital, he added.

Ag market improvement sluggish

As the ag market comes down from pandemic-era highs, moderation is expected to continue, with used inventory concerns persisting into 2025, according to a William Blair research note on monthly farm data for March.

“Moving through the first quarter of 2024, ag markets continue to moderate after several strong years, with more uncertainty on the outlook for commodity prices, which have retreated significantly from the highs,” according to the research note. “Interestingly, it seems that longer lead times have rapidly reduced with improvements in production at OEM plants, even for categories that were hard to source.”

Demand for farm equipment signaled weakness in Q1, with sales of tractors and combines down double-digits for the quarter following lower March sales, according to the Association of Equipment Manufacturers (AEM).

Total farm tractor sales, which include two-wheel drive and four-wheel drive units, landed at 42,824 units in Q1, down 13.3% year over year, according to AEM. Self-prop combine sales totaled 1,203 units, down 20.4% YoY. For March, total farm tractor sales were 18,917 units, down 12.1% YoY, and self-prop combine sales finished at 389 units, down 23.3% YoY.

Concerns in the farm equipment sector could extend into 2025, according to William Blair.

“With order coverage in tractors helping to blunt the slowdown in 2024, clearly the outlook into 2025 continues to look more like another down or flattish year, pending any weather events in North or South America,” the research note said.

Registration is now open for Equipment Finance Connect, the nation’s only dealer-centric equipment lending and leasing event, which will take place May 5-7 in Nashville, Tenn. Learn about the event and free dealer registration at EquipmentFinanceConnect.com.