Agricultural equipment values and inventory held steady in December as farmers bought more equipment at the end of the year in line with normal seasonal purchasing trends.

The overall farm and agriculture equipment market showed stability with an uptick in inventory and a slight dip in values, Jim Ryan, equipment lease and finance manager at Sandhills Global, told Equipment Finance News.

Combine harvester inventory, for example, grew 3.7% month over month in December.

“The largest rise in the farm equipment sector was in combines, which is typical at yearend , but not to these types of levels,” Ryan said, noting that farm equipment asking values and auction values “were down a little bit but holding steady.”

Farmers historically purchase more equipment at yearend to reduce cash on hand to avoid higher taxes and take advantage of bonus depreciation, a tax incentive that allows a business to immediately deduct a large percentage of the purchase price of eligible assets, such as machinery, to reduce income tax.

Inventory to continue growing

The boost in farm equipment sales provided some relief to a growing inventory glut for the market, but supply is expected to continue building in the next six to nine months, Ryan said.

“We’re going to see an abundance of farm equipment start hitting the market again,” he said. “It’s going to go back to the supply and demand [issue we’ve seen] in the transportation sector.”

Potential weather conditions across the country, especially in the Northeast, could also affect the forestry equipment market, Northeastern equipment dealer Anderson Equipment‘s Finance and Sales Administration Manager John Boy told EFN.

“Weather’s a huge factor,” he said. “You want [the ground] frozen because you can get machines through frozen ground, you can’t get machines through mud.”

Weather can also delay the planting season , which disrupts the entire agricultural cycle and creates economic hardships for farmers.

Farm equipment values inch down

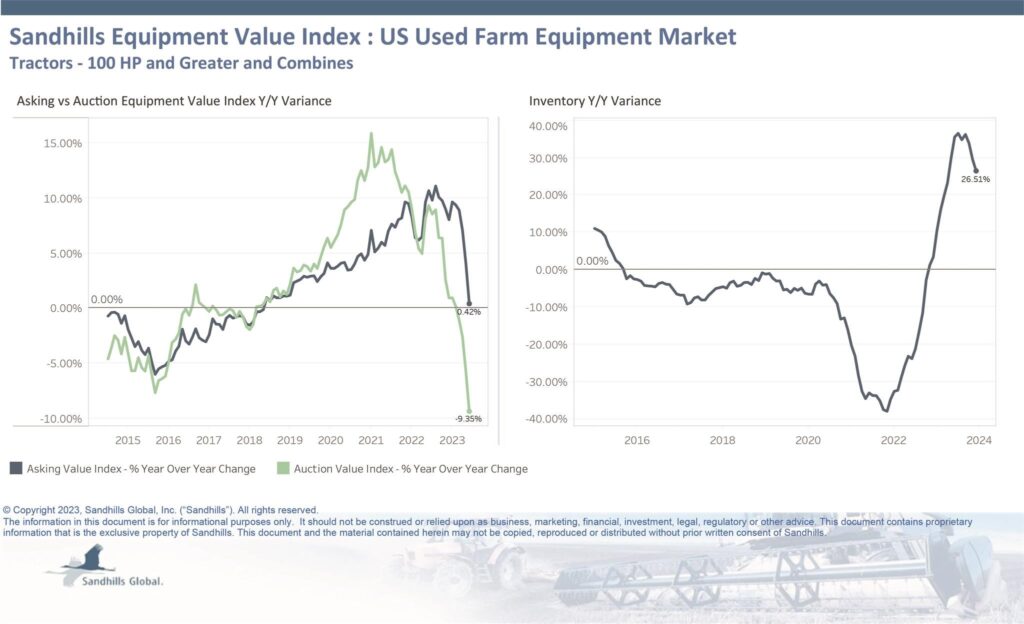

Declining farm equipment values and rising inventory levels in December signal a supply surplus, according to Sandhills Global market data:

- Retail or asking values for farm equipment fell 1.1% month over month but increased 0.4% year over year;

- Auction values for farm equipment declined 1.2% MoM and 9.4% YoY;

- Farm equipment inventory rose 1.1% MoM and 26.5% YoY, with combines leading the charge.

Compact and utility tractor inventories jump

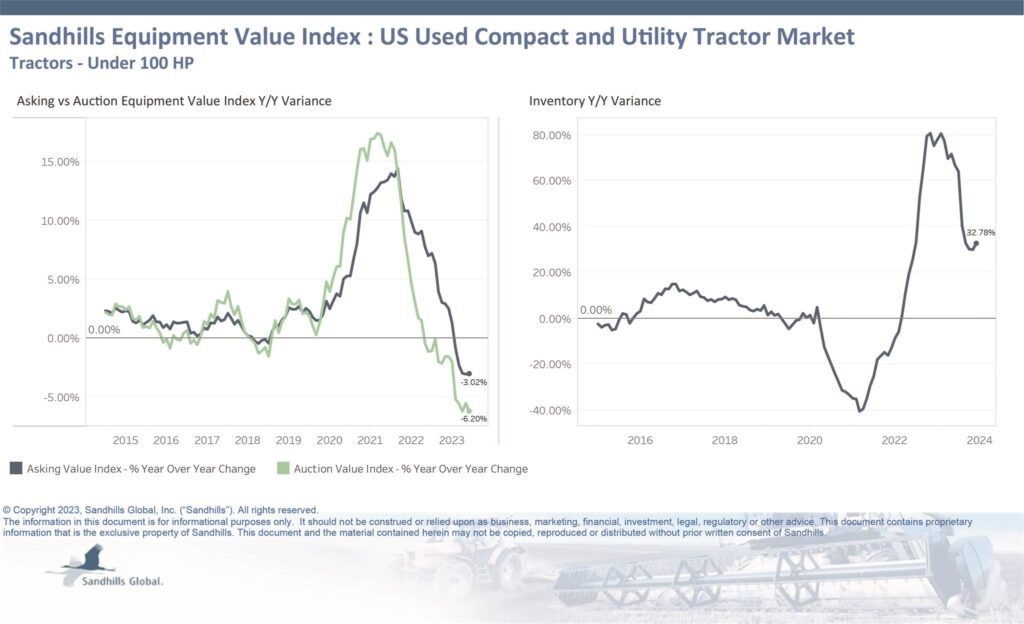

Compact and utility tractor values and inventory continued to trend downward and upward, respectively, with the market slowly turning more favorable for buyers:

- Used compact and utility tractor retail values dipped 0.1% MoM and 3% YoY;

- Compact and utility tractor auction values inched down 1% MoM and 6.2% YoY; and

- Compact and utility tractor inventory rose 1.9% MoM and 32.8% YoY.

“Asking and auction values remained steady from where it was in November and October, and you’re continuously seeing an uptick in inventory on the compact utility side,” Ryan said. “[With] high-horsepower tractors and the combines, you’re going to get to a point here in the next six to nine months where it’s not going to be favorable for sellers.”