Confidence in the equipment finance industry declined for the second consecutive month amid inflationary pressures and a slowdown in business activity.

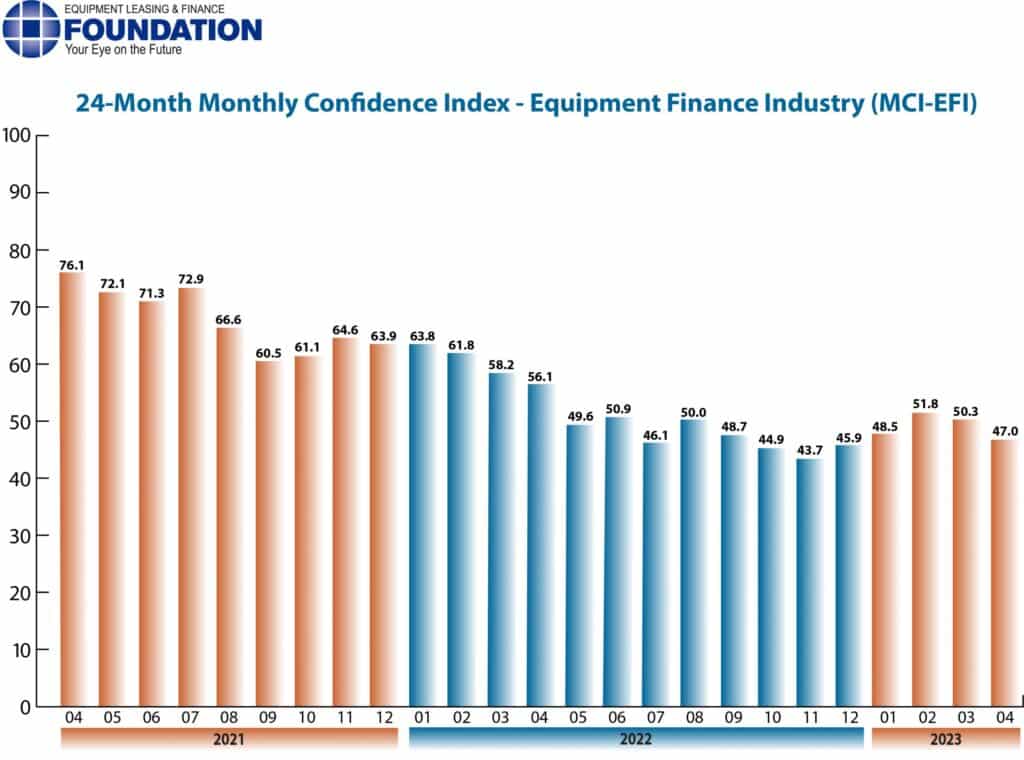

The Monthly Confidence Index for the equipment finance industry landed at 47 in April, down from 50.3 in March and 56.1 in April 2022, driven in part by a growing expectation that spending on business development activities will slow, according to the Equipment Leasing and Finance Foundation (ELFF), the foundational arm of the Equipment Leasing and Finance Association.

ELFF’s index surveys equipment finance sector executives about the current conditions and future expectations in the industry. A score of 50 or higher generally indicates optimism

In April, 18.5% of executives indicated there will be a decrease in spending on business development activities during the next six months, up compared with 7.1% in March, according to the index. Meanwhile, 37.0% of respondents expect their company will increase spending on business development activities, down from 39.3% last month, while 44.4% indicated there will be “no change” in business development spending compared with 53.6% last month.

The current state of the U.S. economy, especially inflation also factors into the decline in industry sentiment, according to the index.

None of the leadership surveyed evaluated the current U.S. economy as “excellent,” down from 3.7% in March, while 88.9% of executives describe it as “fair,” unchanged month over month. The rate of executives who evaluated the economy as “poor” rose to 11.1% compared with 7.4% last month.

Referencing the future of the U.S. economy, 48.2% of executives indicated they believe it will “stay the same” over the next six months, a decrease from 53.6% in March, according to the index. More respondents believe economic conditions in the United States will worsen over the next six months, landing at 44.4% compared with 42.9% a month ago, while 7.4% believe that U.S. economic conditions will get “better” over the next six months, an increase from 3.6% in March.

Execs still see opportunity in current economy

While general confidence continues to decline from February, some executives still see an opportunity in a higher-interest-rate environment.

“The equipment finance industry has survived and thrived in times of rising rates,” Fred Van Etten, president of Midland Equipment Finance, told Equipment Finance News. “I don’t expect this time would be materially different.”

Fixed-rate financing is one way companies are navigating the current interest rate environment, Van Etten said.

“Typically, customers who are looking to add equipment desire fixed-rate financing and therefore want to lock in their rate,” he said. “Midland Equipment Finance has experienced this trend; the rising rates have not impacted our customer’s interest in our products.”

Adaptation and a customer-focused approach are also part of the strategy for navigating current market conditions, RJ Grimshaw, chief executive and president of UniFi Equipment Finance, told EFN.

“The current commercial equipment finance industry is experiencing a softness that requires adaptability, resilience and innovation to navigate,” he said. “By staying nimble and customer focused, we can weather the challenges and emerge stronger on the other side.”

Still, a slowdown in core capital goods represents another concern for the equipment finance industry.

Core capital goods orders, which exclude aircraft and defense equipment, declined for the second consecutive month and were down 0.4% MoM in March following a 90-bps downward revision on February’s number, according to the Commerce Department. In February, core capital goods orders decreased 0.7% MoM.

“Inventory has come back significantly from the COVID load, but at this point, the combination of interest rates, the increase in equipment costs and the slightly lower farm sentiment has slowed things,” Jay Darden, regional sales manager at Farm Credit Express, told EFN. “I don’t see any significant drivers that are going to move the market. … Things are going to trade sideways for the foreseeable future.”