Values for used heavy-duty trucks and semitrailers improved in April, but continued declines in freight rates limit any upside.

Asking prices and auction values improved for late-model lease returns, fleet returns and fleet maintenance trucks in April and signal positivity, but rate concerns continue to hold back market improvements, Sandhills Global Equipment Lease and Finance Manager Jim Ryan told Equipment Finance News.

The next two months are expected to clarify how freight and spot rates will affect the industry, he said. “If we can get freight rates and spot rates to start going up, you’ll start seeing the turnaround, for sure, but a lot is keyed on that.”

Newer used trucks and trailers that come off lease and fleet returns benefit the auction house and customers who want better units, ACT Research Vice President Steve Tam told EFN.

“It honestly depends on the seller and what their motivation is, as to will they dispose of the trucks. And if you look at the auctions, it’s not unusual to see a 2-year-old truck or 3-[year-old truck] go through the auction today,” he said. The auctions love it, as that’s the truck that they advertise in the sale, and they might have 10 of those.”

Impact of freight rates

Freight rates improved in some segments year over year in April, with flatbed spot rates up 1.6% YoY, according to Beaverton, Ore.-based software company DAT Freight & Analytics, which tracks freight and spot rates. While some markets have seen slight improvement, overall spot truck posts fell 21.8% YoY.

Higher rates could also boost the used market if drivers leave big fleet operations to become independent, Ryan said.

Freight and spot rates typically rise gradually, but if the proposed tariffs take effect, large fleet operators like Werner may face pressure on their pricing, and as their margins tighten, maintaining profitability will become increasingly challenging. he said.

“You wonder how many of the drivers all of a sudden decide to opt out and become owner-operators again if freight rates go up, so that obviously [would have a] huge impact on the used market.”

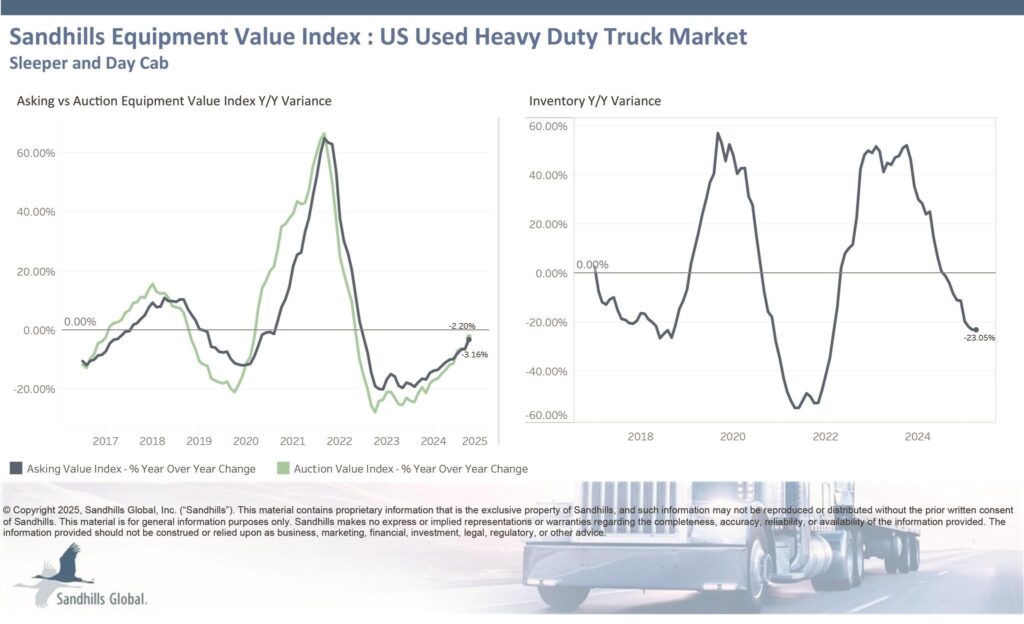

Sandhills used heavy-duty trucks

- Inventory decreased 23.1% YoY but rose 3.8% month over month;

- Asking values fell 3.2% YoY, but inched up 0.2% MoM; and

- Auction values dropped 2.2% YoY but rose 1.6% MoM.

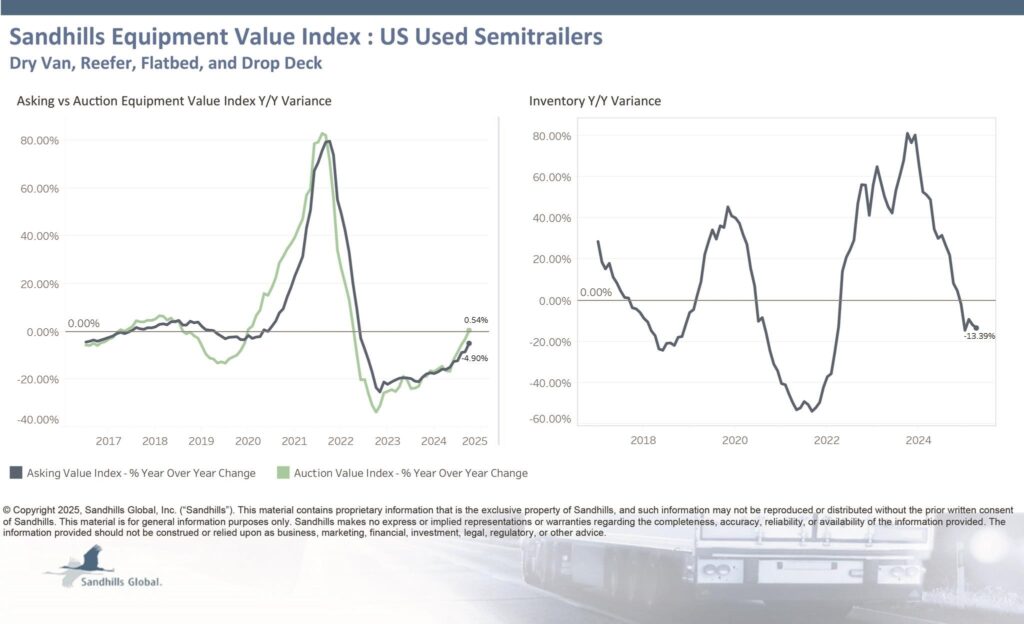

Used semitrailers

- Inventory fell 13.4% YoY, but rose 1% MoM;

- Asking values declined 4.9% YoY, but increased 1.1% MoM; and

- Auction values rose 0.5% YoY and 1.4% MoM.

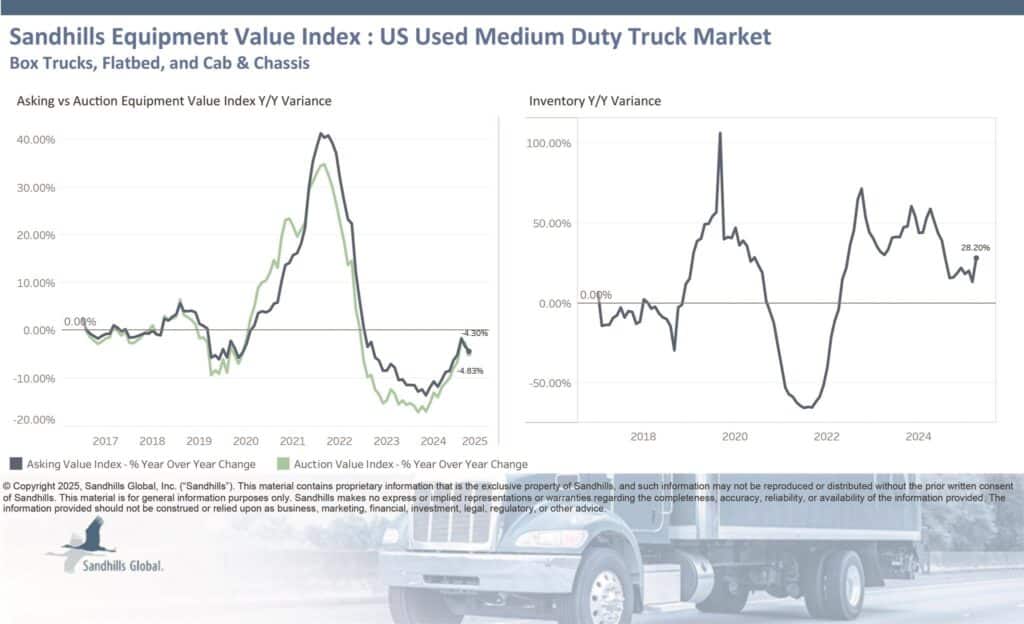

Used medium-duty trucks

- Inventory jumped 28.2% YoY and 18.3% MoM;

- Asking values fell 4.3% YoY and 1.6% MoM; and

- Auction values declined 4.8% YoY and 3.2% MoM.

Lenders return to transportation

As the overall trucking industry improves, lenders will also have renewed opportunities in the space, Tom Mariani, a strategic adviser for equipment lenders and dealers at Rinaldi Advisory Services, said recently at Equipment Finance Connect 2025 in Nashville, Tenn.

“This will bring back some people that may have pulled back out of transportation and some of the other markets,” he said.

“We have to get through a couple more months of tariff play, and then I think we’ll be able to see what the path forward is going to look like.”

Some lenders also continue to work with fleet companies to avoid taking back trucks as freight rates remain down in many segments, ACT Research’s Tam said.

“Lenders have been very forgiving. As long as you’ve got freight to haul … [they’ll] work your loan out so that [they] don’t have to take your truck back.”