Used-truck inventory declined in all major categories last month, but prices have yet to reflect recent improvements in the industry.

Increased tonnage, reduced interest rates and three straight months of declining used inventory are reasons for optimism in the commercial trucking industry. However, potential repossessions could lead to a setback, Sandhills Global Equipment Lease and Finance Manager Jim Ryan told Equipment Finance News.

“There are some different entities out there that are in bankruptcy or going through court proceedings,” he said. “There is going to be another wave of [repossessions] and a glut of inventory hitting the market. So, it’s nice to see some of that inventory flushed out now before that second wave or third wave.”

Auction and asking values for used medium- and heavy-duty trucks declined in September despite falling inventory, according to Sandhills Global’s monthly report, released in early October.

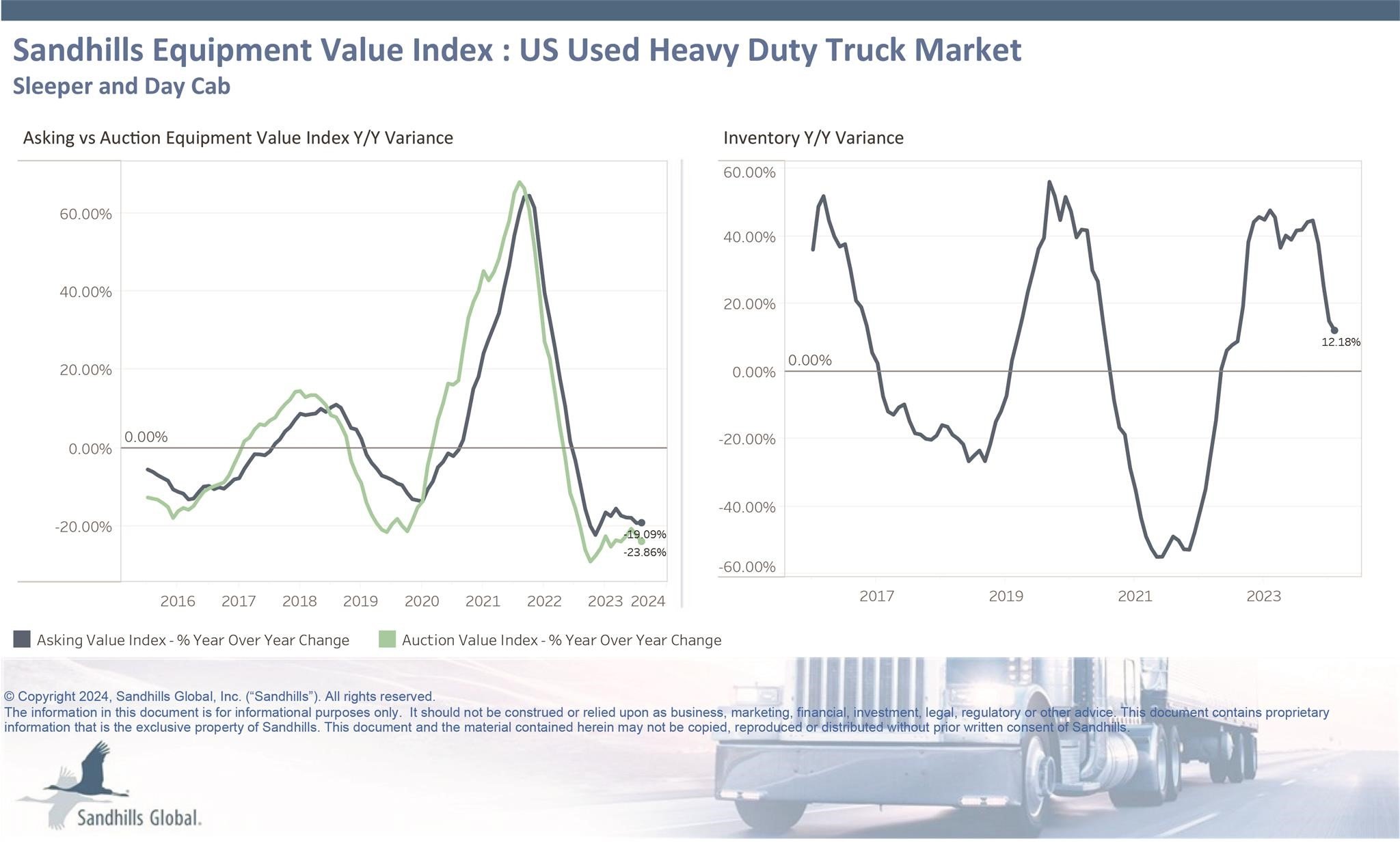

Used heavy-duty trucks

- Inventory fell 5.9% year over year and 2.7% month over month in September;

- Asking values dropped 17.3% YoY and 0.7% MoM; and

- Auction values were down 20.4% YoY and 3.5% MoM.

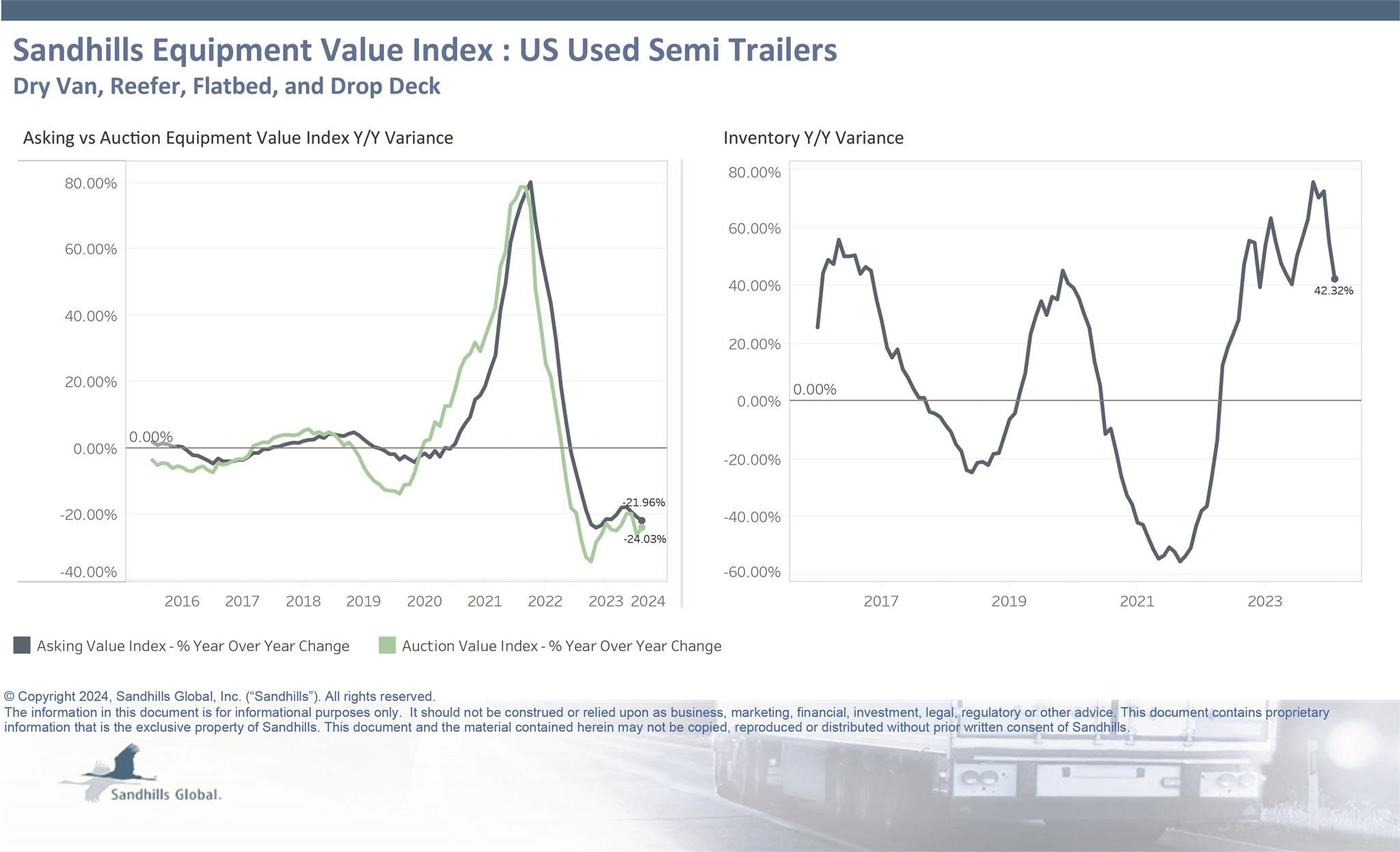

Used semitrailers

- Inventory rose 22.8% YoY, but fell 2.8% MoM;

- Asking values dropped 16.2% YoY, but increased 1% MoM; and

- Auction values fell 16.7% YoY and 0.1% MoM.

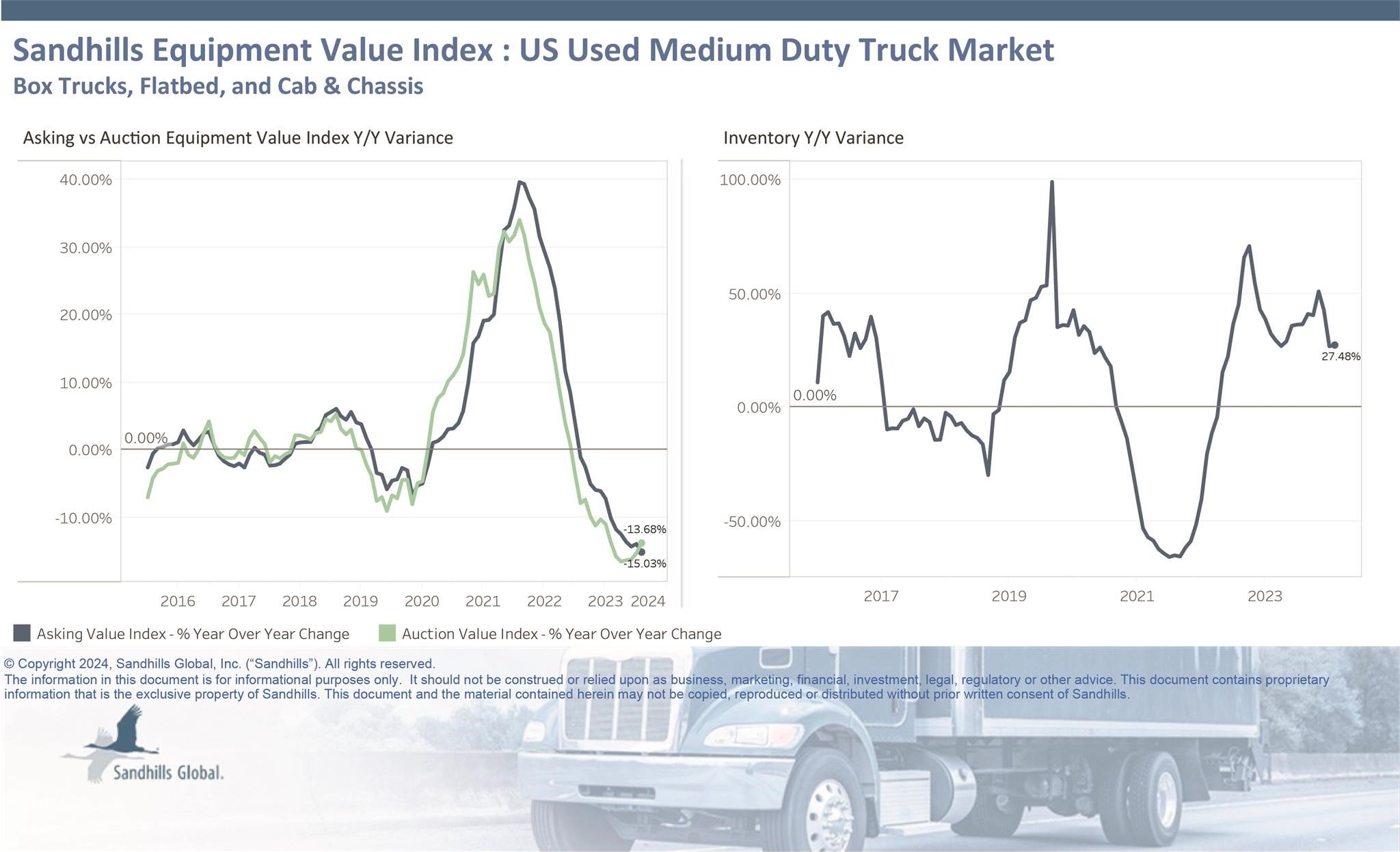

Used medium-duty trucks

- Inventory declined 2.9% YoY and 2.7% MoM;

- Asking values were down 14.9% YoY and 0.3% MoM; and

- Auction values dropped 23.6% YoY and 2.3% MoM.

Daily needs boost medium-duty market

The medium-truck market, which includes flat beds, box trucks and cab chassis, has been relatively stable compared to its heavy-duty counterpart, according to Sandhill’s monthly indices. The medium-duty market has been more resistant to challenges such as high operating costs due to the everyday needs of consumers, Matt Manero, president of Carrollton, Texas-based Commercial Fleet Financing, told EFN.

“The medium-duty market serves a lot of the day-to-day needs of Americans, whether that be towing, local delivery, small-scale construction, plumbing, electrical, etc.,” he said.

“That immediacy gives the medium duty an ongoing customer base to service and helps provide more stable profit. But its better-than-other-sector performance also suggests that people are still spending to take care of smaller projects or go for the less expensive purchases.”

The heavy-duty market and the overall trucking industry will see more of a boost when consumers are confidently making larger purchases, such as new homes, Manero said.

Register here for the free webinar “Used equipment financing in 2025 as markets normalize,” taking place on Tuesday, Oct. 22, at 11 a.m. ET.