Used medium-duty truck values drop 7.5% amid freight pressures

Used heavy-duty truck inventory down 13.9% YoY in August

Used medium-duty truck values fell again in August as inventories remained elevated amid tariff concerns and freight rate pressures.

Transportation values continue to struggle as weak freight spot rates limit overall auction activity despite mostly stable inventory levels, though some sectors are showing isolated strength, Sandhills Global Equipment Lease and Finance Manager Jim Ryan told Equipment Finance News.

“A lot of your late model, lease-return type trucks are bringing an uptick from what they have been in the past,” he said. “Until you fix spot rates, what are you going to do?”

With seven freight carriers filing for bankruptcy over the last month, there’s direct pressure on spot rates and rising uncertainty over market recovery or asset absorption, Ryan said.

“It’s always tough, as those bankruptcies could play out a long time, too,” he said. “It could be a while before we see [those units] re-enter the market, but it is interesting.”

Truck pressure extending into 2026

Uncertainty around emissions policy, tariff pressures and lease returns is fueling downward pressure on used heavy- and medium-duty truck values, with significant inventory expected to hit the market through 2026, Ryan said.

“There are thousands of trucks that are yet to even hit the market that are still out there coming off lease that will hit at some point,” he said. “It’ll probably cycle in the next year, Q1, Q2, Q3, but there’s going to be a lot of label inventory still to hit the market on that side.”

On the dealer side, Custom Truck One Source aims to maintain margins in the 15% to 18% range headed into 2026, as past highs of 17% to 18% margins in 2023 and 2024, driven by supply chain constraints and incremental pricing opportunities now face pressure, Chief Financial Officer Christopher Eperjesy said on Sept. 18 during the 2025 D.A. Davidson Diversified Industrials and Services Conference in Nashville, Tenn.

In the second quarter, Custom Truck One Source’s margin landed at 15.5%, up 45 basis points (bps) compared to the first quarter, according to the company’s earnings report.

“There’s a lot more inventory out there in terms of availability of chassis, but also attachments, and so with that, we have seen some pressure when it comes to pricing,” Eperjesy said. “Also, there’s going to be a mixed component, both product and customer mix, as we sell to larger customers and buy larger amounts of equipment, so there’s going to be a margin impact there.”

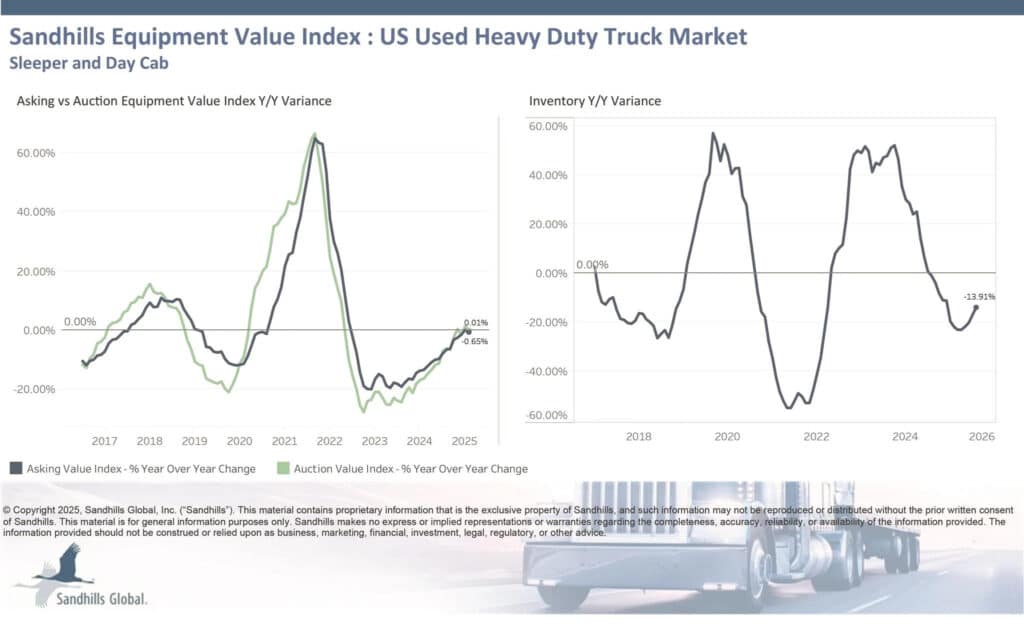

Used heavy-duty trucks

- Inventory fell 13.9% year over year and 0.2% month over month;

- Asking values decreased 0.7% YoY and 1.5% MoM; and

- Auction values declined 1 basis point YoY and 2.1% MoM.

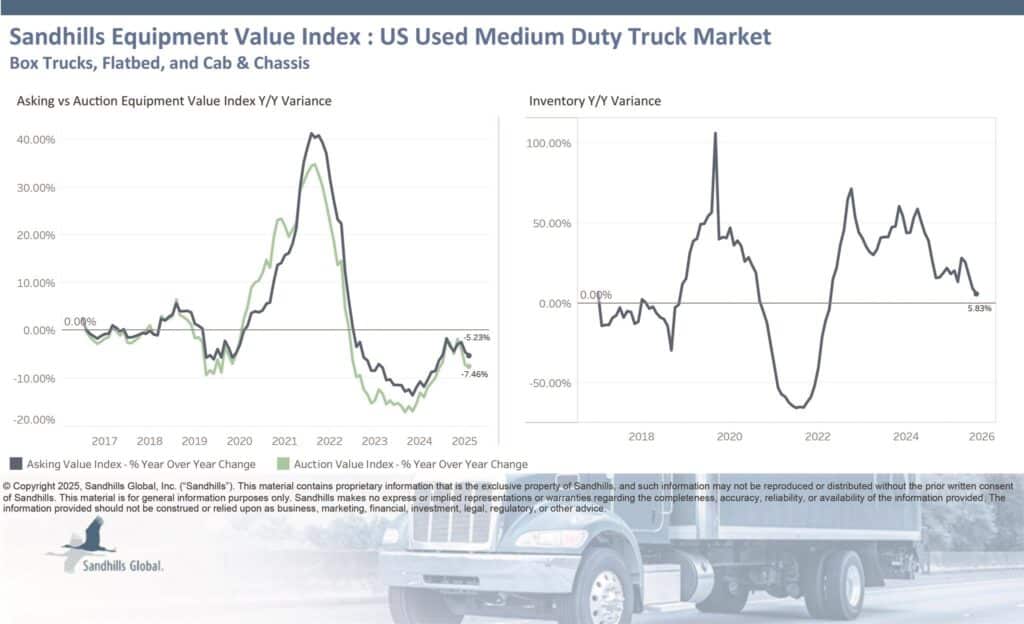

Medium-duty used trucks

- Inventory rose 5.8% YoY, but fell8.5% MoM;

- Asking values dropped 5.2% YoY and 1.9% MoM; and

- Auction values fell 7.5% YoY and 1.1% MoM.

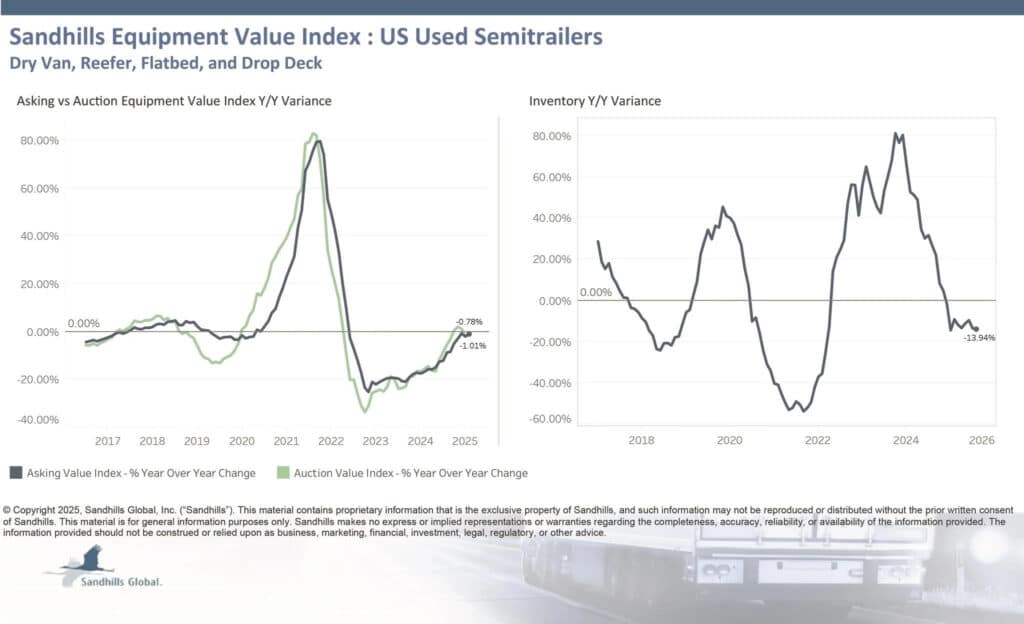

Used semitrailers

- Inventory decreased 13.9% YoY and 0.2% MoM;

- Asking values declined 1% YoY and 0.8% MoM; and

- Auction values slid 0.8% YoY and 0.5% MoM.

Check out our exclusive industry data here.