Used Class 8 truck retail sales and prices were down for the second consecutive month in April, according to new data from ACT Research.

The Columbus, Ind.-based analysis firm tracks monthly order price and volume figures, and Vice President Steve Tam told Equipment Finance News he expects prices to stabilize through the remainder of this year.

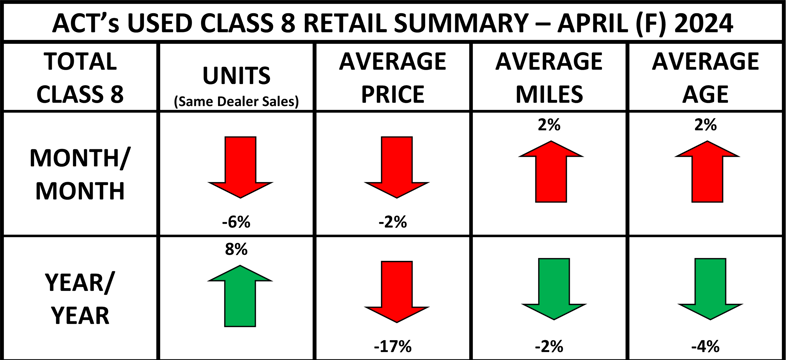

Used retail prices for Class 8 trucks were 17% lower on a year over year basis, and 1.9% lower month over month, to $58,900 in April.

The average age of used Class 8 trucks being sold decreased 4% year over year, though ACT Research didn’t provide exact figures.

“Same-dealer Class 8 retail truck sales slowed for a second straight month in April,” Tam said in a statement on the findings Thursday.” However, “the 5.6% drop was less than the seasonal decline indicated by history. April typically falls 10 percentage points from March, to about 1 percentage point below average.”

Activity in the wholesale trucking market “contracted by a much greater amount,” Tam noted, down 30% YoY.

Auction sales also declined 48% MoM from March, an expected outcome, Tam said. Total market same-dealer sales were down 30% in April.

ACT Research’s preliminary reporting on the sector expected U.S. Class 8 tractor orders would decline 25% YoY in April. However, trailers orders in North America increased 21% YoY, as did orders of Class 5, 6 and 7 trucks, which were up 1.9% YoY in April to 18,863 units.

“The problem really in our estimation comes on a new truck side,” Tam told Equipment Finance News. “The OEMs just want to pound all kinds of equipment out into the marketplace, which again is extending that cycle because it’s not letting us put the capacity we have back to work as we start to see freight start to improve, it just keeps the imbalance out there for longer.”

Despite a difficult ordering environment, lenders are still looking to finance transportation equipment, Tam said.

“Lenders may be working with folks trying to stretch out the loans or terms to keep trucks on the road; the banks don’t want the trucks,” Tam said. “They can keep it at least generating some revenue and paying the interest until we can pick up and see capacity tighten up. I would submit that this cycle pales in comparison to previous cycles we’ve seen.”